Credit Cards

$0 annual fee: Apply for SavorOne Student Cash Rewards

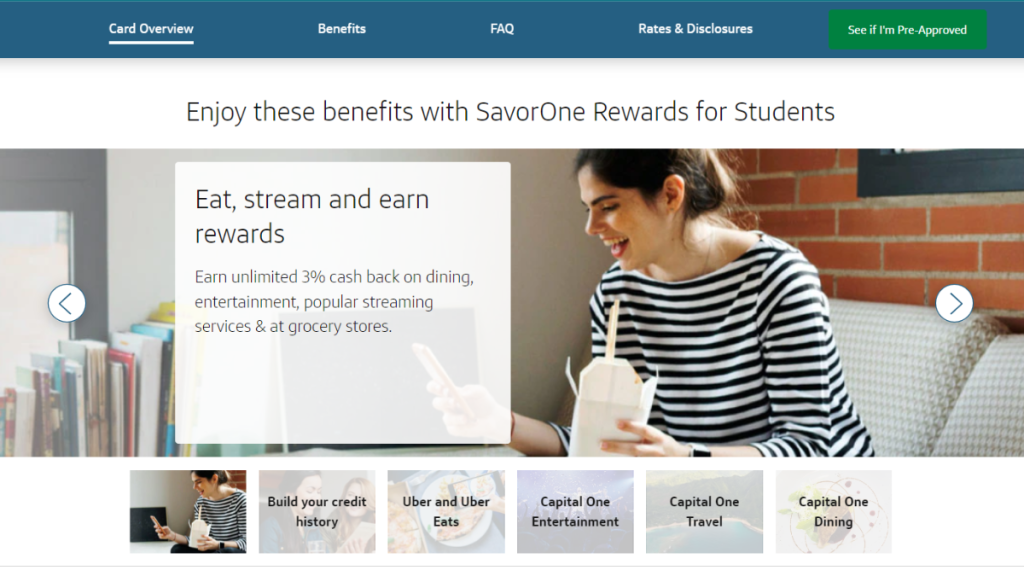

Do you think getting up to 3% cash back and paying no annual fee is a good deal? If so, keep reading and learn how to apply for the SavorOne Student Cash Rewards.

Advertisement

Enjoy the many benefits of a rewards credit card!

Learn how to apply for the SavorOne Student Cash Rewards, and you’ll have a way better way to manage your finances during your college years.

You will need a previous credit history to apply for this one, but it will be worth the effort. Capital One has made a very powerful card, and you’ll enjoy it!

Apply for the card: Online

Applying for a credit card is not hard. However, it’s not always easy to get approved for it. So let’s review the eligibility requirements:

- Have a valid address in the U.S and be at least 18 years old;

- Your monthly income must exceed your rent/mortgage;

- Also, you must be able to prove you’re enrolled in a higher educational program, like University and College.

There are other requirements, but these are the major ones when it comes to cardholders’ profile analysis.

Further, go to the Capital One website to start the application process.

If you’re unsure about your approval odds, you can pre-qualify. If you receive the SavorOne Student Cash Rewards offer, continue with the application!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Fill out the application form

Find the SavorOne Student Cash Rewards on the Capital One website and hit the “Apply Now” button. You’ll be redirected to the application form.

It is not very long, but there will be many fields to pay attention to. This way, you avoid rejection because of some wrong or confusing information.

Once you fill it all with your personal and financial information, read carefully the terms and conditions.

So if you agree with them, hit “continue” and submit your application.

Furthermore, wait for Capital One response, and if you’re approved, congratulations!

Apply for the card: Mobile App

If you are already a Capital One client, you can apply for a new credit card using your mobile app.

For new applicants, you’ll get redirected to the Capital One website, and then you can follow the previous instructions on how to apply.

SavorOne Student Cash Rewards or Discover It® Secured Credit Card?

Looking for a credit card that accepts your short credit history? Let’s see an alternative to the SavorOne Student Cash Rewards.

Another great option for people who are new to credit is a secured credit card.

Indeed, they have an easier application process, and you can save money from the security deposit.

Regarding cards for young people, Discover is a tough competitor to Capital One. Take a look at the Discover It® Secured Card features:

| SavorOne Student Cash Rewards | Discover It® Secured Credit Card | |

| Credit Score | Good or excellent; | All types of credit; |

| Annual Fee | You won’t have to pay any annual fee for this credit card; | $0 annual fee; |

| Purchase APR | From 19.99% to 29.99%. The APR will depend on your creditworthiness; | 27.29% variable; |

| Cash Advance APR | 29.99%; | 29.49% variable; |

| Balance Transfer Fee: | $0 at the Transfer APR, 3% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you. | N/A. |

| Welcome Bonus | $50 cash bonus. Terms apply; | New members can enjoy a dollar-for-dollar cashback match from Discover at the end of their first year; |

| Rewards | 1% on every purchase bonus: 3% cash for supermarket, streaming services, dining, and entertainment. | 2% cash back at gas stations and restaurants up to $1,000 (combined) per quarter; 1% cash back on all other purchases. |

If you prefer the Discover It® Secured Credit Card, you can be sure to get one of the best-secured credit cards available today.

The following link will take you to our application guide. Take the first step to taking charge of your financial future with a rewarding, secured card!

Discover It® Secured Credit Card: how to apply

Learn how to apply for the Discover It® Secured Credit Card and improve your score to excellence while earning cash back rewards!

About the author / Julia Bermudez

Trending Topics

When is the best time to rent a car?

Find the best time to rent a car with these tips. Save money on transportation and enjoy riding a car during your travel!

Keep Reading

Citi Custom Cash℠ Card Review: Earn Up to 5% Cash Back

Check out our Citi Custom Cash℠ Card full review and learn how you can start earning cash back! Enjoy 0% intro APR for 15 months!

Keep Reading

High Paying Military Career for Seniors: Up to $50K Bonuses

Discover the top high-paying military jobs that offer financial stability and adventure. Explore career options and benefits!

Keep ReadingYou may also like

Earn 1.5% cash back: HSBC Cash Rewards Mastercard® review

If you're in the market for a new credit card, check out our HSBC Cash Rewards Mastercard® Review! Up to 14% bonus cash back and more!

Keep Reading

Merrick Bank Double Your Line® Secured Credit Card: how to apply

Learn now how to apply for Merrick Bank Double Your Line® Secured Credit Card and rebuild your credit history!

Keep Reading

A Golden Opportunity: Apply for the PenFed Gold Visa® Card

Ready to embrace low-interest credit? Learn how to apply for the PenFed Gold Visa® Card in our step-by-step guide.

Keep Reading