Debit Cards

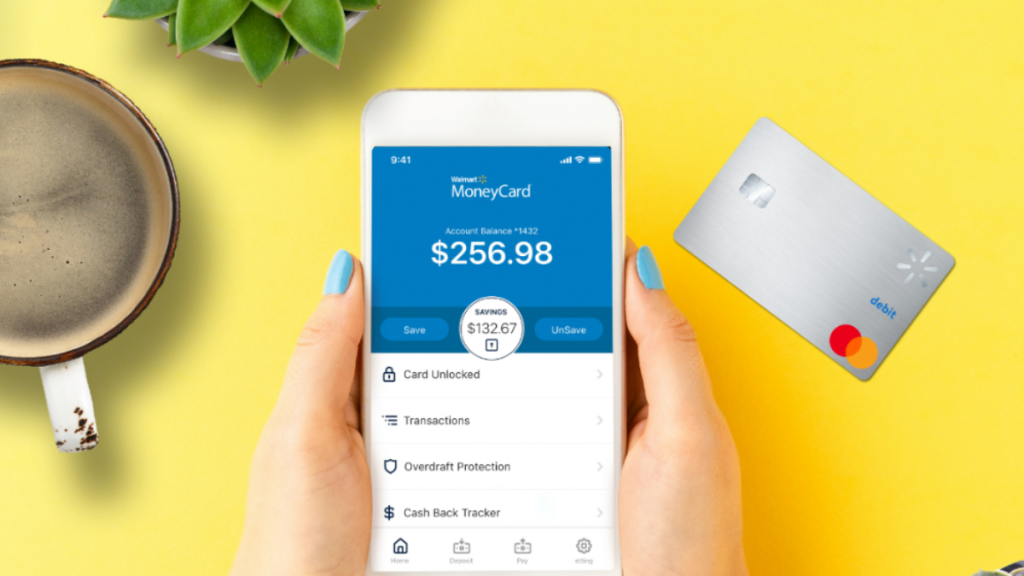

Save money in your grocery shopping: apply for Walmart MoneyCard®

If you're an Walmart customer, there is a better way to use your money there: apply for the Walmart MoneyCard® to earn cash back rewards!

Advertisement

Get this card and start using it on the same day to enjoy its benefits for shopping

Getting a card with cash back doesn’t have to be complicated or require a high credit. Apply for the Walmart MoneyCard® and start benefits today!

With a simple system, you’ll discover an efficient way to manage your money and keep the pantry full throughout the month. So keep reading and learn more!

Apply for the card: Online

You’ll see how to apply for the Walmart MoneyCard® in only a few minutes. So, this card has been efficient since the beginning!

Firstly, open your account. You must be at least 18 and provide your personal info, such as full name, SSN, address, etc. Do it on the Walmart website.

To complete the process, you must have your smartphone to apply, as they must check your devices and your ability to receive texts.

Then, you can acquire the physical card at any Walmart nearby. With your account opened, activate and register your card. Also, download the app!

You can make your first deposit and start using the card. The cashback you earn can be redeemed as a balance on your card at the end of the first year.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card: Mobile App

Once you create your account, you must download the mobile app to manage your account.

Thus, you can track your rewards, check your balance, and every transaction made with your Walmart MoneyCard®.

Walmart MoneyCard® or QuicksilverOne Cash Rewards?

Are you interested in cash back but prefer applying for a credit card instead? Then we’ve got you covered!

Before applying for the Walmart MoneyCard, look at your credit score and see if you could apply for a credit card.

Also, check the QuicksilverOne Cash Rewards! This Capital One credit card will give you cash back on every purchase, not just at Walmart.

So check the comparative table below to see how these two cards perform side by side:

| Walmart MoneyCard® | QuicksilverOne Cash Rewards | |

| Credit Score | No credit score requirement; | Fair credit; |

| Annual Fee | $5.94 per month. However, you can waive this fee with a minimum $500 deposit; | Just $39 yearly; |

| Purchase APR | No purchase APR; | Variable 30.49%; |

| Cash Advance APR | As this is a reloadable card, there is no cash advance. You can just take your deposit back; | Variable 30.49%; |

| Welcome Bonus | Unfortunately, there is no welcome bonus when you apply for the Walmart MoneyCard; | This Capital One card has no welcome bonus; |

| Rewards | From 1% up to 3% cashback. Earn a 2% interest rate on your savings. | Enjoy a flat rate of 1.5% cash back on every purchase. |

Would you like to learn more about QuicksilverOne Cash Rewards features and see if you have what it takes to apply for it?

We’ve done a full review and an application guide to help you navigate the process and take a step into your new credit life.

Apply for Capital One QuicksilverOne Cash Rewards

Getting a credit card has become easier. Read on and see how to apply for the QuicksilverOne Cash Rewards by moving just your fingers.

About the author / Julia Bermudez

Trending Topics

5 best paying jobs in major banks: make your dream job a reality!

Do you want to know the best-paying jobs in major banks? Figure this and a lot more out in today's article!

Keep Reading

Honest Loans: all you need to apply

Find out what makes Honest Loans the right choice before you decide to apply. Borrow up to $50K for several purposes! Keep reading!

Keep Reading

Apply for Chase Freedom Unlimited®: No Annual Fee & 0% Intro APR

Follow these easy steps and learn how to apply for the Chase Freedom Unlimited® credit card. 0% intro APR on purchases and more!

Keep ReadingYou may also like

Hair Stylist Training by Online Makeup Academy: enroll today

Enroll in the Hair Stylist Training by Online Makeup Academy and start your new job today. Read on and learn more!

Keep Reading

PenFed Pathfinder® Rewards Visa Signature®: how to apply

Learn now how to apply for the PenFed Pathfinder® Rewards Visa Signature® and earn premium travel rewards in a straightforward process.

Keep Reading

$750 credit limit: Freedom Gold Card review

Do you need to shop for a few things but have difficulty getting approved for a credit card? This Freedom Gold Card review has the solution!

Keep Reading