Credit Cards

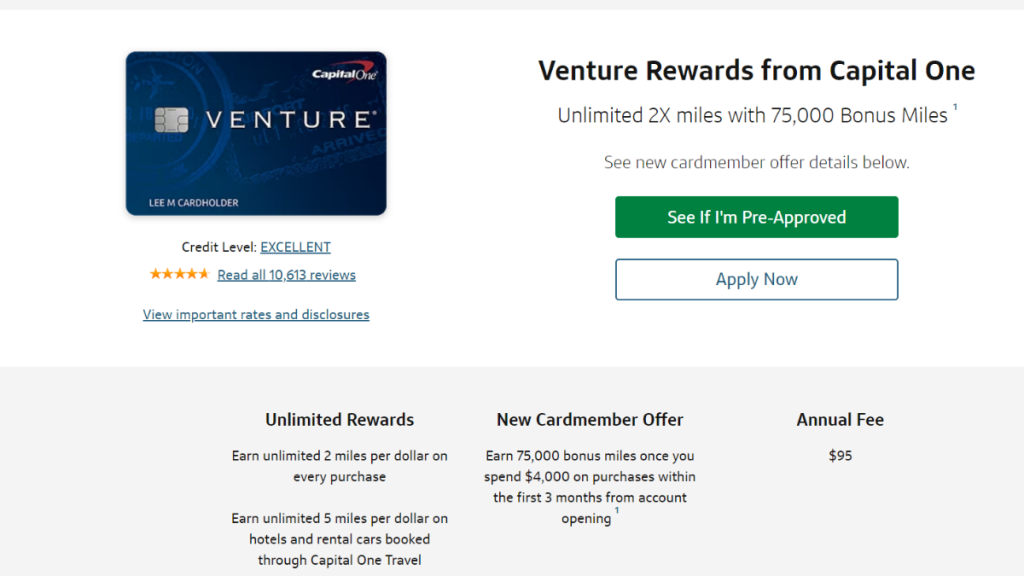

75K bonus miles: Capital One Venture Rewards Credit Card review

This card features a fantastic rewards program, with limitless 2x miles on all purchases and flexible redemption for both travel and cash back.

Advertisement

Earn up to 5 miles for every dollar

In this full review, you’ll discover why the Capital One Venture Rewards Credit Card has been making quite a splash.

Apply for Capital One Venture Rewards Credit Card

Travel perks, flexible redemption options and a generous sign-up bonus? Learn how to apply for the Capital One Venture Rewards Credit Card!

With unlimited 2x miles on every purchase, this card offers a stellar rewards program. Further, learn more about its benefits!

| Credit Score | Excellent credit history is required; |

| Annual Fee | $95; |

| APR | Purchase APR: 19.99% – 29.99%(Variable); Balance Transfer APR: 19.99% – 29.99% (Variable); |

| Cash Advance APR | 29.99% (Variable). |

| Welcome Bonus | Get 75,000 extra miles after spending $4,000 in the first three months of account opening; |

| Rewards | It awards 5 miles per dollar on hotels and rental cars booked through Capital One Travel and 2 miles per dollar on everything else. |

Capital One Venture Rewards Credit Card overview

The Capital One Venture Rewards Credit Card is a good option if you’re always on the road and looking for a rewards program.

Indeed, with no foreign transaction fees, this card lets you use your funds overseas without any added expense.

You’ll also earn 2 miles per dollar on every purchase, allowing you to rack up rewards quickly.

In addition, the sign-up bonus is nothing to scoff at: 75,000 bonus miles after spending $4,000 in the first three months.

Whether planning a weekend getaway or a trip worldwide, this credit card can help make your travels more rewarding.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Capital One Venture Rewards Credit Card main features

There are endless options for credit cards, but if you’re looking for an attractive rewards program, this is worth it.

However, when choosing a credit card, it is crucial to be aware of its disadvantages.

So review the benefits and drawbacks of the Capital One Venture Rewards Credit Card here.

Pros

- Earn 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- 2X miles on every purchase, every day.

- 5X miles on hotels and rental cars booked through Capital One Travel.

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn.

- Receive up to a $100 credit for Global Entry or TSA PreCheck®.

- Enjoy two complimentary visits per year to Capital One Lounges or to 100+ Plaza Premium Lounges through the Partner Lounge Network.

- Use your miles to get reimbursed for any travel purchase – or redeem by booking a trip through Capital One Travel.

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more.

- Transfer your miles to your choice of 15+ travel loyalty programs.

Cons

- Annual charge of $95;

- There is no intro APR for either purchases or balance transfers.

Minimum credit score to apply

This card requires an excellent credit score to apply.

How to apply for the Capital One Venture Rewards Credit Card?

Applying for a credit card can be daunting, especially if you don’t have much experience with online applications.

If you want to know the steps to apply for the Capital One Venture Rewards Credit Card, then check out our next post and learn more!

Apply for Capital One Venture Rewards Credit Card

Travel perks, flexible redemption options and a generous sign-up bonus? Learn how to apply for the Capital One Venture Rewards Credit Card!

About the author / Giovanna Klein

Trending Topics

Up to 5% cash back: Capital One® Walmart Rewards® Card Review

Don't miss this Capital One® Walmart Rewards® Card Review - enjoy up to 5% cash back on all purchases and $0 annual fee! Read on!

Keep Reading

Introduction to Technical Drawing by Alison: enroll today

If you want to enroll in the Introduction to Technical Drawing course by Alison, you'll do well to check this article! We'll teach you how!

Keep Reading

Happy Money Loans review: Your Gateway to Smart Borrowing

Do you need a good loan provider? If so, get the lowdown on their services in our Happy Money Loans review! Up to $40,000 quickly!

Keep ReadingYou may also like

First Progress Platinum Prestige Mastercard® Secured Credit Card review

Check our First Progress Platinum Prestige Mastercard® Secured Credit Card review and learn how to earn rewards while you build your score!

Keep Reading

How to Open an Account at Chase Bank: hassle-free process

Looking for a new banking experience? Discover how to open an account at Chase Bank and enjoy their customer-focused approach.

Keep Reading

Earn points: U.S. Bank Altitude® Go Visa Signature® Card review

Check this U.S. Bank Altitude® Go Visa Signature® Card review and learn how to earn points and save money with no annual fee!

Keep Reading