Credit Cards

Capital One Quicksilver Cash Rewards: 0% Intro APR!

Enjoy a sweet welcome bonus, unlimited cash back rewards, and a series of exclusive benefits with the Capital One Quicksilver Cash Rewards. See how to apply below!

Advertisement

Unlimited cash back rewards and easy online application!

Are you ready to start earning cash back rewards? The Capital One Quicksilver Cash Rewards makes it easy, and you can apply for it in a couple of minutes.

This awesome card features competitive benefits! So stick with us and learn how to get yours easily!

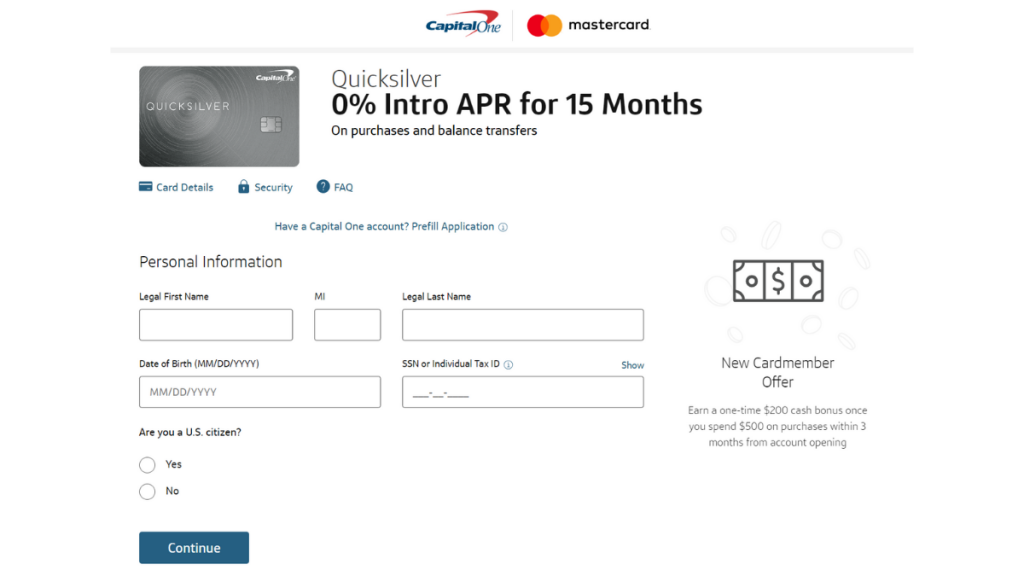

Apply for the Quicksilver Cash Rewards online

Before you apply for the Capital One Quicksilver Cash Rewards Credit Card, you can pre-qualify and see your approval odds.

Firstly, access the Capital One website. If you think you’ll get approved, you can pre-qualify or go through the application process.

Both forms will require personal and address information, as well as your SSN and financial info, like your income.

Submit your application, and you’ll get an answer very soon.

However, if you do not qualify for the Capital One Quicksilver Cash Rewards Credit Card, Capital One will show you other card options to apply for.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card via mobile app

Indeed, Capital One does have a great app for financial management. You can even track your credit score and check your transactions.

However, their website is the best way to apply for the Capital One Quicksilver Cash Rewards Credit Card. You can also go to a Capital One physical branch.

Capital One Quicksilver Cash Rewards Credit Card or Upgrade Triple Cash Rewards Visa®?

If you want to earn rewards, we have another recommendation for you. It is the Upgrade Triple Cash Rewards Visa®.

The Capital One Quicksilver Cash Rewards Credit Card and the Upgrade Triple Cash Rewards Visa® have cash back but at different rates.

Also, none of these credit cards charge an annual fee. So read the table below to compare all of its features.

| Capital One Quicksilver Cash Rewards Credit Card | Upgrade Triple Cash Rewards Visa® | |

| Credit Score | Good to excellent; | Good to excellent; |

| Annual Fee | None; | $0 per year; |

| Purchase APR | 0% intro APR for 15 months. 19.99% – 29.99% after; | From 14.99% to 29.99%. Terms apply; |

| Cash Advance APR | Variable 29.99%; | N/A; |

| Welcome Bonus | Earn a $200 cash bonus after spending $500 on purchases in the 1st 3 months; | A $200 welcome bonus is for those who open a Rewards Checking account and make 3 debit card transactions. Terms apply; |

| Rewards | 1.5% unlimited cashback on purchases. | From 1% up to 10% cash back on purchases, according to its category. |

Now, you can apply for the Upgrade Triple Cash Rewards Visa® if you want.

In the following, you’ll find our comprehensive application guide about it.

Upgrade Triple Cash Rewards Visa®: how to apply

We'll show you how to apply for the Upgrade Triple Cash Rewards Visa® online! Earn up to 10% cash back and more! Read on!

About the author / Julia Bermudez

Trending Topics

How to Reach Economic Success

Achieve economic success with our unique guide! Explore tips & tools to drive growth and financial stability in your life.

Keep Reading

How to apply for a job at Taco Bell: Flexible hours!

Looking for a job with flexible hours and great benefits? Learn how you can apply for a job at Taco Bell and what to expect from the process.

Keep Reading

500 bonus points: Apply for Brink’s Money Prepaid Mastercard®

Check out how to apply for the Brink's Money Prepaid Mastercard® - earn points on purchases and manage your money easily! Read on!

Keep ReadingYou may also like

What happens if you don’t use your credit card?

Are you wondering what happens if you don’t use your credit card? We got the answer! Read on and see what you can do about it.

Keep Reading

How to apply for the OpenSky® Secured Visa®

Learn how to apply for the OpenSky® Secured Visa® Credit Card and get one of the best tools available to help you improve your credit score!

Keep Reading

How to apply for a job at Subway: Growth opportunities for all

Ready to make your mark? Apply for a job at Subway and join a team that serves up success and endless opportunities.

Keep Reading