Credit Cards

How to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card

Learn how to easily apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and get the credit you deserve!

Advertisement

The First Progress Platinum Prestige Mastercard® Secured Credit Card is your perfect ally for building credit!

This post will show you the easy steps to apply for a First Progress Platinum Prestige Mastercard® Secured Credit Card.

With great approval odds and credit building tools, this card offers you the opportunity to get your credit score back on track.

Keep reading to learn everything about its application process. You can open the door to better credit today!

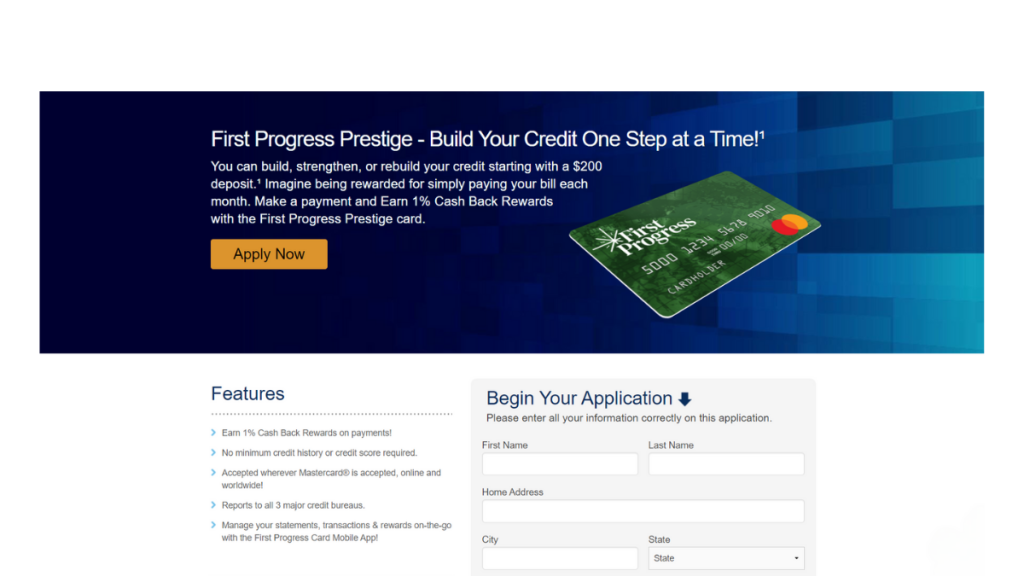

Apply for the First Progress Platinum Prestige online

Applying for the First Progress Platinum Prestige Mastercard® Secured Credit Card is simple! Here’s how to do it online:

First, access the First Progress website and look for the First Progress Platinum Prestige Mastercard® Secured Credit Card to apply for it.

Then hit “apply online,” and you’ll get redirected to the application form. You’ll see that it is a very short and simple form.

So, fill out the form with basic information and submit the form. You’ll soon get the answer and can complete the application.

Also, remember that the security deposit will set your credit limit. But you can not refund it until you pay your balance and cancel your account.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card via mobile app

While you can manage your account using First Progress’ mobile app, you can’t apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card with it.

To apply, you need to access their website and fill out the application form from there.

First Progress Platinum Prestige or First Progress Platinum Select?

Not only will First Progress give you the chance to build a good score, but you can choose which of their cards fit you best.

If you’d like to look at another option, we recommend the First Progress Platinum Select Mastercard® Secured Credit Card.

See the comparison table below to see which option tends to your financial needs better.

| First Progress Platinum Prestige Mastercard® Secured Credit Card | First Progress Platinum Select Mastercard® Secured Credit Card | |

| Credit Score | Poor/Limited/No Credit. | Poor/Limited/No Credit. |

| Annual Fee | $49. | $39. |

| Purchase APR | 15.24% variable. | 19.24% variable. |

| Cash Advance APR | 24.24% variable. | 25.24% variable. |

| Welcome Bonus | None, currently. | There’s none, currently. |

| Rewards | Get 1% back on all of your credit card payments. | 1% cash back on card payments. |

If you’d like to learn how to get your First Progress Platinum Select Mastercard® Secured Credit Card, check the following link!

First Progress Platinum Select application

Learn every step it takes to apply for the First Progress Platinum Select Mastercard® Secured Credit Card and build a better financial future for yourself!

About the author / Julia Bermudez

Trending Topics

The Weekend Woodworker Course review

This in-depth review will provide a comprehensive look at the Weekend Woodworker Course. Learn everything you need in 6 weekends! Read on!

Keep Reading

Happy Money Loans review: Your Gateway to Smart Borrowing

Do you need a good loan provider? If so, get the lowdown on their services in our Happy Money Loans review! Up to $40,000 quickly!

Keep Reading

Avant Credit Card: how to apply

Getting an unsecured credit card can be simple! Check now how to apply for Avant Credit Card. Qualify with fair credit and build it fast!

Keep ReadingYou may also like

What Are Tax Receipts and Why Are They Important?

Understand why tax receipts are important and how to take advantage of them. Learn here what you need and how to maximize your benefits!

Keep Reading

Up to 5% back: Apply for the Prime Visa Credit Card

Ready to start earning 5% back on Amazon.com purchases? Follow our guide on how to apply for the Prime Visa Credit Card.

Keep Reading

Chase Freedom Flex℠ Review: Up to 5% Cash Back

Review Chase Freedom Flex℠ features with us! Earn cash back on purchases and pay no annual fee! Make the most of your spending!

Keep Reading