Credit Cards

Absa Flexi Core Credit Card: how to apply

Getting the Absa Flexi Core Credit Card is easy and fast! Earn up to 30% cash back on payments and enjoy an interest-free period! Read on!

Advertisement

This credit card offers you great rewards while helping you build your credit!

If you’re looking for a credit card option with multiple rewards, learn how to apply for Absa Flexi Core Credit Card now!

Thus, this card is a great option for anyone looking for an easy-to-manage and convenient credit card solution. So keep reading and learn more!

Apply for the card: Online

Applying for this card is easy and simple and can be done in person or online. To fill in the online application form, all you need is the following:

- On the Absa website, click the Apply Now option;

- Enter the characters shown in the image on the Online Account Application page;

- Please submit the six-step questionnaire;

- You have the option of saving and continuing later or continuing at each step.

Further, meet the required documents to apply for the Absa Flexi Core Credit Card:

- Your South African identity or Smart Card holders;

- Verification of Residency;

- Income documentation for the most recent three months.

You will be redirected to another website

Apply for the card: Mobile App

Although it is impossible to apply for this card using the mobile app, Absa offers an easy-to-use banking app.

Thus, it allows you to access and manage your financial life easier.

For example, you can keep your account and card secure, simplify your life and do your banking on the go.

Absa Flexi Core Credit Card or African Bank Gold Credit Card?

Indeed, choosing the right credit card is not an easy task!

To simplify your decision, we compared Absa Flexi Core Credit Card and the African Bank Gold Credit Card.

So read the table below and learn more about both cards’ details!

| Absa Flexi Core Credit Card | African Bank Gold Credit Card | |

| Min. Monthly Income | R2,000 per month; | No minimum income requirement. However, African Bank will review your bank statements; |

| Initiation Fee | R 175.00; | Not disclosed; |

| Monthly Fee | R44; | R69; |

| Interest Rate | Up to 57 days interest-free on qualifying transactions. A non-specified interest rate after; | The interest rate ranges from 15% to 27.50%; |

| Rewards | Earn cash back on payments and enjoy the Absa Advantage by completing challenges and getting rewarded. | Currently, this African Bank credit card has no rewards program. |

Further, learn how to apply for the African Bank Gold Credit Card. We’ve made the process simple for you! So read on!

African Bank Gold Credit Card: how to apply

If you want to apply for the African Bank Gold Credit Card, you have made a great decision. 60 days interest-free period and free swipes.

About the author / Giovanna Klein

Trending Topics

Absa: how to apply for a job opening

Want to know how you can apply for a job at Absa without any complications? Check out this article and discover how in very easy steps!

Keep Reading

Hoopla Loans: all you need to apply

If you're looking for a loan and want to find the best lenders and offers, check out how to apply for Hoopla Loans! Up to R250,000!

Keep Reading

Apply for ABSA Personal Loans with Confidence

Need funds for your dreams? Apply for ABSA personal loans and make them a reality with quick access to the funds you require.

Keep ReadingYou may also like

How to apply for a job at RCL Foods: Competitive pay!

Are you interested in learning how to apply for a job at RCL Foods? Check out this post! Earn up to R20,000 per month! Read on!

Keep Reading

African Bank Black Credit Card Review: High Credit Limit!

Elevate your financial status: read our African Bank Black Credit Card review. Uncover its top-notch benefits! 0% interest for 62 days!

Keep Reading

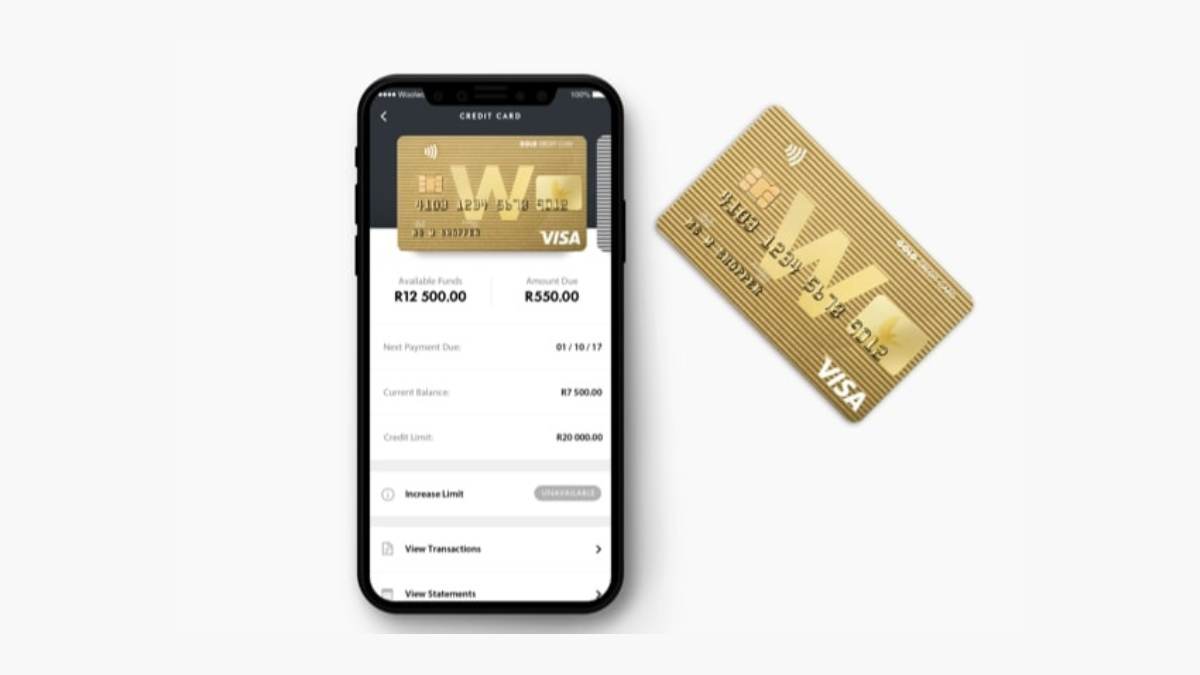

Your Ticket to Shopping Rewards: Woolworths Gold Credit Card review

Looking for a credit card that rewards your loyalty? Check out our review of the Woolworths Gold Credit Card.

Keep Reading