Credit Cards

Standard Bank Gold Credit Card review: enjoy travel perks

Do you enjoy traveling and living the best life? Get a credit card that enhances your lifestyle! Enjoy up to 20% off at Emirates! Read on!

Advertisement

Standard Bank Gold Credit offers up to 30% off on select brands

Getting rewards for your purchases and travel benefits is just the tip of the iceberg. Read our Standard Bank Gold Credit Card full review to learn more!

Standard Bank Gold Card: how to apply

If you want to apply for the Standard Bank Gold Credit Card, you’re in the right place. Enjoy up to 30% off at your favorite brands! Read on!

You will access a great range of benefits for an affordable monthly fee. Find out why this is one of the most popular credit cards in South Africa!

| Min. Monthly Income | R5,000; |

| Initiation Fee | R180; |

| Monthly Fee | R63; |

| Interest Rate | Personalized Interest Rate, ranging from 10.25% to 21%; |

| Rewards | Up to 20% discounts on flight tickets with partner airlines; 5% cashback for booking your trip with selected partners; Discounts to rent cars and buy luggage; Earn UCount Rewards Points for every purchase and much more. |

Standard Bank Gold Credit Card overview

The Standard Bank Gold Credit Card has so many benefits that you’ll have difficulty believing it.

Thus, this credit card will fit your lifestyle if you love traveling and living great life experiences.

The cashback and discounts will allow you to travel even more.

The eligibility requirements include a minimum monthly income of R5 000. This is not accessible for some, but it is far from the most exclusive travel card.

Therefore, the Standard Bank Gold Credit Card will be a great financial tool to use daily and collect discounts and cashback every time you swipe it.

You will be redirected to another website

Standard Bank Gold Credit Card main features

Most credit cards in South Africa have an extensive list of fees to be charged. However, the Standard Bank Gold Credit Card has many benefits.

Then our Standard Bank Gold Credit Card review would not be complete without comparing the pros and cons. So check it out!

Pros

- Affordable monthly fee and relatively low origination fee;

- Travel benefits include travel insurance, up to 20% off flight tickets, a 10% discount to buy luggage, exclusive entertainment experiences, car rental facilities, and more;

- Discount at Wine-Of-The-Month Club and many other food and lifestyle purchases;

- Every time you use your Standard Bank Gold Credit Card, you earn UCount Rewards Points to redeem for even more perks;

- The credit limit can be as high as R250 000.

Cons

- If you use your Standard Bank Gold Credit Card abroad, you’ll have to pay fees;

- No free transactions, so you’ll have to pay every time you use this credit card.

Requirements needed to apply

If you’re unsure you qualify for this card, you can ask for an instant quote at the Standard Bank website.

But know that you need a high credit score, at least R5,000 monthly income, and you can’t have any debts.

How to apply for the Standard Bank Gold Credit Card?

Once you fulfill the eligibility requirements, applying for the Standard Bank Gold Credit Card is easy.

The following content will tell you the step-by-step!

Standard Bank Gold Card: how to apply

If you want to apply for the Standard Bank Gold Credit Card, you’re in the right place. Enjoy up to 30% off at your favorite brands! Read on!

About the author / Julia Bermudez

Trending Topics

Fincheck Personal Loans review: access multiple lenders

Learn what makes Fincheck Personal Loans the best choice for you in this review. Borrow up to R500,000. Keep reading and learn more!

Keep Reading

How to reverse money using Capitec App: easy step-by-step

If you've ever accidentally sent a payment with the Capitec App you didn't mean to, learn how to reverse money using Capitec App!

Keep Reading

Standard Bank: how to apply for a job opening

If you want to apply for a job at Standard Bank, you'll want to check this article out! We'll cover important information on what you can do!

Keep ReadingYou may also like

Apply for the TymeBank Credit Card: 55 days of interest-free!

Apply anytime, anywhere: Learn how to easily apply for the TymeBank credit card from the comfort of your home.

Keep Reading

Choose the right credit card and reach financial freedom

Learn why it's important to to choose the right credit card and how to pick one that matches your finances and lifestyle!

Keep Reading

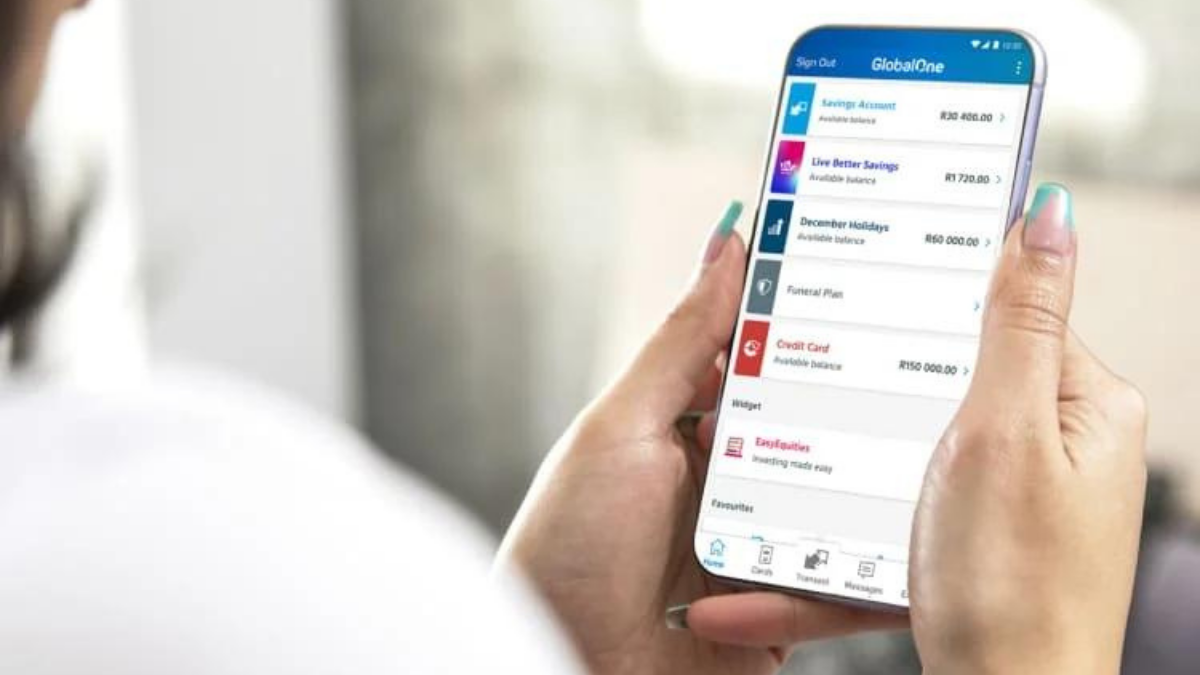

Shop the World Online: Capitec Global One Card Review

Are you ready to make the most of your money? Then don't miss our Capitec Global One Card review! Enjoy 55 days of no interest! Read on!

Keep Reading