Credit Cards

Apply for the OpenSky® Plus Secured Visa® Credit Card

Cracking the code to credit success has never been easier. Join us as we walk you through a comprehensive step-by-step guide on applying for the Opensky Plus Secured Credit Card.

Advertisement

Credit Repair Simplified: Step-by-Step OpenSky Plus Application

Take control of your credit and pave the way to a brighter financial future! Check how to apply for the OpenSky® Plus Secured Visa® Credit Card.

Whether you’re looking to rebuild your credit or establish a solid financial foundation, we’ve got you covered.

Apply for the OpenSky® Plus Secured Visa® Credit Card Online

You can apply online for the OpenSky® Plus Secured Visa® Credit Card. Therefore, it is quick and convenient. So, to get started, follow these simple steps:

- First, go to the official OpenSky® website in your web browser;

- Then, look for the “Apply Now” button on the page and click on it to begin your application;

- Fill out the online application form, providing accurate and up-to-date personal details such as your name, address, date of birth, and contact information;

- Also, take the time to carefully read and understand the terms and conditions associated with the OpenSky® Plus Secured Credit Card. This includes information about interest rates, fees, and cardholder responsibilities;

- Once you’ve reviewed the terms and conditions, check the box indicating that you agree to them. Then, submit your application for review;

- Make your refundable security deposit: If approved, you’ll receive instructions on how to make your refundable security deposit. This deposit will serve as collateral for your credit limit;

- Once your security deposit is received and your account is set up, you’ll receive your OpenSky® Plus Secured Visa® Credit Card by mail. Activate the card according to the provided instructions and begin using it to build your credit.

Be sure to double-check all the details before submitting your application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card: Mobile App

The OpenSky® Plus Secured Credit Card does have a mobile app available for its customers. It provides convenient access to manage your account.

However, to apply for the OpenSky® Plus Secured Visa® Card, you would need to visit the OpenSky® website and complete the online application form.

OpenSky® Plus Secured Visa® Credit Card or Assent Platinum Secured Card?

So, are you looking for an alternative to the OpenSky® Plus Secured Visa® Credit Card? Then consider exploring the Assent Platinum Secured Card.

This credit card option offers similar features and benefits, including the opportunity to build or rebuild your credit history responsibly.

So discover how this card compares to the OpenSky® Plus Secured Visa® Credit Card and determine which option best suits your financial goals.

| OpenSky® Plus Secured Visa® Credit Card | Assent Platinum Secured Card | |

| Credit Score | No Credit/Poor/Fair. | All credit scores are accepted; |

| Annual Fee | Enjoy a $0 annual fee. | $0 annual fee; |

| Purchase APR | 29.99% (variable). | 28.99%; |

| Cash Advance APR | 29.99% (variable). | 28.99%; |

| Welcome Bonus | None. | None; |

| Rewards | None. | This is not a rewards card. |

To learn more about the Assent Platinum Secured Card, we invite you to check out our comprehensive review by clicking the following link.

Apply for Assent Platinum Secured Card

Do you know how to apply for the Assent Platinum Secured Card? You’re missing out on this Mastercard. Pay $0 annual fee!

About the author / Julia Bermudez

Trending Topics

Navy Federal Personal Loan review: Up to $50,000 in loans for veterans!

If you're a veteran looking for the best loan option, you can read our Navy Federal Personal Loan review! Borrow up to $50K in no time!

Keep Reading

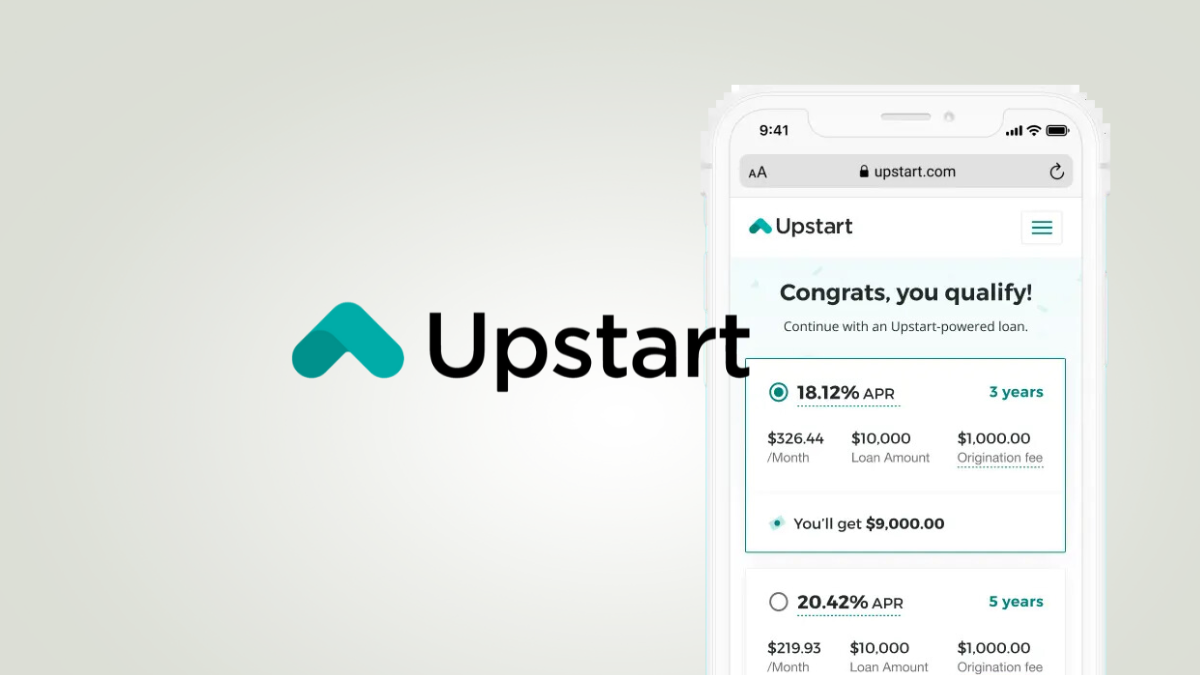

Find financial freedom: Upstart Loan review!

Do you need a loan to upgrade your finances with up to $50,000? If so, you can read on for our Upstart Loan review!

Keep Reading

Capital One VentureOne Rewards for Good Credit: how to apply

Start earning 1.25 miles for every dollar you spend: learn how to apply for the Capital One VentureOne Rewards for Good Credit!

Keep ReadingYou may also like

How to apply for a job at Handy: Get great competitive pay!

Ready to make your skills shine? Learn how to apply for a job at Handy and unlock a world of opportunities.

Keep Reading

How to Invest Money: Your path to financial growth!

Unlock the secrets of financial growth with our expert guide on how to invest money wisely and start building wealth today!

Keep Reading

Wells Fargo Reflect® Card: how to apply

If you’d like to apply for the Wells Fargo Reflect® Card to enjoy the 0% intro APR, you’re in the right place. Read on to learn how to do it!

Keep Reading