Credit Cards

Apply for TSB Platinum Balance Transfer Card: amazing perks

Discover the seamless steps to apply for the TSB Platinum Balance Transfer Card. Enjoy 0% APR on balance tranfers for 24 months!

Advertisement

Apply for the TSB Platinum Balance Transfer Card: quick application!

Looking to make managing your credit card debt a whole lot easier? Learning how to apply for the TSB Platinum Balance Transfer Card might just be the answer.

Also, with its attractive features and benefits, applying for this card could be a game-changer in your financial journey. So, read on to learn how to apply!

Apply for the card: Online

Before diving in, understanding the application process is key to ensuring a smooth and successful transition.

In this comprehensive guide, we’ll walk you through the step-by-step process of applying for the TSB Platinum Balance Transfer Card.

Also, from eligibility criteria to necessary documents, we’ll cover it all, empowering you with the knowledge needed to make an informed decision.

So, whether you’re seeking to consolidate your debts or take advantage of the competitive interest rates, this guide will simplify the application procedure.

You will be redirected to another website

Application

Before you apply, you’ll need to learn about the requirements:

- You need to be at least 18 or over;

- Be a UK resident;

- You’ll need to have a regular income.

Also, you may need to send proof of income, details of any balance that you’ll transfer, your address in the UK, your bank account number, and other documents.

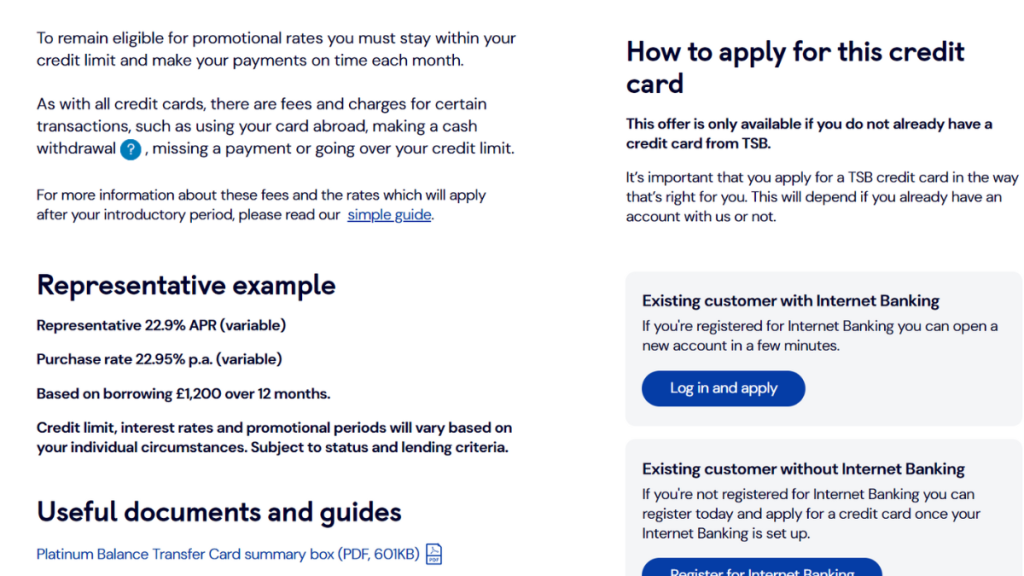

Then, you’ll be able to to go the official website and start the application process by providing the personal information required.

So, after that, you’ll be able to complete the application and wait for a quick response!

Apply for the card: Mobile App

You’ll be able to use the TSB mobile app to manage all your financial products with TSB Bank. Therefore, you’ll be able to manage your credit card features and much more!

However, you’ll need to complete the application online through the official website!

TSB Platinum Balance Transfer Card or Fluid Credit Card?

Are you not so sure about getting the TSB Platinum Card? If that’s the case, we can help you find a different option.

So, for example, you can try applying for the Fluid Credit Card.

Also, with this card, you’ll be able to get 0% interest on balance transfers for your first 9 months using the card as a new cardholder.

Moreover, you’ll be able to get a credit limit ranging from £250-£4,000!

Therefore, you can read our comparison table below to learn more about these two cards and see which is the best option for your needs!

| TSB Platinum Balance Transfer Card | Fluid Credit Card | |

| Annual Fee | No account fee; | There is no annual fee; |

| Credit Limit | The credit limit varies depending on your financial analysis; | Initial credit limit of £250-£4,000; |

| Representative APR | Representative 22.9% variable APR; | 34.90% variable APR; |

| Purchase Rate | 22.95% p.a. purchase rate (variable); | Representative 34.94% variable purchase rate; |

| Welcome Bonus | Up to 24 months of 0% interest, then 22.9% variable APR for new cardholders; | You’ll get 0% interest on balance transfers for your first 9 months using the card (with a 3% fee); *Terms apply; |

| Rewards | There is no rewards program. | No rewards program. |

So, if the Fluid credit card has all the features you need, you can read our blog post below to learn more and find out how to apply for it!

Apply for the Fluid Credit Card

Learn how to apply for the Fluid Credit Card: 0% interest on balance transfer for 9 months! Keep reading and learn more!

Trending Topics

Apply for the Zable Credit Card: Build credit

Explore a guide to apply for your Zable Credit Card effortlessly. No hidden fees - achieve your ideal credit rating!

Keep Reading

Apply for Halifax Clarity Card: Achieve financial freedom

Learn how to apply for the Halifax Clarity Card effortlessly. From necessary personal information to navigating the application channels!

Keep Reading

HSBC Classic Credit Card: how to apply

Looking for a way to apply for the HSBC Classic Credit Card? You’ve just found the perfect application guide. Up to £1,000 credit limit!

Keep ReadingYou may also like

Why Has My Credit Score Gone Down? 10 Possible Reasons

Why has my credit score gone down? Find the answer to this question and learn more about your credit score in your blog post. Read on!

Keep Reading

TSB Advance Credit Card review: No annual fee!

Discover the ins and outs of the TSB Advance Credit Card in our review. Ensure 0% intro interest period, no annual fee and more!

Keep Reading

Zopa Credit Card review: £0 annual fee

A modern person deserves a modern credit card. Read this Zopa Credit Card review! Enjoy up to £2,000 credit limit! Keep reading and learn!

Keep Reading