Loans

Apply for Happy Money Loans: Unlocking Financial Possibilities

Looking for a hassle-free loan option? If so, read on to learn how to apply for a loan through Happy Money Loans and achieve your dreams with ease!

Advertisement

Apply for Happy Money Loans in 2 minutes!

Are you in need of financial support to achieve your dreams and goals? Then, read on to apply for Happy Money Loans!

Moreover, applying for a loan with Happy Money Loans is a simple process that can provide you with the funds you need to cover various expenses.

Apply for the loan: Online

Whether it’s starting a business, buying a new home, or consolidating debt, you can find ways to get the money you need through Happy Money.

Moreover, to apply online, you’ll need to go to the official website and provide the information required.

Then, you’ll get a quick pre-qualification response to complete the application!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

You’ll need to meet some requirements if you want to try to get a loan through this lender.

For example, you’ll need to be at least 18 years old and have a valid Social Security Number.

Moreover, you’ll need to have a valid checking account and no current delinquencies in your name.

Also, you’ll need to have a minimum FICO Score of 585 points.

Therefore, you may also need to meet some other requirements during the application process.

Apply for the loan: Mobile App

You can easily use the mobile app to manage all your loans and finances. Also, you’ll be able to manage your account, make set-ups, and get alerts.

However, you won’t be able to complete the application process through the mobile app.

Therefore, you’ll need to follow the steps on the topic above to apply online.

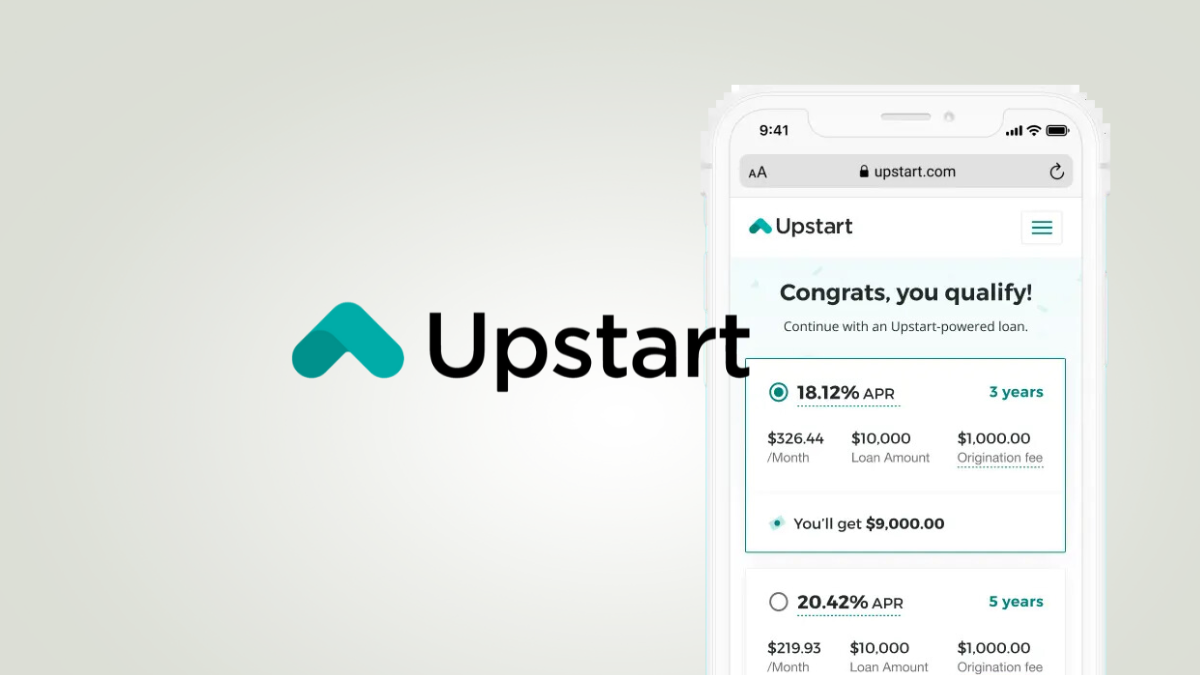

Happy Money Loans or Upstart Loan?

If you’re not so certain about getting your loans through Happy Money Loans, you can try Upstart Loan!

Also, with this lender, you can find loans of up to $50,000 with no minimum credit score!

Therefore, read our comparison table below to learn more about this lender and see which is the best choice for your needs!

| Happy Money Loans | Upstart Loan | |

| APR | From 11.72% to 26.67% variable APR; | 5.2% to 35.99% variable APR; |

| Loan Purpose | Debt consolidation and personal loans for various reasons; | Almost all personal loan reasons, including moving-out loans, credit card debt consolidation loans, wedding loans, and more; |

| Loan Amounts | From $5,000 to $40,000; | From $1,000 to $50,000; |

| Credit Needed | You’ll need at least a medium credit score level of 600 to have more chances of getting this loan; | The initial credit check won’t affect your credit score. However, there is no minimum credit score; |

| Terms | From 24 to 60 months; | From 3 to 5 years with fixed rates; |

| Origination Fee | There are origination fees to get a loan through this lender; | There can be origination fees depending on the loan terms and amount; |

| Late Fee | There are no late fees; | There can be late fees, depending on the loan terms and amount; |

| Early Payoff Penalty | You won’t have to pay any prepayment fees. | There are no prepayment penalty fees. |

Do you want to learn more about Upstart Loan and how to apply for it? If so, you can read our post below to learn more!

Find out how to apply for an Upstart Loan!

Find a loan option with an innovative model and loans of up to $50,000! Read on to learn how to apply for an Upstart Loan!

About the author / Victoria Lourenco

Trending Topics

Capital One VentureOne Rewards for Good Credit review

Read this Capital One VentureOne Rewards for Good Credit review and discover why this card is a must! Earn up to 5 miles on purchases!

Keep Reading

Tax deduction: what is it and how does it work?

Knowing how does tax deduction work can help you gain tax relief by lowering the amount of money you pay in taxes. Check now!

Keep Reading

The Ultimate Credit Solution for All: Upgrade Card review

Read our review to learn more about the Upgrade Card - $0 annual fee! This is your key to building credit fast! So read on and learn more!

Keep ReadingYou may also like

Moving out of state: a checklist to prepare for your new life!

If you’re moving out of the state, don’t do it before reading this checklist! This post has valuable tips for making the best decisions.

Keep Reading

Maximize your earnings: apply for Sam’s Club® Mastercard®

Learn now how to apply for the Sam’s Club® Mastercard®! With this card, you can earn cash back on your purchase and save money!

Keep Reading

Apply for the OpenSky® Plus Secured Visa® Credit Card

Tired of being turned down for credit? Say hello to a fresh start and learn how to apply for the OpenSky® Plus Secured Visa® Credit Card!

Keep Reading