Loans

Apply for SmartFundSolutions: no hidden fees

Discover a straightforward path to financial support with SmartFundSolutions. Learn application tips in our guide for hassle-free loan access!

Advertisement

Seamless Loan Access: Learn how to apply for SmartFundSolutions

Looking for a hassle-free way to secure a loan? Learning how to apply for SmartFundSolutions might just be the answer.

Also, applying for a loan can often feel like navigating a labyrinth, but with SmartFundSolutions, the process is streamlined and straightforward.

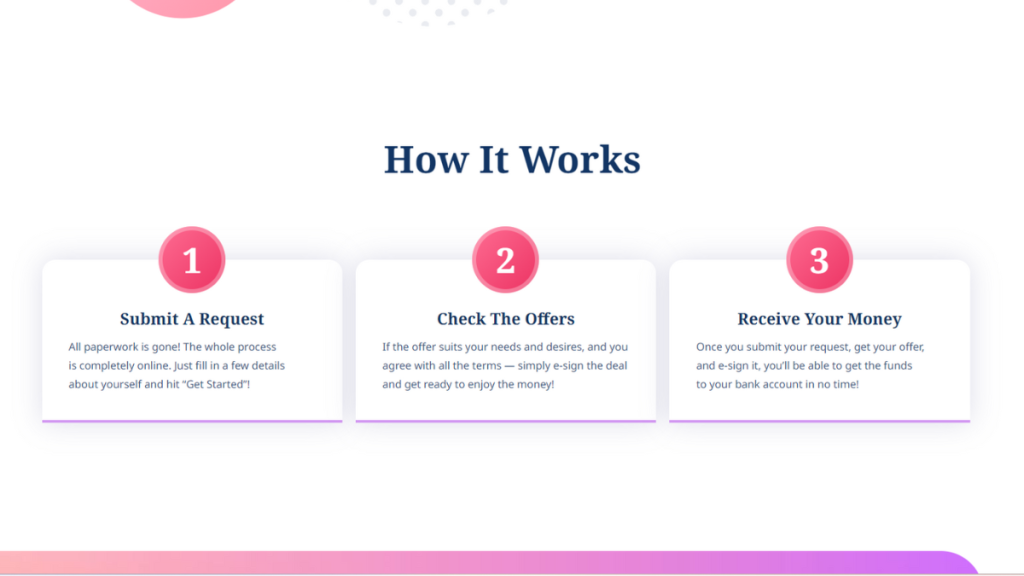

Apply for the loan: Online

If you need financial assistance and are considering this provider, here’s a step-by-step guide on how to apply.

Also, transparent communication and adherence to regulations can build trust in their services.

Always exercise caution and ensure you’re comfortable with the terms before entering into any financial agreement.

So, you’ll be able to apply online easily by going to their official website and providing the personal information required.

Then, you’ll need to complete the application only after you read the terms and conditions!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

You can only apply for a loan through this lender if you live in the States, where it is available. You’ll need to be a US resident and be of age to apply.

Moreover, this lending platform will connect you with different lenders to find the perfect loan for your needs.

Therefore, some requirements depend on the lender you choose to borrow from and other aspects of your finances!

Apply for the loan: Mobile App

There is not much information about a mobile app for this lender. So, you’ll need to complete the application online through the official website online!

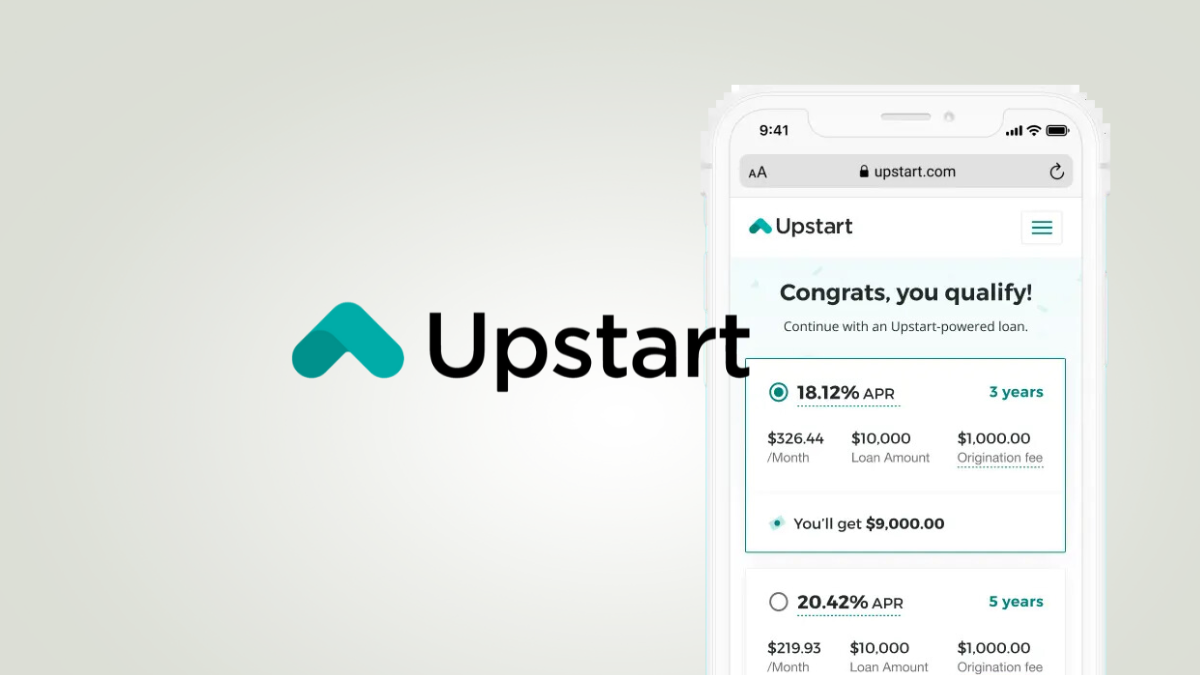

SmartFundSolutions or Upstart Loan?

If you’re unsure about getting a loan through SmartFundSolutions, we can help you find a different loan option!

Therefore, you can try applying to get a loan from Upstart Loan!

Also, this lender will offer incredible features for your money needs!

Moreover, you’ll be able to get up to $50,000, depending on your finances, and there are no origination fees!

Therefore, you can check out our comparison table below for the best option for your needs!

| SmartFundSolutions | Upstart Loan | |

| APR | APR is only available after starting the application process, but it can go from 4.99% to 450%, depending on the loan; | 5.2% to 35.99% variable APR; |

| Loan Purpose | All personal loan purposes can be found through SmartFundSolutions; | Almost all personal loan reasons, including moving-out loans, credit card debt consolidation loans, wedding loans, and more; |

| Loan Amounts | From $200 up to $5,000; | From $1,000 to $50,000; |

| Credit Needed | You can find a loan with any credit type; | The initial credit check won’t affect your credit score. However, there is no minimum credit score; |

| Terms | The terms depend on your financial situation and the loan type; | From 3 to 5 years with fixed rates; |

| Origination Fee | There can be origination fees; | There can be origination fees depending on the loan terms and amount; |

| Late Fee | There can be many late fees if you don’t make your payments on time; | There can be late fees, depending on the loan terms and amount; |

| Early Payoff Penalty | It depends on the lender. | There are no prepayment penalty fees. |

So, if you like Upstart Loan, you can check out our blog post below to learn more about it and see how to apply for it!

Find out how to apply for an Upstart Loan!

Find a loan option with an innovative model and loans of up to $50,000! Read on to learn how to apply for an Upstart Loan!

About the author / Victoria Lourenco

Trending Topics

Avant Credit Card review: qualify with fair credit!

If you are looking for a decent credit card for rebuilding your credit, check our Avant Credit Card review. Up to $3,000 limit! Read on!

Keep Reading

Easy Trades, Smart Choices: Robinhood Investing App Review

Simplify your investing journey with our Robinhood Investing App Review. Easy-to-use, commission-free, and accessible.

Keep Reading

Clear Money Loans review: Up to $35,000!

Are you in need of a lending platform with loans of up to $35,000? If so, you can read our Clear Money Loans review!

Keep ReadingYou may also like

Woodworkers Training Program by GWTP: enroll today

Enroll in the Woodworkers Training Program offered by GWTP and start learning today! Begin a successful career in woodworking. Read on!

Keep Reading

The Weekend Woodworker Course: enroll today

Explore the joys of woodworking and create beautiful, unique pieces! Enroll in The Weekend Woodworker Course and build a career of success!

Keep Reading

Empower Your Finances: Choosing Credit Cards for Good Credit

Unlock the full potential of your good credit score by choosing the perfect credit cards for good credit. Read on!

Keep Reading