Credit Cards

15 Months of 0% APR: Apply for the Citi Custom Cash℠ Card

Earn up to 5% cash back on purchases and pay $0 annual fee! Keep reading and learn how to apply for Citi Custom Cash℠ Card!

Advertisement

$200 bonus cash back and more!

Are you ready to start earning cash back on your purchases straightaway? Apply now for Citi Custom Cash℠ Card.

With this card, you’ll earn cash back on purchases in a variety of categories, including restaurants, gas stations, groceries, and more.

Apply for the card: Online

To apply for the Citi Custom Cash℠ Card, you can use the Internet or the telephone. You can easily apply online straightaway.

Firstly, all you need to do is access the card’s official website and click on Apply Now.

Then, fill out the form with your info, such as Social Security Number, Address, and annual income.

Lastly, read the terms and conditions before submitting your application.

There you will find the detailed interest rates and charges!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card: Mobile App

Although it may not be possible to apply for the Citi Custom Cash℠ Card through the mobile app.

Still, Citi offers one of the best-reviewed banking apps with Citi Mobile.

On the app, you’re able to view your statements, check balances and recent activity, make same-day or scheduled payments easily, and much more!

Citi Custom CashSM Card or Bank of America® Unlimited Cash Rewards Credit Card?

Credit card rewards are a great way to earn extra cash while making purchases you would make anyway.

But with so many options, how do you choose the right one for you?

Certainly, the Citi Custom Cash℠ Card and the Bank of America® Unlimited Cash Rewards Credit Card are excellent options for earning rewards!

Then let’s compare them below!

| Citi Custom CashSM Card | Discover it® Cash Back Credit Card | |

| Credit Score | Good to excellent; | Good to excellent credit score; |

| Annual Fee | The card charges no annual fee; | The card charges no annual fees; |

| Purchase APR | 0% APR for 15 months. 18.74% to 28.74% after that; | 0% APR for 18 billing cycles. 17.74% – 27.74% Variable APR after; |

| Cash Advance APR | The cash advance annual percentage rate is 29.99%; | 20.74% to 29.74%, based on your creditworthiness, when you open your account for Direct Deposit and Check Cash Advances, and 29.74% for Bank Cash Advances; |

| Welcome Bonus | Earn $200 cash back after spending $1,500 on purchases in the 1st 6 months; | Earn a $200 cash reward bonus after spending at least $1K on purchases within 90 days from account opening; |

| Rewards | You’ll get 5% cash back on your top qualifying purchase category, up to $500, every billing cycle, and 1% cash back on everything else. | Get a cashback of 1.5% on any transaction you make. |

Are you interested in learning more about this option? Then keep reading our following article! Let’s go!

Apply Bank of America® Unlimited Cash Rewards

Learn how to apply for the Bank of America® Unlimited Cash Rewards and get unlimited 1.5% cash back on all purchases!

About the author / Giovanna Klein

Trending Topics

PREMIER Bankcard® Secured Credit Card review: up to $5K limit

Learn how the PREMIER Bankcard® Secured credit card works and in our full review. Reestablish your credit in no time! Keep reading and learn!

Keep Reading

Introduction to Mechanical Drawings by Udemy review: wide access

If you'd like to know more about this course, our Introduction to Mechanical Drawings by Udemy review is perfect! Check it out here!

Keep Reading

Pay no hidden fees: How to apply for the Extra Debit Card

Do you want to apply for Extra Debit Card? Follow our simple instructions to apply online or through their mobile app - pay no interest!

Keep ReadingYou may also like

Up to $2K limit: Surge® Platinum Mastercard® review

This Surge® Platinum Mastercard® review will show you how to get a credit card with a $1,000 initial credit limit with Mastercard® coverage!

Keep Reading

$0 annual fee: Apply for the Instacart Mastercard®!

Ready to level up your Instacart experience? Learn how to apply for the Instacart Mastercard® effortlessly - up to 5% cash back!

Keep Reading

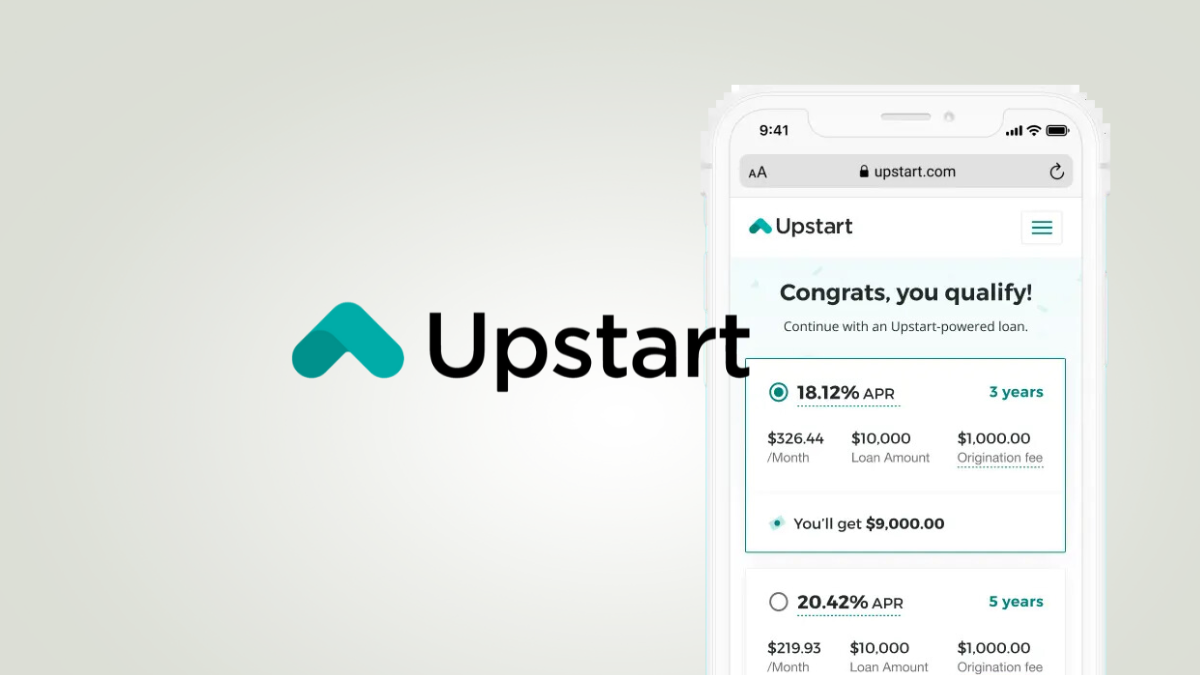

Find financial freedom: Upstart Loan review!

Do you need a loan to upgrade your finances with up to $50,000? If so, you can read on for our Upstart Loan review!

Keep Reading