Loans

Apply with Ease for a Standard Bank Loan: up to R300,000

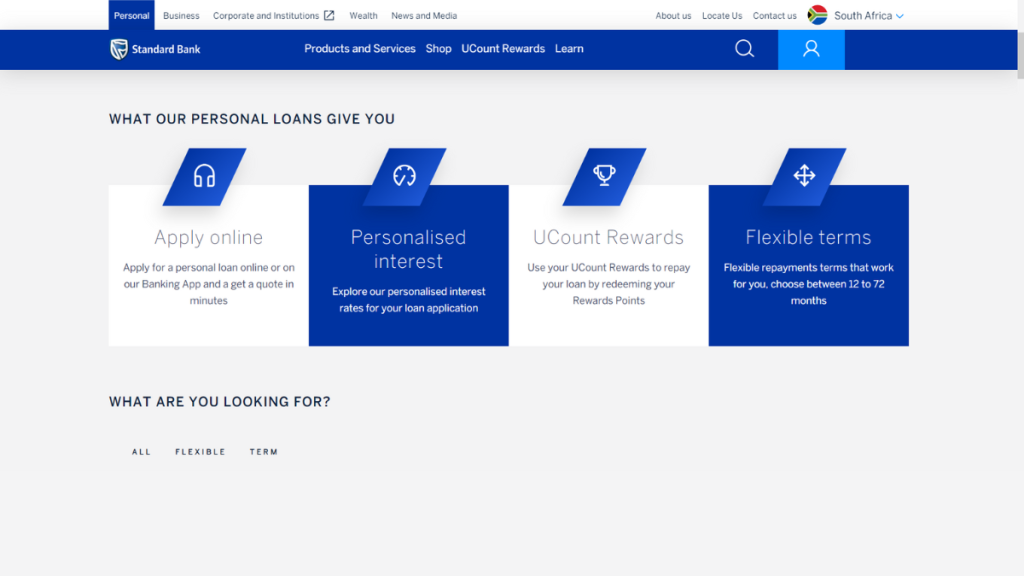

Your financial journey begins here. Explore the streamlined process of applying for a Standard Bank loan and unlock opportunities.

Advertisement

One Step Closer: How to Apply for a Standard Bank Loan and Realize Your Goals

Picture this: your dreams, aspirations, and ambitions are all within reach. That’s what happens when you learn how to apply for a Standard Bank Loan.

Further, we break down the steps to applying for this lender, ensuring that your path to financial empowerment is as simple as it is rewarding.

Apply for the loan: Online

Applying for a Standard Bank loan online is a breeze.

Moreover, they offer you the convenience of initiating your financial journey from the comfort of your own space.

You will be redirected to another website

Via Website:

- Visit the Standard Bank Website: Start by accessing the official Standard Bank website through your web browser;

- Explore Loan Options: Secondly, navigate to the loan section and explore the various loan options available. Choose the one that best aligns with your financial needs and goals;

- Initiate Application: After that, click on the chosen loan option to initiate the application process. You’ll be guided through a series of steps where you’ll need to provide relevant information and documentation;

- Provide Details: Finally, fill in the required personal, financial, and contact details accurately. Be prepared to upload necessary documents, such as proof of income and identification;

- Review and Submit: Now, before finalizing, review the entered information to ensure accuracy. Once satisfied, submit your application;

- Wait for Response: Standard Bank will review your application and contact you regarding the outcome. This may involve additional verification steps.

Apply for the loan: Mobile App

- Download the Standard Bank Mobile App: If you haven’t already, download the Standard Bank Mobile App from your device’s app store;

- Login or Register: Log in to your existing account or register if you’re a new user;

- Navigate to Loans: Access the “Loans” section within the app to explore the available loan options.

- Select Your Loan: Choose the loan product that suits your needs and goals;

- Start Application: Initiate the loan application process by providing the required details and documents. The app will guide you through the necessary steps;

- Review and Submit: Before submitting, review all entered information for accuracy. Make any necessary corrections, and then proceed to submit your application;

- Confirmation and Response: After submission, you’ll receive a confirmation of your application. Standard Bank will review your application and communicate the outcome to you.

Applying for a Standard Bank Loan online offers a user-friendly and efficient way to access the financial support you need.

Standard Bank Loan or Absa Loans?

In the world of loans, both Standard Bank and Absa stand as significant players.

Exploring the nuances of their offerings can help you make an informed decision aligned with your financial goals.

| Standard Bank Loans | Absa Loans | |

| Interest Rate | Personalized, no more than 17.5%; | Starts at 13.75%; |

| Loan Purpose | Personal loans for every purpose you need; | This loan can be used for many purposes, including medical expenses, home renovation, travel, wedding, etc.; |

| Loan Amounts | R3,000 – R300,000; | up to R350,000; |

| Repayment Term | 12 to 72 months; | From 1 up to 3.5 years; |

| Initiation Fee | From R419.75 to R1207.50. | 10% of the loan amount or at least R80. |

Not sure about these options yet? Then read the Absa Loans full review to have a clearer vision of its features.

Apply for ABSA Personal Loans with Confidence

Need funds for your dreams? Apply for ABSA personal loans and make them a reality with quick access to the funds you require.

About the author / Julia Bermudez

Trending Topics

6 best ways to make extra money in South Africa

Do you want to know how to make extra money in South Africa? This is the post for you! Click here and check out how to do it today!

Keep Reading

Find out how to apply for a Hippo Loan of up to R350,000!

Do you need a loan to help you manage your finances? If so, you can learn how to apply for a Hippo Loan of up to R350,000. So, read on!

Keep Reading

Standard Bank Gold Credit Card review: enjoy travel perks

The Standard Bank Gold Credit Card can be your first credit card, and this review will show you why! Earn points on every purchase.

Keep ReadingYou may also like

Find a job at ChesaNyama: Flexible hours!

Looking for a job at ChesaNyama? Find out how you can become part of the team with our helpful tips and advice on landing your dream job.

Keep Reading

15 best weekend jobs to get extra money

Need to boost your income but don't have much time during the week? Discover the top 15 weekend jobs that can help you earn some extra cash.

Keep Reading

Capitec: how to apply for a job opening

Do you want to apply for a job at Capitec? If you do, you'll want to do it right. We'll teach you just that in this post, so check it out!

Keep Reading