Credit Cards

Apply for Capital One Quicksilver Secured Cash Rewards Credit Card

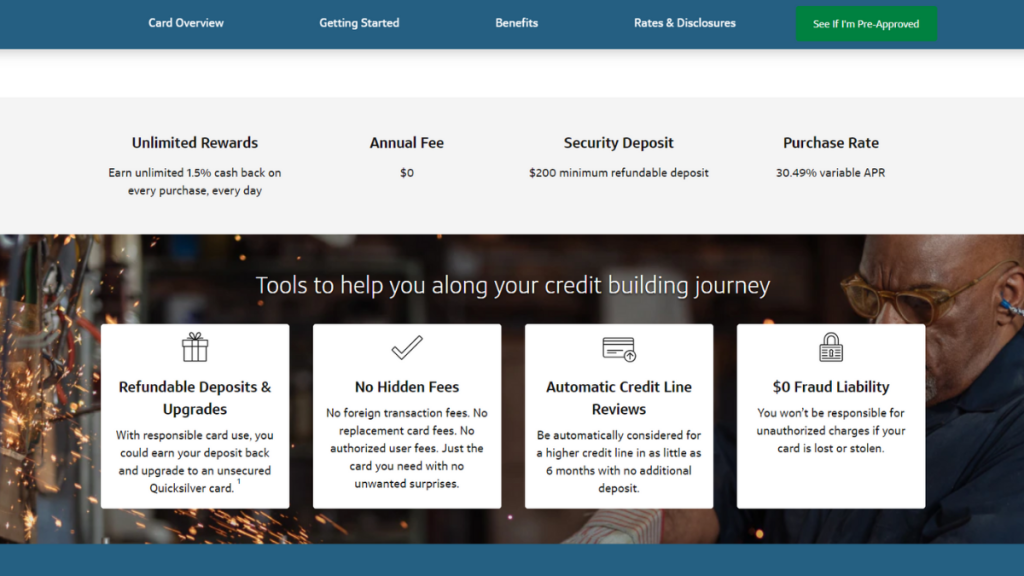

Earn rewards, rebuild your credit and keep track of your financial life easily with this secured credit card - Capital One Quicksilver Secured Cash Rewards Credit Card!

Advertisement

Earning rewards while rebuilding your credit score is more than possible with this secured credit card!

Today, you’ll learn how to apply for Capital One Quicksilver Secured Cash Rewards Credit Card!

Applying for the Capital One Quicksilver Secured Credit Card is fast, easy, and secure. Learn more about its application process below.

Apply for the card: Online

The Capital One Quicksilver Secured Cash Rewards Credit Card may be your solution if you want to build credit but lack a credit history.

Applying for this card is easy and can be done completely online. Firstly, on Capital One’s website, click on the “Apply Now” button.

Capital will request your personal information, contact information – such as residential address and email address -and financial information.

You will be able to revise all of the important disclosures of the card before applying, such as eligibility, rates, and fees.

Make sure to read it all before compromising.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card: Mobile App

Applying for the card through the mobile app is impossible, but Capital One offers 3 mobile apps and digital services you will find really useful.

The first is their mobile app, where you can access your account information 24/7/365. Make a payment and check your balance or recent transactions.

They also offer Eno, an assistant that keeps track of your accounts and is ready to signal whenever a problem or transaction occurs.

Last but not least, Capital One offers CreditWise, a service made for you to monitor your credit even if you don’t have a Capital One credit card.

Capital One Quicksilver Secured Credit Card or OpenSky® Secured Visa® Credit Card?

When choosing the right credit card to rebuild your credit, it is important to know all your options before deciding.

Here, you can find a comparison between Capital One and OpenSky secured credit cards so that you can be sure of your decision.

| Capital One Quicksilver Secured Credit Card | OpenSky® Secured Visa® Credit Card | |

| Credit Score | There is no credit check; | No credit check; |

| Annual Fee | Capital One charges no annual fee for this card; | $35; |

| Purchase APR | 30.74% variable APR; | 22.64% variable; |

| Cash Advance APR | 30.74% variable APR; | 22.64% variable; |

| Welcome Bonus | None; | None; |

| Rewards | Earn 1.5% unlimited cash back on all your purchases. | There are no rewards on purchases. |

Are you interested in learning how to apply for the OpenSky® Secured Visa® Credit Card? Great! Then don’t miss our following article!

We’ll explain the process in detail so you won’t miss a thing. Then, keep reading and learn more!

OpenSky® Secured Visa® Credit Card: how to apply

Learn how to quickly and easily apply for the OpenSky® Secured Visa® Credit Card and start improving your credit score today!

About the author / Giovanna Klein

Trending Topics

Empower Your Finances: Choosing Credit Cards for Good Credit

Unlock the full potential of your good credit score by choosing the perfect credit cards for good credit. Read on!

Keep Reading

Rebuild Credit: Apply for the Fortiva® Mastercard® Credit Card

Learn how to apply for the Fortiva® Mastercard® Credit Card and rebuild your credit to perfection! Earn cash back on purchases!

Keep Reading

Up to $50,000: Find out how to apply for an Upstart Loan!

Find a loan option with an innovative model and loans of up to $50,000! Read on to learn how to apply for an Upstart Loan!

Keep ReadingYou may also like

Unique Platinum Card review: $1,000 credit line with no credit checks!

Do you want a card that will still give you a chance if you have a low credit score? Then don't miss the Unique Platinum Card review. 0% APR.

Keep Reading

LendingClub Personal Loans review: up to $40,000

In this LendingClub Personal Loans review, we listed all the features and benefits of choosing it! Enjoy affordable conditions! Read on!

Keep Reading

SavorOne Student Cash Rewards review: get 3% cash back!

SavorOne Student Cash Rewards is a champion in every expert’s review. Check the outstanding list of benefits in this post - $50 cash bonus!

Keep Reading