Credit Cards

How to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card

Looking to build your credit score? Learn more about the First Progress Platinum Elite Mastercard® Secured Credit Card and how to apply for it!

Advertisement

Rebuild your credit score with the First Progress Platinum Elite Mastercard® Secured Credit Card

When you apply for the First Progress Platinum Elite Mastercard® Secured Credit Card, not only will you get a valuable tool; but a chance of better credit and a healthier financial future.

You’ll get a card with competitive rates and Mastercard benefits. And with credit building features, your score will soar in no time.

Ready to learn how to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card? Then keep reading and we’ll show you how to do it.

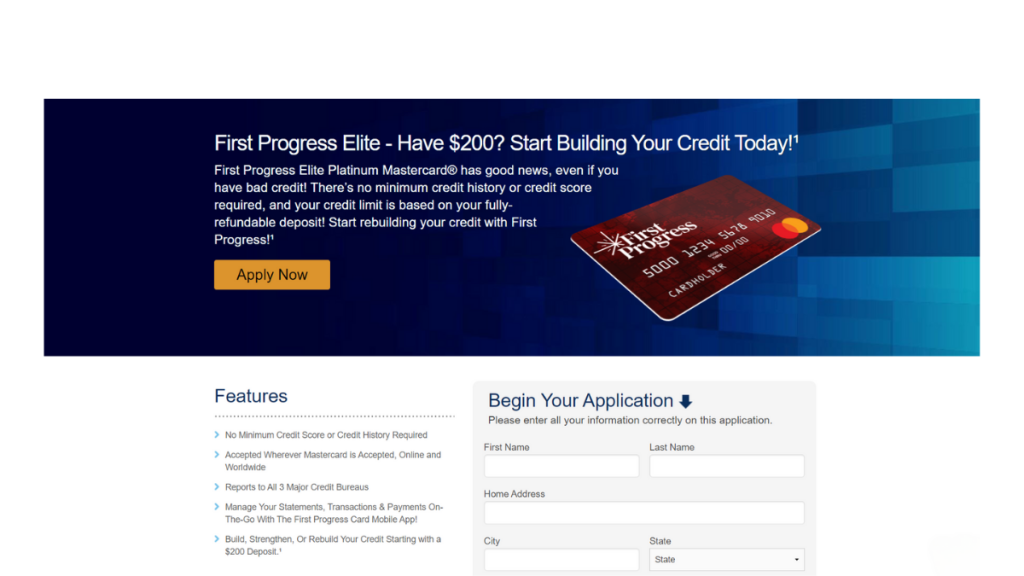

Apply for the First Progress Platinum Elite online

One of the main advantages of the First Progress Platinum Elite Mastercard® Secured Credit Card is the hassle-free application process. It’s straightforward!

So with your documents in hand, access the First Progress website and find the First Progress Platinum Elite Secured. Select “apply online.”

Further, you’ll be redirected to a simple application form. This application is to prove you fulfill the basic requirements to own a credit card.

Also, you can check the card features on the left side of the screen after filling out the application form on the right. Check the boxes and submit your application.

You must make a security deposit to settle your credit limit if approved. Wait for your First Progress card to arrive and start building credit quickly!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card via mobile app

Mobile apps make managing accounts easier, and First Progress has an app for its customers.

However, the only way to apply for the First Progress Platinum Elite Mastercard® Secured Credit Card is on their website.

First Progress Platinum Elite Mastercard® Secured Credit Card or Destiny Mastercard® Card?

You can check another option if you’re not willing to pay a security deposit to apply for the First Progress Platinum Elite Mastercard® Secured Card.

The Destiny Mastercard® Card does not require a good credit score from its applicants, and the annual fee range from $59 to $99.

The purchase APR is similar to the First Progress Platinum Elite Mastercard® Secured Credit Card. The difference is that Destiny offers an unsecured credit line of $700.

So check the comparative table and see how these two credit cards perform side by side.

| First Progress Platinum Elite | Destiny Mastercard® Card | |

| Credit Score | Poor/Limited/No Credit. | Poor to Good. |

| Annual Fee | $29. | See terms. |

| Purchase APR | 25.24% Variable. | See terms. |

| Cash Advance APR | 30.24% Variable. | See terms. |

| Welcome Bonus | None, currently. | None. |

| Rewards | This is not a rewards credit card. | There are none. |

If you prefer the Destiny Mastercard®, check the following content with a full review of the application process.

Destiny Mastercard® Card: how to apply

Thanks to the internet, now you can apply for the Destiny Mastercard® Card from the comfort of your home. Qualify with poor credit! Read on!

About the author / Julia Bermudez

Trending Topics

Enjoy Unique benefits: Apply for Unique Platinum Card

Read on and learn how to apply for the Unique Platinum Card! Qualify with no credit check and earn monthly rewards - stay tuned!

Keep Reading

Top apps to recover deleted photos: keep your memories safe!

Don’t be afraid to miss important files ever again. Download one of the best apps to recover deleted photos from this list!

Keep Reading

Apply for Applied Bank® Secured Visa® Gold Preferred® Card

Learn how to apply for the Applied Bank® Secured Visa® Gold Preferred® Card and start using this Visa® card everywhere! Read on and learn!

Keep ReadingYou may also like

Global Economic Markets: What You Need to Know

Explore the world of global economic markets. Get insights and understanding with our comprehensive guide.

Keep Reading

Merrick Bank Double Your Line® Secured Credit Card: how to apply

Learn now how to apply for Merrick Bank Double Your Line® Secured Credit Card and rebuild your credit history!

Keep Reading

Can you get a credit card with no job?

Is there any chance you can get a credit card with no job? The odds are not the best, but let’s see what you can do.

Keep Reading