Credit Cards

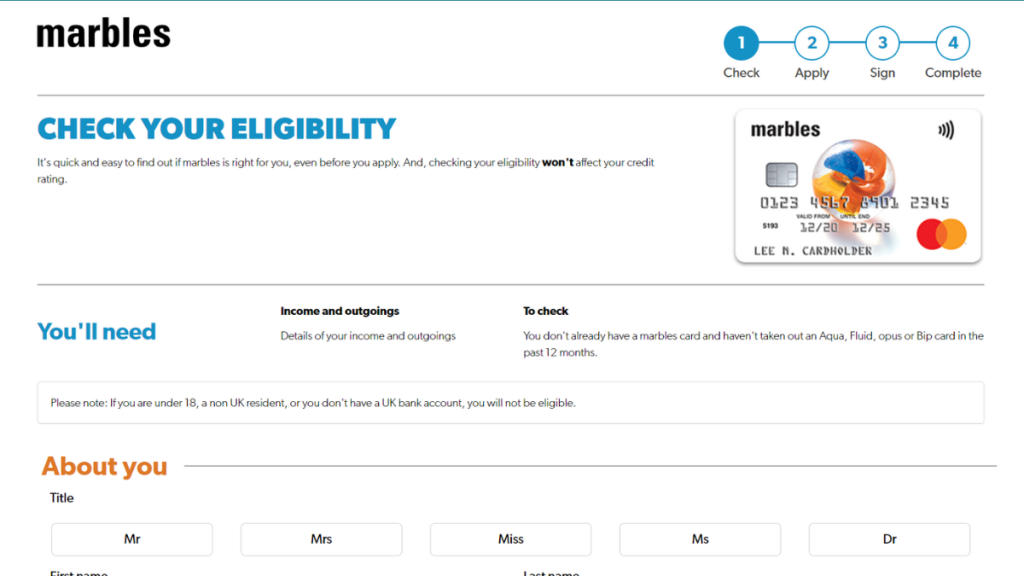

Apply for the Marbles Credit Card: Check eligibility for free!

Unlock financial accessibility with the Marbles Credit Card! Learn how to navigate the process, for a stronger credit future!

Advertisement

Apply for the Marbles Credit Card: Quick application

Applying for a credit card can often feel like navigating a labyrinth of terms, conditions, and eligibility criteria. So, you can read on to learn how to apply for the Marbles Credit Card!

Also, this card is designed to offer accessibility and financial empowerment. It is a potential solution for those seeking to boost their credit!

Apply for the card: Online

In this guide, we’ll walk you through the process of applying for the Marbles Credit Card, demystifying the steps and shedding light on what applicants can expect.

Also, whether you’re aiming to establish your credit history or simply seek a card with manageable features, understanding the application of this card is the first step to its benefits.

So, to have a chance to qualify, you’ll need to check your eligibility through the official website.

Then, you’ll be able to see if you pre-qualify or not and complete the application with your personal information.

Also, after you complete the application, you’ll be able to get your card and start enjoying its benefits if you’re approved.

You will be redirected to another website

Apply for the card: Mobile App

You’ll be able to use the mobile app for this card to manage all your finances.

However, you’ll need to go to the official website to complete the application process.

Therefore, read our topic above to learn about how to apply online through the website!

Marbles Credit Card or Fluid Credit Card?

If you’re not so sure about getting the Marbles Credit Card, we can help you with a different credit card option for your needs.

So, you can try applying for the Fluid Credit Card. Also, with this card, you’ll be able to get incredible perks, such as 05 interest on balance transfers for your first 9 months and more!

Moreover, you’ll be able to get an initial credit limit of up to £4,000. Plus, you won’t need to pay any annual fee to use this card’s incredible features.

Therefore, you can check out the comparison table below to learn more about this card and see which option is the best for you at the moment!

| Marbles Credit Card | Fluid Credit Card | |

| Annual Fee | There is no annual fee; | There is no annual fee; |

| Credit Limit | Initial credit limit from £250 up to £1,500; | Initial credit limit of £250-£4,000; |

| Representative APR | 34.9% representative variable APR; | 34.90% variable APR; |

| Purchase Rate | 34.9% representative for purchases; | Representative 34.94% variable purchase rate; |

| Welcome Bonus* | No welcome bonuses; | You’ll get 0% interest on balance transfers for your first 9 months using the card (with a 3% fee); Terms apply* |

| Rewards | No rewards program. | No rewards program. |

So, if you like the features of the Fluid Credit Card, you can find out how to apply for it!

Therefore, you can read our blog post below to learn more about this card and find out how the application process works!

Apply for the Fluid Credit Card

Learn how to apply for the Fluid Credit Card: 0% interest on balance transfer for 9 months! Keep reading and learn more!

About the author / Victoria Lourenco

Trending Topics

Why Has My Credit Score Gone Down? 10 Possible Reasons

Why has my credit score gone down? Find the answer to this question and learn more about your credit score in your blog post. Read on!

Keep Reading

Post Office Money Classic Credit Card review

A credit card with £0 annual fee and 0% intro APR to build credit exists. Check this Post Office Money Classic Credit Card review!

Keep Reading

Zable Credit Card review: No annual fee!

Delve into our insightful Zable Credit Card review - no hidden fees and amazing credit-building features! Keep reading and learn more!

Keep ReadingYou may also like

Tesco Foundation Credit Card: how to apply

Learn now how to apply for Tesco Foundation Credit Card. Earn points on every purchase! Keep reading and learn more!

Keep Reading

Ocean Credit Card Review: No annual fee!

Explore the Ocean Credit Card's pros and cons in our review. $0 annual fee and amazing benefits! Get your card within 10 days!

Keep Reading

Minty Personal Loans: all you need to apply

Are you looking for an easy application and no additional costs? Learn how to apply for Minty Personal Loans! Up to £3,000!

Keep Reading