Credit Cards

Discover It® Secured Credit Card review

Check out our Discover It® Secured Credit Card review to learn how to increase your credit score and earn more value for your money with cash back on every purchase!

Advertisement

Earn valuable cash back rewards while you build up your score!

Are you ready to improve your credit score while earning valuable cash back rewards? In this Discover It® Secured Credit Card review, we’re going to show you how you can easily do that!

Discover It® Secured Credit Card: how to apply

Learn how to apply for the Discover It® Secured Credit Card and improve your score to excellence while earning cash back rewards!

The Discover It® Secured Credit Card is one of the best credit building cards in the market, and for good reason! Check some of its features below:

| Credit Score | All types of credit are welcome to apply. |

| Annual Fee | $0 annual fee. |

| Purchase APR | 27.99% variable. |

| Cash Advance APR | 29.99% variable. |

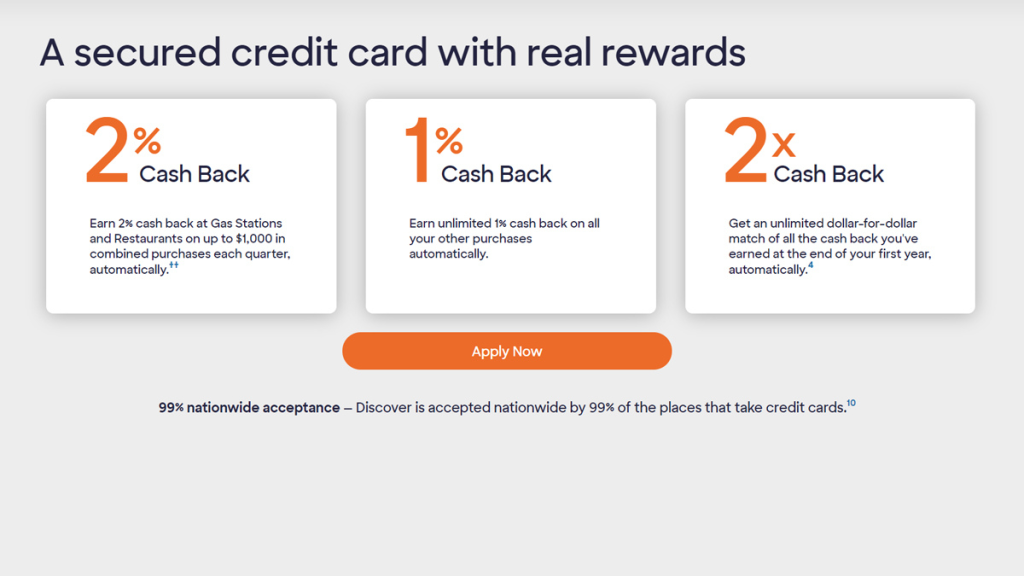

| Welcome Bonus | New members can enjoy a dollar-for-dollar cash back match from Discover at the end of their first year. |

| Rewards | 2% cash back at gas stations and restaurants up to $1,000 (combined) per quarter; 1% cash back on all other purchases. |

Discover It® Secured Credit Card overview

The Discover it® Secured Credit Card is a fantastic credit card for people who are either new to credit or are looking to improve their rating.

It’s one of the very few cards in the market that charges zero annual fees and offers cash back rewards. Plus, your security deposit can be as low as $200.

To make it even better, new members get a sweet welcome bonus from Discover. At the end of your first year, you’ll earn a dollar-for-dollar cash back match .

Responsible use and on-time payments can improve your score thanks o credit bureau reporting from Discover. You can even graduate to an unsecured card and get your deposit back!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover It® Secured Credit Card main features

The Discover it® Secured Credit Card offers an array of benefits. However, there are a couple of disadvantages that might impact your decision.

Pros

- No annual fee;

- It helps you build credit;

- Earn up to 2% cash back on purchases;

- Discover reports your credit history to all 3 major credit bureaus;

- Great and rewarding welcome bonus.

Cons

- Approval is not guaranteed;

- It is not as widely accepted as some other network cards;

- Potentially high APR.

Minimum credit score to apply

The Discover it® Secured Credit Card is a secured credit card, so there are no minimum score requirements. However, keep in mind that no approval is guaranteed.

That said, you still need to meet the minimum criteria by Discover to get it.

How to apply for the Discover It® Secured Credit Card?

So if you believe that the Discover it® Secured Credit Card is your key to a better score, applying for it is a breeze!

Follow the link below to learn all the details about the application process. We’ll give you a complete walkthrough of what to expect and how you can easily get the card today!

Discover It® Secured Credit Card: how to apply

Learn how to apply for the Discover It® Secured Credit Card and improve your score to excellence while earning cash back rewards!

About the author / Giovanna Klein

Trending Topics

Hair Styling & Salon Management Course by New Skills Academy review

Check out this review of the Hair Styling & Salon Management Course by New Skills Academy! Build a career in no time!

Keep Reading

500 bonus points: Apply for Brink’s Money Prepaid Mastercard®

Check out how to apply for the Brink's Money Prepaid Mastercard® - earn points on purchases and manage your money easily! Read on!

Keep Reading

CNC Machine Operator Course by MWCC: enroll today

If you'd like to enroll in the CNC Machine Operator Course by MWCC, this article is perfect! We'll teach you all about the process!

Keep ReadingYou may also like

Apply for Chase Freedom Flex℠: Enjoy Rewards & No Annual Fee!

Learn how to apply for Chase Freedom Flex℠ today and take advantage of its rewards. Enjoy 0% intro APR for 15 months! Read on!

Keep Reading

Navigating Fair Credit: Top Credit Cards for Smart Consumers

Take charge of your financial future with these credit cards catered to fair credit holders, making credit building a seamless journey.

Keep Reading

How to move out of your parents’ house: 6 easy steps

Every bird must fly away from its nest at some point. See how to move out of your parents' house and start a new life.

Keep Reading