Loans

Bad Credit Loans: all you need to apply

The quick and simple way to get the best offer - even if you have a bad credit score. Borrow up to $10K with Bad Credit Loans! Read on!

Advertisement

Find the best lender for you and get the money you need fast!

You’ve come to the right place if you have poor credit history and want to compare lenders. So find out how to apply for Bad Credit Loans.

BadCreditLoans.com is a quick and easy way to get the personal loan you need, whether it’s for unexpected car repairs or past-due expenses!

Apply for the loan: Online

BadCreditLoans.com is a lending match platform that helps you compare lenders and choose the best option.

Applying for a loan on their website is easy and takes only one minute.

Firstly, fill out the online form that Bad Credit Loans provides. So they will match you to a lender who will evaluate your loan request.

So after reviewing your application, a lending institution will offer you a loan. Further, to accept the offer, you must sign the contract electronically.

Last but not least, you will receive your funds. However, before signing, completely understand the loan’s terms.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

Indeed, to apply for a Bad Credit Loans, you must meet the following requirements:

- 18 years or older;

- Be legal residents of the United States;

- Have a consistent source of income and a checking account;

- Have a working email and phone number.

Once approved, you might meet the lender’s particular requirements too!

Bad Credit Loans or LendingClub Personal Loans?

Indeed, when it comes to the right terms and conditions for your loan, it is important to compare all the available offers!

Although different platforms, you can find similar offers when you compare lenders from both!

So check the comparison between their features below to help you decide!

| Bad Credit Loans | LendingClub Personal Loans | |

| APR | APRs ranging from 5.99% to 35.99%; | APR ranges from 8.05% to 36.00%; |

| Loan Purpose | Debt consolidation, large purchases, home improvement, vacation, and more; | Credit card and debt consolidation, balance transfers, medical bills, home improvements, and more; |

| Loan Amounts | Up to $10,000; | You can apply for loans from $1,000 to $40,000; |

| Credit Needed | All types of credit; | Borrowers with fair to excellent credit can get one; |

| Terms | Up to 72 months; | From 36 to 60 months (or 3 to 5 years); |

| Origination Fee | It depends on the lender you choose; | From 2.00% to 6.00% of the loan amount; |

| Late Fee | It depends on the lender you choose; | Not disclosed; |

| Early Payoff Penalty | It depends on the lender you choose. | None. |

Are you interested in learning more about LendingClub Personal Loans services? So keep reading!

Further, we’ll explain everything you need about this platform! Then let’s go!

LendingClub Personal Loans: all you need to apply

Learn now how to apply for a LendingClub Personal Loans. Qualify with fair credit and enjoy personalized rates! Keep reading for more!

About the author / Giovanna Klein

Trending Topics

Don’t Overpay: Affordable Life Insurance Solutions for Seniors

Exploring life insurance for seniors: Get expert insights on coverage choices and financial planning to make the most of your retirement!

Keep Reading

Apply for Chase Freedom Unlimited®: No Annual Fee & 0% Intro APR

Follow these easy steps and learn how to apply for the Chase Freedom Unlimited® credit card. 0% intro APR on purchases and more!

Keep Reading

Watch your favorite movies and series for free: 7 best apps

Need a free app to stream your favorite shows and movies? Here are the top 7 apps to watch free movies you can download right now.

Keep ReadingYou may also like

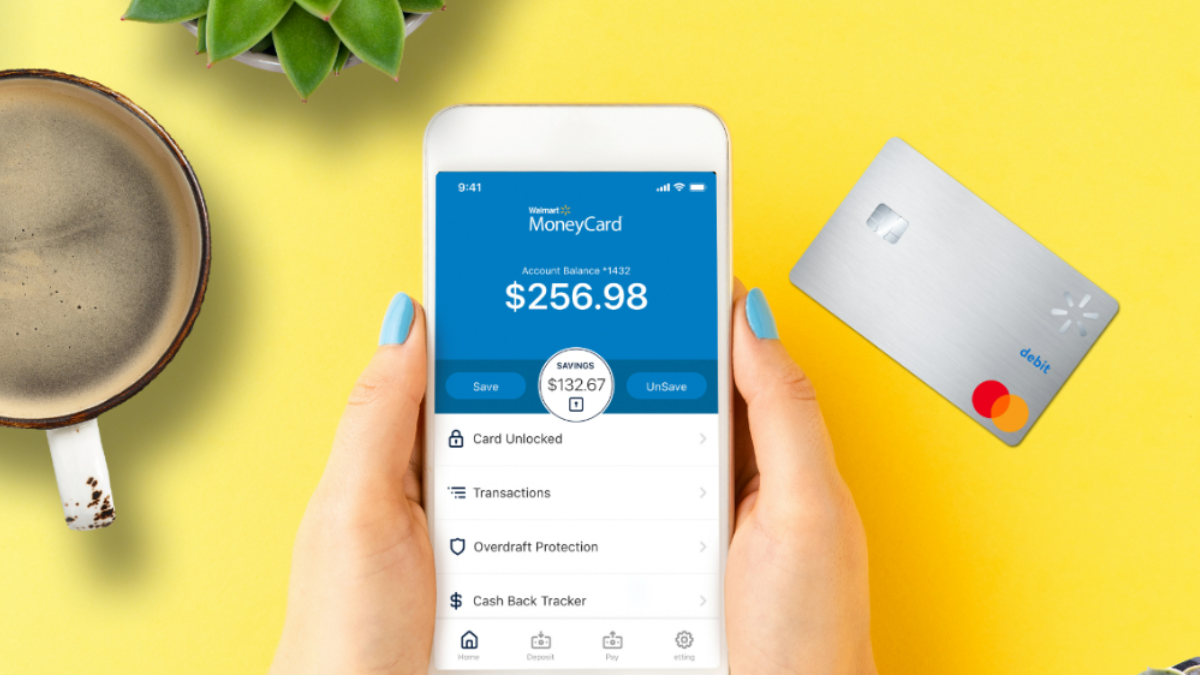

Earn up to 3% cash back: Walmart MoneyCard® review

Learn a better way to use money! Check this Walmart MoneyCard® review and start earning rewards - up to 3% cash back!

Keep Reading

What credit score do you need to rent a house?

Having a good credit score to rent a house can be a game-changer. Learn more about how to check your credit score and improve it!

Keep Reading

Find a job at The Cleaning Authority: Competitive pay and professional training

Unlock a world of possibilities with a job at The Cleaning Authority. Join a team that combines excellence and a passion for cleanliness!

Keep Reading