Credit Cards

Apply for Chase Freedom Unlimited®: No Annual Fee & 0% Intro APR

Applying for the Chase Freedom Unlimited® card doesn't have to be confusing. So read on and learn how to ensure rewards and pay $0 annual fee!

Advertisement

Earn 1.5% unlimited cash back on purchases and more!

Have you ever wanted more control over your finances but weren’t sure how to start? Then apply for the Chase Freedom Unlimited® credit card!

With its simple rewards program and no annual fee, it’s ideal for building financial security! Then keep reading and learn how to apply for it!

Apply for the card: Online

To qualify and apply for the Chase Freedom Unlimited® credit card, you must have good to excellent credit (a FICO score of at least 670).

You must also be 18 years old and have a valid SSN.

In addition, you should have a stable income source and not have filed for bankruptcy in the past two years. Lastly, it is only available to US residents.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

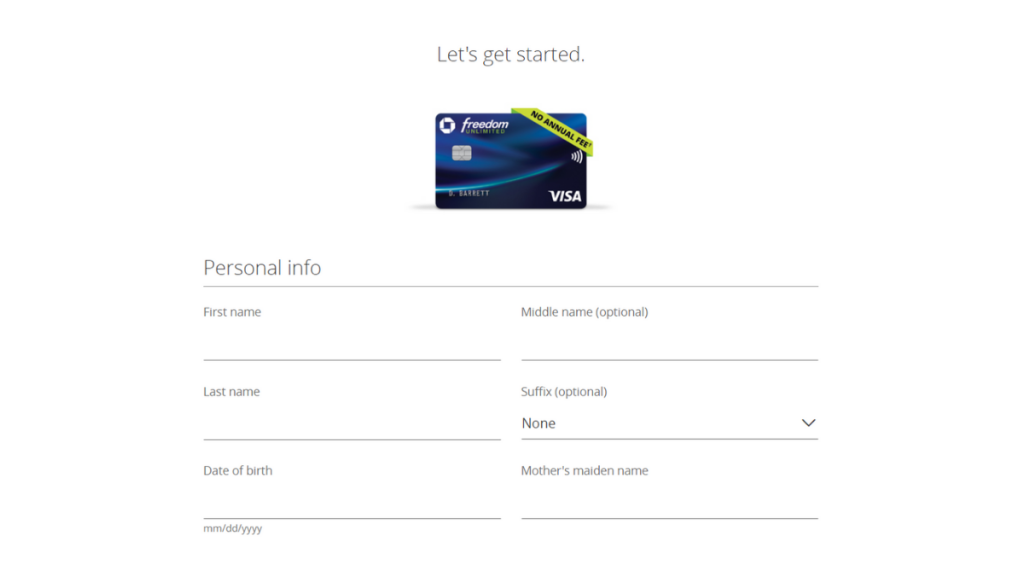

How to apply online: application form

Ready to unlock the benefits of Chase Freedom Unlimited®? Applying is easy – just head to Chase’s website and complete the necessary information.

The application form will require basic info, from your name and address to income details.

Don’t forget to verify your identity with additional info like a driver’s license or passport! Once you hit submit, you’ll get an answer fast – usually within minutes.

If you do not qualify to apply for the Chase Freedom Unlimited®, you can receive offers for other Chase credit cards.

Apply for the card: Mobile App

If you are a Chase customer, you can request a new credit card using Chase’s excellent mobile app.

But if that’s not the case, proceed as previously explained, and apply through its website.

Chase Freedom Unlimited® or Chase Freedom Flex℠?

Even with all these benefits, are you still unsure about Chase Freedom Unlimited®?

In fact, you’re right! Never apply for a credit card without looking at other options.

So let’s present another card from the Chase Freedom family of cards: the Chase Freedom Flex℠.

Both cards have a $0 annual fee and cash back rewards, so look at the comparative table and see if you find the difference between them!

| Chase Freedom Unlimited® | Chase Freedom Flex℠ | |

| Credit Score | Good to Excellent – at least 670; | Good or excellent; |

| Annual Fee | $0; | $0; |

| Purchase APR | 20.49% – 29.24% variable (after the 0% period of 15 months); | 20.49% – 29.24% variable (with a 0% period for 15 months); |

| Cash Advance APR | 29.99% variable; | 29.99% variable. *based on Prime Rate; |

| Welcome Bonus | Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back! | $200 cash bonus after spending $500 on purchases in the 1st 3 months; |

| Rewards | 5% cash back on travel purchased through Chase Ultimate Rewards®; 3% on drugstore purchases, dining, takeout, and eligible delivery services; 1.5% on everything else. | According to each purchase category, from 1% to 5% cash back. |

To check the application guide we’ve made for the Chase Freedom Flex℠, click the following link and keep learning more about credit cards.

Chase Freedom Flex℠: how to apply

Learn how to apply for Chase Freedom Flex℠ today and take advantage of its rewards. Enjoy 0% intro APR for 15 months! Read on!

About the author / Julia Bermudez

Trending Topics

Maximize your earnings: apply for Sam’s Club® Mastercard®

Learn now how to apply for the Sam’s Club® Mastercard®! With this card, you can earn cash back on your purchase and save money!

Keep Reading

DoorDash Rewards Mastercard® review: Up to 4% cash back!

Are you ready to earn up to 4% cash back on purchases with no annual fee? Find out in our DoorDash Rewards Mastercard® review!

Keep Reading

What credit score do you start with?

If you’d like to determine what credit score you start your financial life with, you’re in the right place. Read on to find out.

Keep ReadingYou may also like

PenFed Pathfinder® Rewards Visa Signature® Card Review: earn back

Have you been searching for a credit card that offers excellent rewards? Check our PenFed Pathfinder® Rewards Visa Signature® Review!

Keep Reading

SmartFundSolutions review: up to $5,000

Discover the ins and outs of SmartFundSolutions in our review. Ensure no hidden fees and flexible conditions! Keep reading!

Keep Reading

How to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card

Learn how to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card an build up your score fast!

Keep Reading