Credit Cards

Apply for the HSBC Balance Transfer Credit Card: Amazing discounts

Master the art of securing the HSBC Balance Transfer Credit Card with our comprehensive guide! 0% intro interest period + amazing discounts!

Advertisement

Apply for the HSBC Balance Transfer Credit Card: Get an intro 0% interest!

Navigating the world of credit cards can often feel like decoding a complex puzzle. But learning how to apply for the HSBC Balance Transfer Credit Card can be an incredible option!

Also, applying for the HSBC Balance Transfer Credit Card might seem daunting, but armed with the right information, it can be an effortless process. So, read on to learn more!

Apply for the card: Online

Throughout this guide, we’ll unravel the prerequisites and documentation needed to bolster your application.

You will be redirected to another website

Requirements

Moreover, before you start applying for this card, you need to learn a bit more about the requirements.

Therefore, to apply, you need to be at least 18 years old, a UK resident, and have an annual income before tax of £6,800 or more!

However, meeting all these requirements doesn’t guarantee your acceptance. So, you’ll need to complete the application process to see if you can qualify!

Online application

To apply online for this card, you’ll need to go to the official website and find the card you want. Then, you’ll need to log in to your HSBC account to start applying for the card you need.

Also, you’ll need to provide the personal information required. After all of this, you’ll be able to complete the application and wait for a response.

Apply for the card: Mobile App

You can use the mobile app to manage all your finances through HSBC. So, you’ll be able to deposit checks, make payments, check your balances, and much more!

However, you’ll need to go through the online application process to complete your application.

HSBC Balance Transfer Credit Card or TSB Platinum Balance Transfer Card?

Are you not so sure about getting the HSBC Card? If that’s the case, we can help you with a different option for your needs!

So, you can try applying for the TSB Balance Transfer Card! Also, with this card, you’ll be able to get incredible perks for no annual fee!

Moreover, you can get up to 24 months of 0% interest as a new cardholder! And there is more.

So, check out our comparison table below to see which option can be the best one for your finances at the moment!

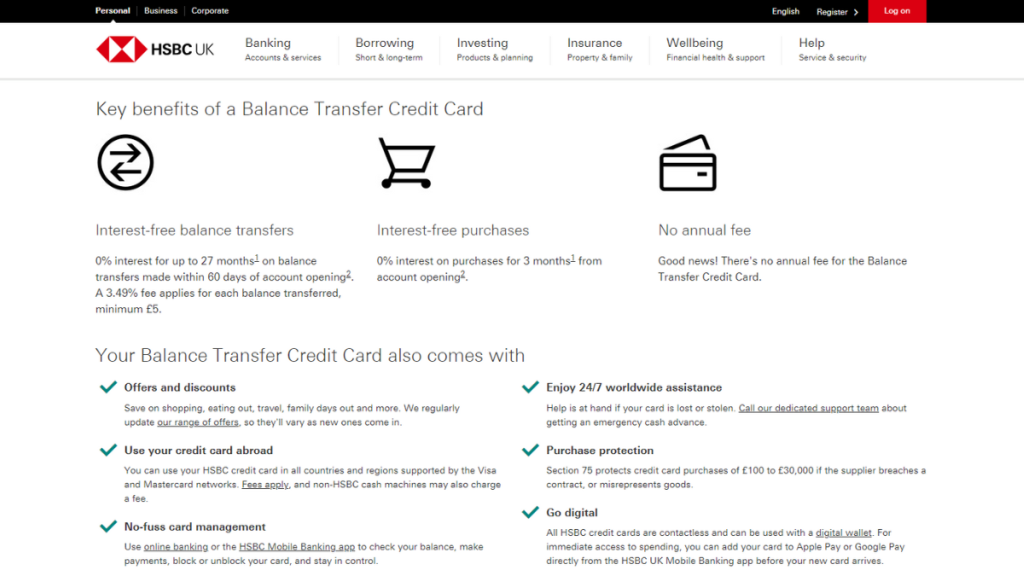

| HSBC Balance Transfer Credit Card | TSB Platinum Balance Transfer Card | |

| Annual Fee | No annual fee; | No account fee; |

| Credit Limit | The credit limit may vary depending on your financial situation; | The credit limit varies depending on your financial analysis; |

| Representative APR | 24.90% representative variable APR | Representative 22.9% variable APR; |

| Purchase Rate | 0% interest on purchases for 24.90% variable p.a.; | 22.95% p.a. purchase rate (variable); |

| Welcome Bonus* | Up to 27 months interest-free for balance transfers (with a 3.49% fee, min £5); *Terms apply | Up to 24 months of 0% interest, then 22.9% variable APR for new cardholders; *Terms apply |

| Rewards | There are no rewards programs. | There is no rewards program. |

So, if this card’s features are the best for your needs, you can read our blog post below to find out all about how the application process works for this card!

Apply for the TSB Platinum Balance Transfer Card

Unlock the potential of learning how to apply for the TSB Platinum Balance Transfer Card with our step-by-step walkthrough!

About the author / Victoria Lourenco

Trending Topics

Loans for people with an IVA: is it possible?

Do you have an IVA and are thinking about applying for loans? Don’t do it before reading this post, because there are some intricacy in it.

Keep Reading

Apply for the TSB Platinum Purchase Card: Intro 0% interest

Learn how to apply for the TSB Platinum Purchase Card with our step-by-step guide. Save on purchases and balance transfers!

Keep Reading

How to Improve Your Credit Score? Tips and Strategies

Discover how to improve your credit score effortlessly! Learn how timely payments, smart credit utilization, and more can help you!

Keep ReadingYou may also like

Does an overdraft affect your credit score?

Spending management is crucial for avoiding overdrafts when it comes to finances. But does an overdraft affect your credit score? Find out!

Keep Reading

HSBC Classic Credit Card review: build a credit rating

If you’re looking for an HSBC credit card, read this HSBC Classic Credit Card review! Qualify with low credit score and pay no annual fee!

Keep Reading

Unveiling the Mystery: What Exactly is a Chaps Payment?

You may use Chaps to wire money to transfer savings accounts. Learn more about Chaps payment and how it can be useful for you.

Keep Reading