Credit Cards

Save money: apply for the Quicksilver Student Cash Rewards!

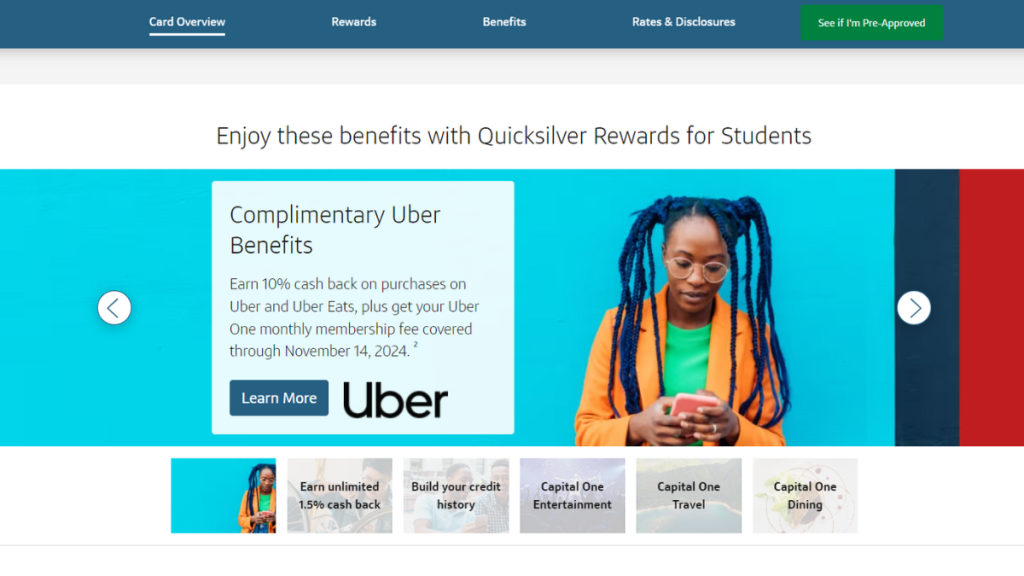

If you’re a student and you still don’t have the Quicksilver Student Cash Rewards, you are wasting time - and money! Get 1.5% cashback and more!

Advertisement

With a simple online application process, you can enjoy the benefits of the Quicksilver Student Cash Rewards!

The Quicksilver Student Cash Rewards by Capital One is a great card for students who want to earn cash back on their everyday purchases to apply to.

Indeed, with no annual fee, no foreign transaction fees, and a flat 1.5% cash back rate, it’s a great option that can help you save money over time.

Apply for the card: Online

Getting the Quicksilver Student Cash Rewards is just a few clicks away! The application process is entirely online through the Capital One website.

To apply for the Quicksilver Student Cash Rewards, just provide some basic information such as name, address, and social security number.

You’ll also have to share some financial details like income and expenses to help Capital One evaluate your eligibility for the card.

So all you have to do is make sure to fill it out correctly. Be honest about your financial situation, and Capital One will make you the best offer.

Before applying, make sure you go through the terms and conditions carefully, including the reward program details.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply for the card: Mobile App

Unfortunetely, you cannot apply for the Quicksilver Student Cash Rewards throught the mobile app.

Still, you can use it to manage your card, check transaction, redeem rewards and more.

Quicksilver Student Cash Rewards or SavorOne Student Cash Rewards?

Have you been eyeing the Capital One credit cards for students but are unsure which one to go for? So let me break it down for you.

Indeed, the Quicksilver Student Cash Rewards provides a flat 1.5% cashback on all purchases, making it more versatile for everyday spending.

The SavorOne Student Cash Rewards offers higher cashback percentages for dining and entertainment, making it perfect for socializing more!

So take a look at the comparative table below to see more of its features:

| Quicksilver Student Cash Rewards | SavorOne Student Cash Rewards | |

| Credit Score | Fair credit; | Good credit; |

| Annual Fee | $0 annual fee; | You won’t have to pay any annual fee for this credit card; |

| Purchase APR | It will vary according to your credit history: 19.99%, 25.99% or 29.99%; | From 19.99% to 29.99%. The APR will depend on your creditworthiness; |

| Cash Advance APR | variable 29.99%; | 29.99%; |

| Welcome Bonus | $50 cash bonus as soon as you spend $100 using this credit card in the first 3 months, which is pretty easy to achieve; | $50 cash bonus. Terms apply; |

| Rewards | Unlimited cash back: 1.5% on every purchase! | 1% on every purchase bonus, also 3% cash for supermarket, streaming services, dining, and entertainment. |

If you prefer a higher cashback rate, then check the application guide we’ve made to help you get the SavorOne Student Cash Rewards!

Apply for SavorOne Student Cash Rewards

Apply for the SavorOne Student Cash Rewards card and keep building your credit history with one of the best cards to earn cash back!

About the author / Julia Bermudez

Trending Topics

$0 annual fee: Apply for the DoorDash Rewards Mastercard®!

Hungry for savings? Learning how to apply for the DoorDash Rewards Mastercard® is your ticket to rewards, discounts, and more!

Keep Reading

LendingClub Personal Loans review: up to $40,000

In this LendingClub Personal Loans review, we listed all the features and benefits of choosing it! Enjoy affordable conditions! Read on!

Keep Reading

How to move out of your parents’ house: 6 easy steps

Every bird must fly away from its nest at some point. See how to move out of your parents' house and start a new life.

Keep ReadingYou may also like

650 credit score: is it a good score to achieve?

So you have achieved a 650 credit score. Is it good? What can you get with this score? Read on, and we’ll give you the answers!

Keep Reading

What Are Tax Receipts and Why Are They Important?

Understand why tax receipts are important and how to take advantage of them. Learn here what you need and how to maximize your benefits!

Keep Reading

Chase Freedom Unlimited® Review: Earn an extra 1.5% cash back!

Reading this Chase Freedom Unlimited® review is an excellent option if you're looking for rewards! Earn up to 5% cash back on purchases!

Keep Reading