Credit Cards

FNB Petro Card: how to apply

Apply for the FNB Petro Card today and enjoy its several benefits! Qualify for personalized rates! Keep reading and learn more!

Advertisement

Free AA roadside assistance worth R100 per month

The FBN Petro Card has many freebies like digital banking, AA roadside assistance, and more. So learn now how to apply for FNB Petro Card.

Made for managing and simplifying your vehicle expenses, the FNB Petro Card can be worth it when comparing its costs to its benefits.

Apply for the card: Online

To apply for the FNB Petro Card, you must access FNB’s official site. Select the “Apply Now” button to get started!

Further, you must complete an application form with your personal and financial information.

To fill in the application, you need the following:

- A valid South African ID;

- Be 18 or older at the time of application;

- Provide proof of residence, which must not be older than 3 months;

- A recent payslip;

- If you do not receive your salary through an FNB account, you must provide the recent 3 months’ bank statements.

You will be redirected to another website

Apply for the card: Mobile App

FNB provides a Banking App, which is available on both iOS and Android app stores.

Although you won’t be able to apply via the app, you will be able to do it online banking and through the telephone.

Besides, you will be able to use the banking app to manage your balances and keep track of all fuel purchases and vehicle maintenance expenses.

FNB Petro Card or African Bank Gold Card?

Indeed, choosing your credit card is not an easy task. It takes time and effort, and there are a lot of factors to consider in order to make the right choice.

So if you are not sure which financial product suits you better, make sure to check the comparison between FNB PetroCard and African Bank Gold Card.

While comparing these products, keep in mind that while FNB PetroCard is designed for vehicle expenses, African Bank Gold works like a regular card.

| FNB Petro Card | African Bank Gold Card | |

| Min. Monthly Income | R84.000 per year; | No minimum income is required; |

| Initiation Fee | Up to a maximum of R175; | Not disclosed; |

| Monthly Fee | R40; | R69; |

| Interest Rate | Personalized Interest Rates; | 60 days interest-free period. Then, the interest rate ranges from 15% to 27.50%; |

| Rewards | N/A. | Currently, this African Bank credit card has no rewards program. |

Interested in the African Bank Gold Credit Card? Then keep reading and learn how to apply for this option!

African Bank Gold Credit Card: how to apply

If you want to apply for the African Bank Gold Credit Card, you have made a great decision. 60 days interest-free period and free swipes.

About the author / Giovanna Klein

Trending Topics

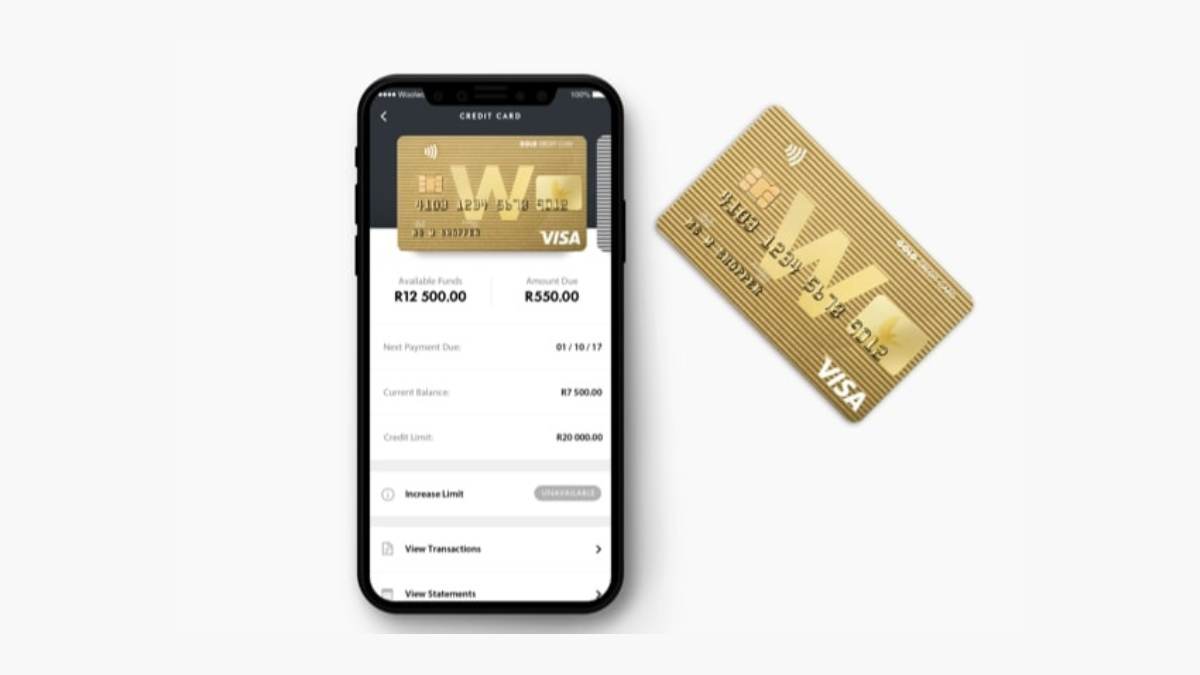

Your Ticket to Shopping Rewards: Woolworths Gold Credit Card review

Looking for a credit card that rewards your loyalty? Check out our review of the Woolworths Gold Credit Card.

Keep Reading

Absa Flexi Core Credit Card: how to apply

Learn how to apply for Absa Flexi Core Credit Card today! Enjoy up to 57 days interest-free and earn cash back on purchases! Read on!

Keep Reading

Choose your loan: fast and affordable options tailored for you

Learn how to choose a loan that meets all your needs and expectations. Ensure the money you need fast! Read our article now!

Keep ReadingYou may also like

Apply for the TymeBank Credit Card: 55 days of interest-free!

Apply anytime, anywhere: Learn how to easily apply for the TymeBank credit card from the comfort of your home.

Keep Reading

Learn which career has the most job opportunities in South Africa!

Have you ever wondered which career has the most job opportunities in South Africa? We'll cover some of them in today's article!

Keep Reading

Standard Bank Loan Review: Your Partner in Progress

Dive into a world of opportunities with Standard Bank Loan with this review. Leverage our financial expertise - personalized rates for you!

Keep Reading