Credit Cards

Merrick Bank Double Your Line® Secured Credit Card: how to apply

Looking for a secured credit card with no surprises? In this article, we will show you how to apply for Merrick Bank Double Your Line® Secured Credit Card!

Advertisement

Get your credit line doubled without any additional deposit with Double Your Line®!

If you’re looking for a way to build credit, you might want to apply for the Merrick Bank Double Your Line® Secured Credit Card.

This secured credit card allows you to use your own money as collateral, which means you can build credit without risking overspending. So read on!

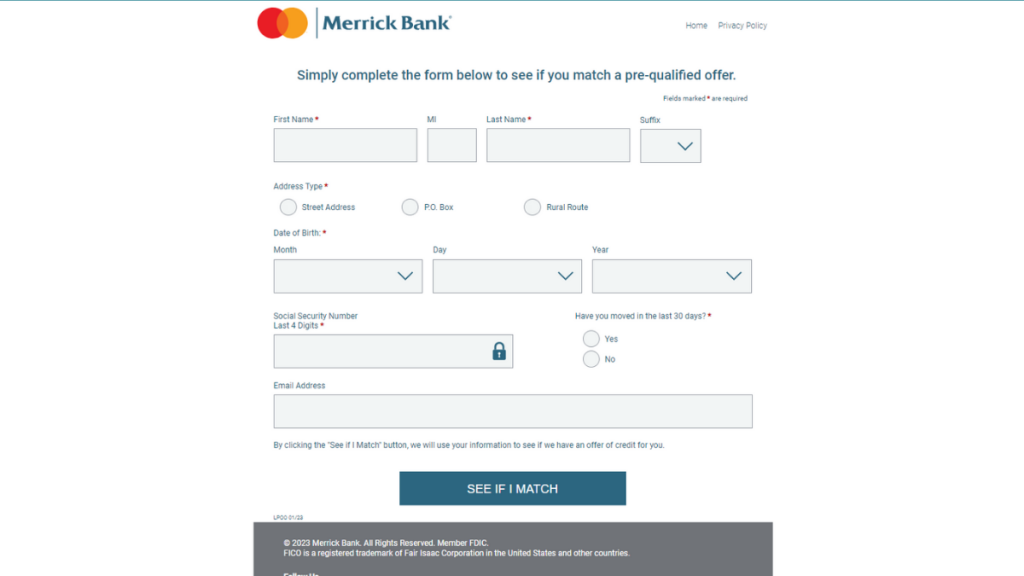

Apply for the card: Online

Applying for a Merrick Bank Double Your Line® Secured Credit Card is simple. You may apply to their website.

First, they will require your personal and financial information, such as your name, date of birth, and income.

Then, Merrick directs you to the E-Sign Disclosure and a summary of the terms subsequently.

Last but not least, after paying the security deposit (of $200), you can review all the information submitted and the card’s terms.

Furthermore, Merrick will review your application, and your Secured Credit Card should be in your mail in up to two weeks.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card: Mobile App

Indeed, applying for the Merrick Bank Double Your Line® Secured Credit Card through Merrick Bank’s app is not possible.

However, the mobile app provides a lot of features.

Indeed, the app allows you to check your balances, schedule and view payments, view transaction details, and more.

Recent updates brought even more benefits to the app, such as monitoring your FICO® Score and activating your new credit card.

Merrick Bank Double Your Line® Secured Credit Card or Discover it® Secured Credit Card?

If you want to explore your credit card options before choosing the right one, look at the Discover it® Secured Credit Card!

Indeed, it brings amazing benefits to those without good credit who need to improve it! Further, check the table below!

| Mission Lane Visa® Credit Card | Discover it® Secured Credit Card | |

| Credit Score | Merrick requires a Poor/No credit score; | All types of credit are welcome to apply; |

| Annual Fee | Starting at $36 per year. Then, you’ll be charged $3 monthly; | $0; |

| Purchase APR | 22.20% Variable; | 27.99% variable; |

| Cash Advance APR | 4%, Min: $10; | 29.99% variable; |

| Welcome Bonus | Merrick does not specify any welcome bonus; | New members can enjoy a dollar-for-dollar cash back match from Discover at the end of their first year; |

| Rewards | Merrick does not specify any reward program. | 2% cash back at gas stations and restaurants up to $1,000 (combined) per quarter; 1% cash back on all other purchases. |

Up next, discover how to apply for the Discover it® Secured Credit Card! So read on and learn more!

Discover It® Secured Credit Card: how to apply

Learn how to apply for the Discover It® Secured Credit Card and improve your score to excellence while earning cash back rewards!

About the author / Giovanna Klein

Trending Topics

$0 annual fee: Assent Platinum Secured Card review

It’s past time for you to be enjoying a real credit card! Check this Assent Platinum Secured Card review to see if this is the one!

Keep Reading

Savings vs. checking accounts: What is the difference?

In the savings vs. checking accounts battle, which one will be the best for your financial journey? Check this article

Keep Reading

Affordable rates for you: Apply for a Navy Federal Personal Loan!

Take the next step towards financial empowerment as a veteran or armed forces member. Learn how to apply for a Navy Federal Personal Loan!

Keep ReadingYou may also like

OpenSky® Plus Secured Visa® Credit Card review

Don't let a lack of credit history hold you back. Explore our OpenSky® Plus Secured Visa® Credit Card review.

Keep Reading

Is there any difference between Transunion and Equifax?

Confused about the differences between TransUnion and Equifax? Learn what makes them different and how they compare in this friendly guide!

Keep Reading

No fees: Apply for Mission Money Visa® Debit Card

Say goodbye to complicated application processes - apply for the Mission Money Visa® Debit Card today! Save on fees!

Keep Reading