Credit Cards

Apply for Halifax Clarity Card: Achieve financial freedom

Discover a hassle-free guide on securing your Halifax Clarity Card with ease. Learn the application process, essential documents, and insider tips for a smoother journey to fee-free international transactions!

Advertisement

Apply for the Halifax Clarity Card: Quick online application!

Looking to unlock a world of fee-free international transactions? Then, learning how to apply for the Halifax Clarity Card might just be the key!

So, applying for the Halifax Clarity Card is a quick journey toward accessing a credit card renowned for its cost-effective approach to global spending. Therefore, read on!

Apply for the card: Online

Whether you’re an avid traveler or simply looking for a smart financial tool, securing the Halifax Clarity Card could be the gateway to a great card!

So, you can get a more streamlined, fee-conscious approach to managing your global transactions.

Before you apply for this incredible card, you’ll need to learn about the requirements:

- Be at least 18 years old;

- You’ll need to be a UK resident;

- You need to have a regular income

Moreover, there can be other requirements to get this card. So, you’ll need to go through the application process to see if you can qualify for this card.

You will be redirected to another website

Application

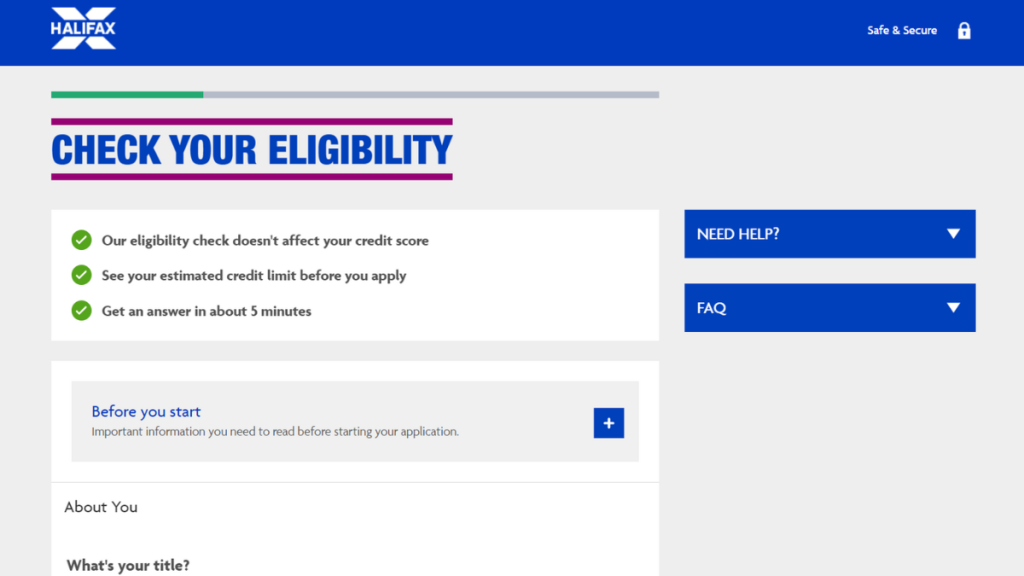

To start, gather your personal information: your address history for the last three years, employment details, and income information.

Also, once armed with these essentials, head to Halifax’s website or visit a local branch to kickstart your application process.

So, to apply for this card online, you’ll need to go to the official website and provide the personal information and documents required.

Then, you’ll be able to complete the application and wait for a quick response from them about your application.

Apply for the card: Mobile App

You’ll be able to use the mobile app to manage your finances with the card.

However, you’ll need to complete the application process online through the official website!

Halifax Clarity Card or Marbles Credit Card?

If you’re not so sure about getting the Halifax Credit Card, we can help you find the right option for your needs!

Therefore, you can try applying for the Marbles Credit Card!

Moreover, this card can have incredible features for those looking for a card with no annual fee and other perks!

Therefore, you can read the comparison table below to learn more about this card and see which can be the best option for your finances!

| Halifax Clarity Card | Marbles Credit Card | |

| Annual Fee | No annual fees; | There is no annual fee; |

| Credit Limit | Around £500, depending on your financial analysis; | Initial credit limit from £250 up to £1,500; |

| Representative APR | 23.94% representative variable APR; | 34.9% representative variable APR; |

| Purchase Rate | 23.94% representative variable purchase rate; | 34.9% representative for purchases; |

| Welcome Bonus | No welcome bonuses; | No welcome bonuses; |

| Rewards | There are no rewards programs. | No rewards program. |

So, if the features of the Marbles card are the best ones for your needs, you can learn how to apply for it!

Therefore, you can read our blog post below to find out how the application process works!

Apply for the Marbles Credit Card

Discover the steps to apply for the Marbles Credit Card! Master the application process and empower your financial journey today!

About the author / Victoria Lourenco

Trending Topics

Barclaycard Forward Card review: up to £1,200 limit

Check out our Barclaycard Forward Card review! Enjoy 3 months of 0% interest on purchases and more! Keep reading and learn more!

Keep Reading

Apply for the Ocean Credit Card: No credit score harm!

Discover the seamless process of how to apply for the Ocean Credit Card - up to £8,000 credit limit! Keep reading and learn more!

Keep Reading

HSBC Balance Transfer Credit Card review: No annual fee!

Unlocking the potential of the HSBC Balance Transfer Credit Card - Explore our review for insights into its benefits and exclusive offers!

Keep ReadingYou may also like

Apply for the Marbles Credit Card: Check eligibility for free!

Discover the steps to apply for the Marbles Credit Card! Master the application process and empower your financial journey today!

Keep Reading

HSBC Classic Credit Card: how to apply

Looking for a way to apply for the HSBC Classic Credit Card? You’ve just found the perfect application guide. Up to £1,000 credit limit!

Keep Reading

Bamboo Personal Loans review: up to £8,000

Check our Bamboo Personal Loans review if you need a flexible personal loan but still improve your credit. Qualify with poor credit!

Keep Reading