Credit Cards

Discover It® Secured Credit Card: how to apply

See how easy it is to apply for the Discover It® Secured Credit Card and take advantage of its cash back rewards while you build up your credit score.

Advertisement

Discover It® Secured Credit Card: Amazing rewards and no annual fee!

If you’re looking for a card that can help you build an excellent score and give you rewards in the process, the Discover It® Secured Credit Card is the answer for your prayers!

Below, we’ll show you how you can easily apply for the card from the comfort of your home. So read on and start your journey towards better credit today!

Apply for the Discover It® Secured Credit Card online

Applying for the Discover It® Secured is very easy, and we’ll show you how!

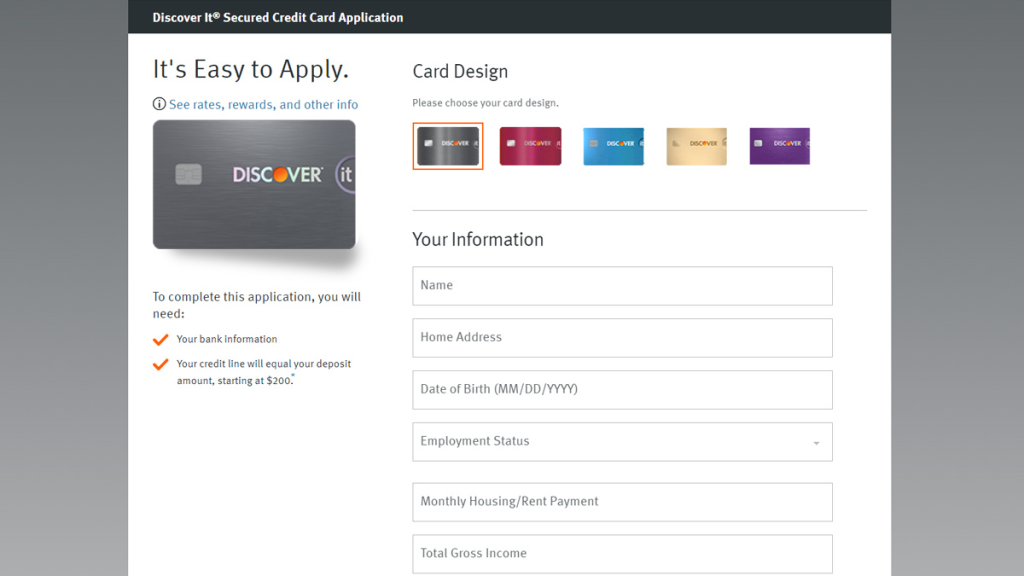

First, access Discover’s official website and search for the Discover It® Secured option. You can either check if you’re pre-approved or apply right away.

If you choose the latter, you’ll be taken to the application page. There, you can choose your new card design and fill out the required form.

Once you finish writing down your personal and financial information, click on “submit” and wait for a response.

If you’re approved, you’ll have to fund your security deposit and wait for the card to arrive in the mail. The process usually takes a few business days, and you can activate the card online.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

To complete the online form, you’ll start by informing your ZIP Code, the last 4 digits of your Social Security Number, and your date of birth.

Further, you must provide your employment status, monthly housing/rent payment, total gross income, and contact info.

After submitting all the required info, you’ll need your bank account handy to provide a minimum security deposit of $200.

Apply for the card via mobile app

Unfortunately, you cannot apply for the card using Discover’s mobile app. However, you can manage your account through it once you get the card.

The app is free and available for Android and iOS users. With the app, you can:

- Check your balance and available credit;

- View or download monthly statements;

- Redeem rewards;

- Make payments;

- Edit or cancel pending payments;

- View and search transaction activity;

- View your FICO Credit Score for free and learn what it means to lenders;

- Add your card to Apple Pay to use for purchases in-store on eligible devices with iOS;

- Freeze or unfreeze your account to prevent new purchases, cash advances, and balance transfers;

- Use the Travel Notification feature to help ensure uninterrupted use of your card while traveling.

Discover It® Secured Credit Card or FIT™ Platinum Mastercard®?

But if you’re looking to improve your score without having to put down a security deposit, there are options. With the FIT™ Platinum Mastercard®, you’ll get all the tools you need to build better credit.

The card offers an unsecured credit limit up to $400 – which you can double with on-time payments. Curious to learn more about? Check some of its features below:

| Discover It® Secured Credit Card | FIT™ Platinum Mastercard® | |

| Credit Score | All types of credit are welcome to apply. | Poor/Fair. |

| Annual Fee | $0 annual fee. | $99 annual fee. You’ll also have to pay $6,25 monthly for maintenance from the second year ahead. |

| Purchase APR | 27.99% variable. | 29.99% variable. |

| Cash Advance APR | 29.99% variable. | 29.99% variable. |

| Welcome Bonus | New members can enjoy a dollar-for-dollar cash back match from Discover at the end of their first year. | No sign-up bonuses. |

| Rewards | 2% cash back at gas stations and restaurants up to $1,000 (combined) per quarter; 1% cash back on all other purchases. | No rewards program. |

To learn more about the FIT™ Platinum Mastercard® and how to apply for it, check the following link!

FIT™ Platinum Mastercard®: how to apply

See how easy it is to apply for the FIT™ Platinum Mastercard® and get an unsecured credit line with Mastercard prestige!

About the author / Giovanna Klein

Trending Topics

Up to $2K limit: Surge® Platinum Mastercard® review

This Surge® Platinum Mastercard® review will show you how to get a credit card with a $1,000 initial credit limit with Mastercard® coverage!

Keep Reading

Chase Freedom Flex℠ Review: Up to 5% Cash Back

Review Chase Freedom Flex℠ features with us! Earn cash back on purchases and pay no annual fee! Make the most of your spending!

Keep Reading

Apply for Capital One Quicksilver Secured Cash Rewards Credit Card

Learn how to apply for Capital One Quicksilver Secured Cash Rewards Credit Card now! $0 annual fee and 1.5% cash back on purchases! Read on!

Keep ReadingYou may also like

Apply for Chase Freedom Unlimited®: No Annual Fee & 0% Intro APR

Follow these easy steps and learn how to apply for the Chase Freedom Unlimited® credit card. 0% intro APR on purchases and more!

Keep Reading

What is Tier 1 Credit?

A poor credit score can hold your ability to pursue loans. Check this article to learn about what is tier 1 credit and how to achieve it.

Keep Reading

Pay no hidden fees: How to apply for the Extra Debit Card

Do you want to apply for Extra Debit Card? Follow our simple instructions to apply online or through their mobile app - pay no interest!

Keep Reading