Credit Cards

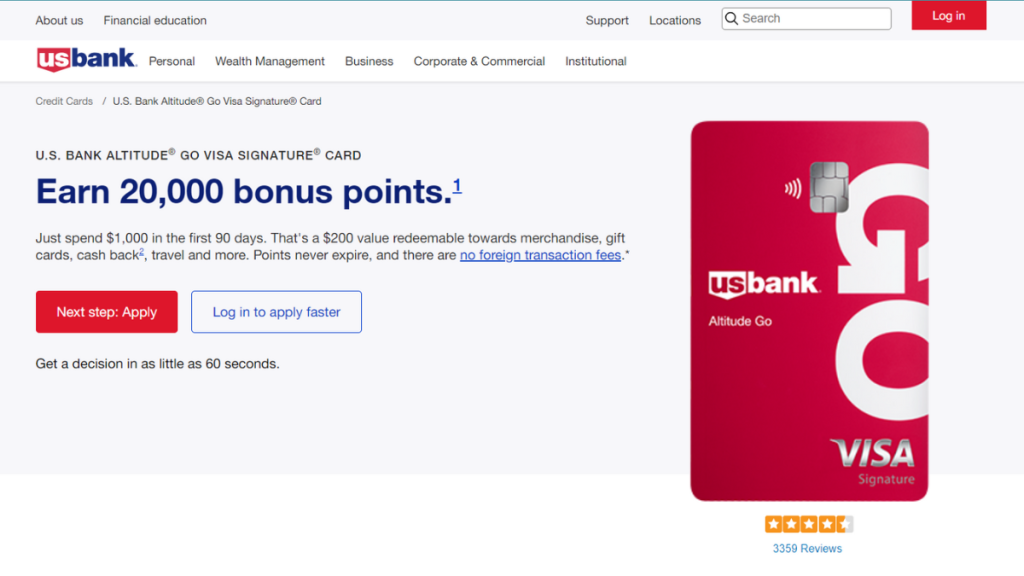

Earn points: U.S. Bank Altitude® Go Visa Signature® Card review

Are you ready to have a game-changing experience? Then don't miss the U.S. Bank Altitude® Go Visa Signature® Card - $0 annual fee and exclusive perks!

Advertisement

Enjoy earning points on everyday purchases and redeem them for travel and more!

Read this review to learn more about the U.S. Bank Altitude® Go Visa Signature® Card and how it can save you money—every day!

Apply for U.S. Bank Altitude® Go Visa Signature®

Learn now how to apply for the U.S. Bank Altitude® Go Visa Signature® Card and earn points on daily purchases – $0 annual fee! Read on!

So today we’ll go over all of the details that make up this generous offer and why it could be worth considering. So read on and learn more!

| Credit Score | Good to excellent; |

| Annual Fee | No annual fees; |

| Purchase APR | 0% intro APR for 12 billing cycles; 18.24% to 29.24% thereafter; |

| Cash Advance APR | 29.99%; |

| Welcome Bonus | Earn 20,000 bonus points when you spend $1,000 in eligible purchases within the first 90 days of account opening; |

| Rewards | 4 points per $1 spent on dining, including takeout and delivery; 2 points per $1 spent at grocery stores (including grocery delivery), gas stations, EV charging stations, and on eligible streaming services; 1 point per $1 spent on all other eligible purchases. Also, get a $15 credit for annual streaming services purchases like Netflix, Apple TV+, Spotify®, and more. |

U.S. Bank Altitude® Go Visa Signature® Card overview

When it comes to managing your finances, the U.S. Bank Altitude® Go Visa Signature® Card is an excellent choice.

Thus, this credit card offers up to 4X points per dollar spent on multiple categories! Therefore, you can earn on evet purchase!

Also, there’s no annual fee, making it a practical option for anyone who wants to enjoy the perks of a rewards card without paying extra.

The card also offers a sleek design with contactless payment options, making it easy and convenient to use.

With a competitive APR and exclusive benefits for cardholders, the U.S. Bank Altitude® Go Visa Signature® Card is definitely worth considering!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

U.S. Bank Altitude® Go Visa Signature® Card main features

The U.S. Bank Altitude® Go Visa Signature® Card packs a punch in a compact design.

Indeed, with its impressive features, it’s no wonder it’s becoming a popular choice for frequent travelers and foodies alike.

However, when it comes to choosing a credit card, it is important to consider all of the perks and drawbacks of your choice.

Further, let’s take a look into the U.S. Bank Altitude® Go Visa Signature® advantages and disadvantages.

Pros

- No annual fee;

- New cardholder bonus offer;

- Bonus categories;

- Intro APR period.

Cons

- It requires a higher credit score.

Minimum credit score to apply

Indeed, this credit card requires an excellent credit score. This means your credit score must be 720 or higher.

How to apply for the U.S. Bank Altitude® Go Visa Signature® Card?

If you’re interested in earning rewards and want to know more about how to apply this card, then check our next post!

Apply for U.S. Bank Altitude® Go Visa Signature®

Learn now how to apply for the U.S. Bank Altitude® Go Visa Signature® Card and earn points on daily purchases – $0 annual fee! Read on!

About the author / Giovanna Klein

Trending Topics

Introduction to Mechanical Drawings by Udemy: enroll today

Want to enroll in the Introduction to Mechanical Drawings course by Udemy? Check out this full guide and learn how to do it today!

Keep Reading

Wells Fargo Reflect® Card review: 0% intro APR

This review will show you how Wells Fargo Reflect® Card helps you save money! Pay a $0 annual fee! Keep reading and learn more!

Keep Reading

Turn Your Credit Around: Discover the Best Cards for Bad Credit

Get information on how to turn your financial life around - learn what are the best credit cards for bad credit.

Keep ReadingYou may also like

Wells Fargo Reflect® Card: how to apply

If you’d like to apply for the Wells Fargo Reflect® Card to enjoy the 0% intro APR, you’re in the right place. Read on to learn how to do it!

Keep Reading

Credit cards made easy. Get the credit card you deserve and Unlock your credit score potential

Choose a credit card to improve your finances! We’ll show you the best options and show you how to choose one of them.

Keep Reading

Up to 5% cash back: Capital One® Walmart Rewards® Card Review

Don't miss this Capital One® Walmart Rewards® Card Review - enjoy up to 5% cash back on all purchases and $0 annual fee! Read on!

Keep Reading