Debit Cards

Earn up to 3% cash back: Walmart MoneyCard® review

If you’re a frequent Walmart shopper, get your Walmart MoneyCard® to catch up to 3% of your purchase back. Keep reading and learn more!

Advertisement

If your regular debit card has no rewards, consider shifting to the Walmart MoneyCard®!

If you’re tired of using a debit card with zero benefits, this Walmart MoneyCard® review will show you a better way to spend and save money.

Apply for Walmart MoneyCard®

Looking for cash back rewards but have a low credit score? Apply for the Walmart MoneyCard®, and you’ll get your rewards!

Easy to get and easy to use, this reloadable card will give you more cash back than most credit cards – with no credit check! Read on and learn more!

| Credit Score | No credit score requirement; |

| Annual Fee | $5.94 per month. However, you can waive this fee with a minimum $500 deposit; |

| Purchase APR | No purchase APR; |

| Cash Advance APR | As this is a reloadable card, there is no cash advance. You can just take your deposit back; |

| Welcome Bonus | N/A; |

| Rewards | From 1% up to 3% cashback. Earn 2% interest rate on your savings. |

Walmart MoneyCard® overview

Would you like to get a reloadable card with no fees that give you cash back? If you said yes, you’re in the right place: the Walmart MoneyCard® full review.

Clearly, we know it sounds too good to be true, but this card is real. Using the Walmart MoneyCard® will give you plenty of benefits with no cons.

Indeed, you can get this card at any Walmart nearby. After that, you can load the card with any amount and start swiping this card everywhere.

Despite being a prepaid debit card, it will give you rewards like a credit card and help you save money, like a savings account with 2% APY.

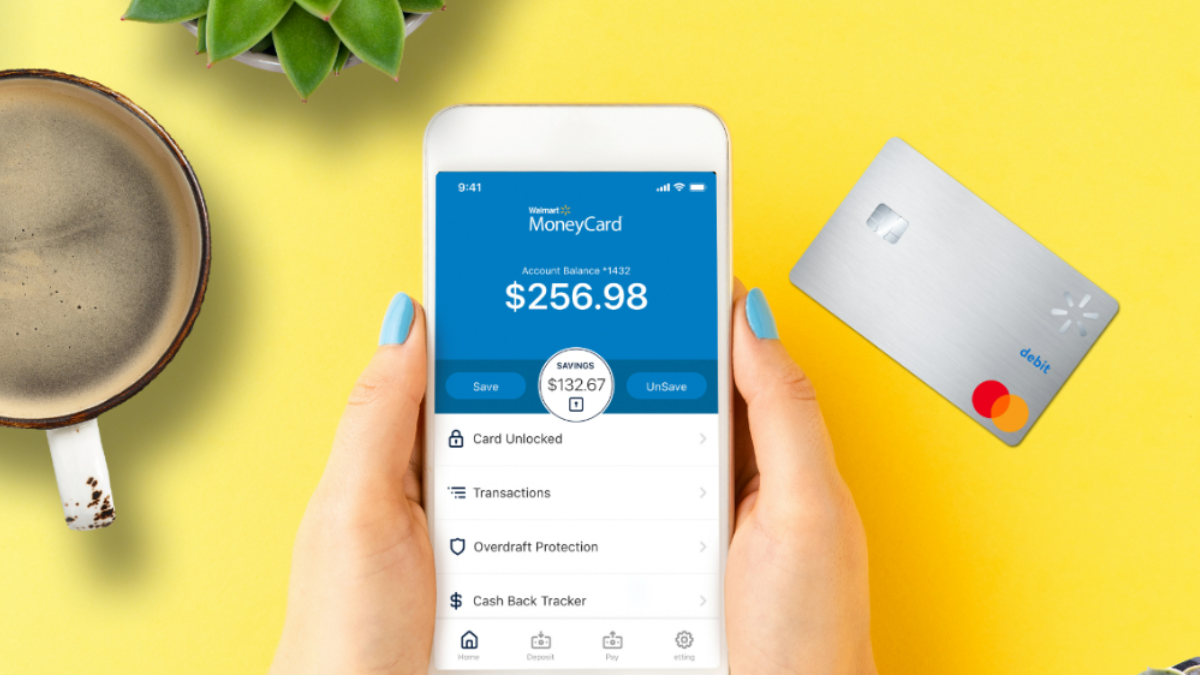

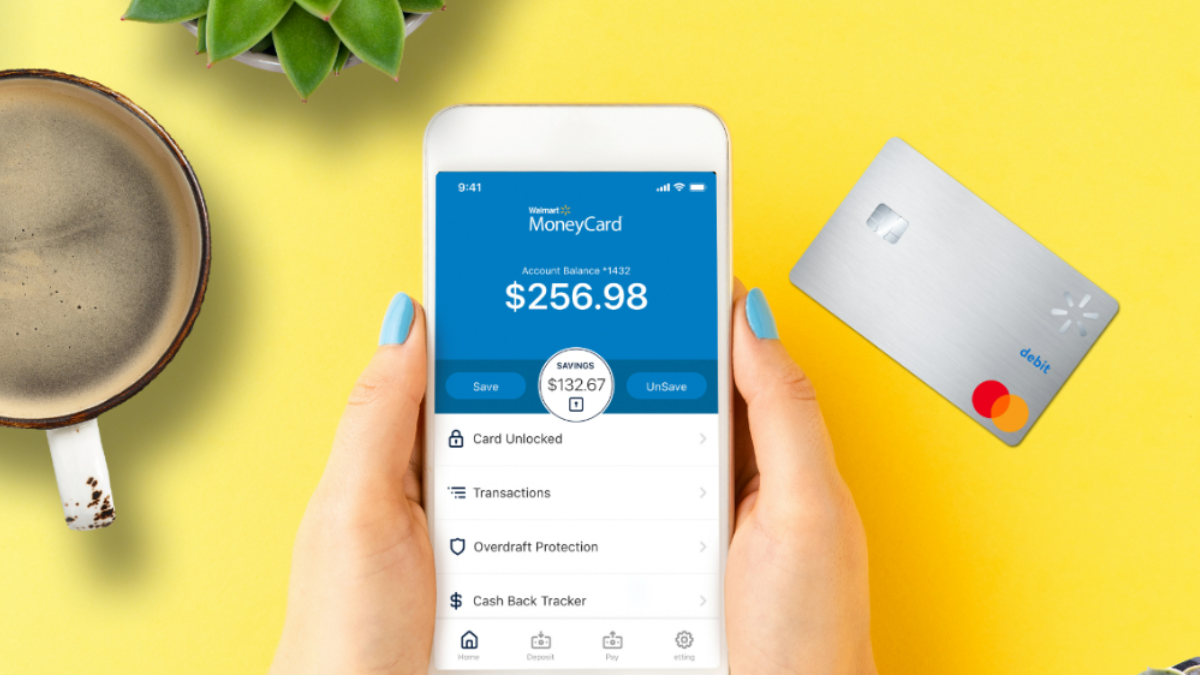

Also, to help you manage your finances like a pro, you can download the app to check your balance, track your spending, and redeem your cash back.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Walmart MoneyCard® main features

Without a doubt, every Walmart frequent shopper can benefit a lot from keeping this credit card in their wallet.

Further, let’s review the Walmart MoneyCard® pros and cons to see if you consider this card a good achievement:

Pros

- You can waive your monthly fee when you direct deposit $500+ in the previous monthly period. Otherwise, $5.94 a month;

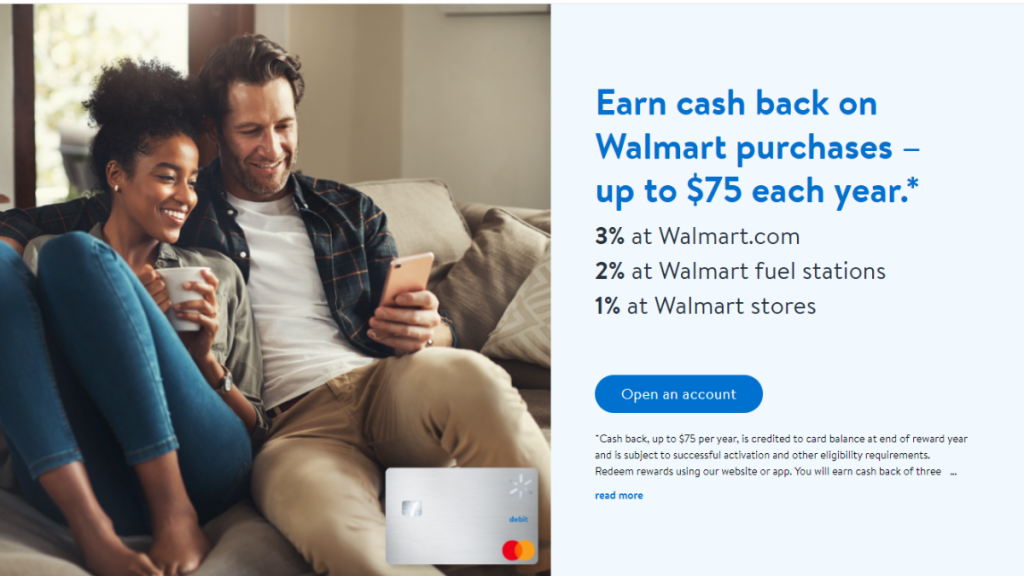

- Get 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, & 1% cash back at Walmart stores, up to $75 each year;

- Earn a 2% interest rate on up to $1,000 balance in your savings account. Plus, get chances to win cash prizes each month;

- Get peace of mind with three coverage levels, up to $200, for purchase transactions with opt-in & eligible direct deposit;

- Please see the site for full terms and conditions.

Cons

- There is a cap of $75 cash back per year, so your rewards are not unlimited;

- As it is not a credit card, it will not help you build a credit score.

Minimum credit score to apply

There is no such requirement. Just get your Walmart MoneyCard®, load it, and start using it. No questions asked about your creditworthiness!

How to apply for the Walmart MoneyCard®?

Indeed, getting this card is as easy as using it. If you’re convinced this card is a must-have, check the following link for application guidance.

Apply for Walmart MoneyCard®

Looking for cash back rewards but have a low credit score? Apply for the Walmart MoneyCard®, and you’ll get your rewards!

About the author / Julia Bermudez

Trending Topics

Get more for your money: Choose your ideal 0% APR credit card!

This post will help you to choose the best 0% APR credit card and save money. Read on to learn more about credit cards!

Keep Reading

Earn more: Apply for Capital One Venture Rewards Credit Card

Travel perks, flexible redemption options, and a generous sign-up bonus? Learn how to apply for the Capital One Venture Rewards Credit Card!

Keep Reading

Revvi Card Review: Earn 1% Cash Back While Building Credit

Get the details on how the Revvi card helps you build credit, earn cash back, and more in our comprehensive review!

Keep ReadingYou may also like

$0 annual fee: Apply for the Instacart Mastercard®!

Ready to level up your Instacart experience? Learn how to apply for the Instacart Mastercard® effortlessly - up to 5% cash back!

Keep Reading

Apply for Chase Freedom Flex℠: Enjoy Rewards & No Annual Fee!

Learn how to apply for Chase Freedom Flex℠ today and take advantage of its rewards. Enjoy 0% intro APR for 15 months! Read on!

Keep Reading

Apply for U.S. Bank Altitude® Go Visa Signature® Card easily

Learn now how to apply for the U.S. Bank Altitude® Go Visa Signature® Card and earn points on daily purchases - $0 annual fee! Read on!

Keep Reading