Credit Cards

Apply for the TSB Platinum Purchase Card: Intro 0% interest

Unlock the secrets to applying for the TSB Platinum Purchase Card. Discover prerequisites, features, and insider tips to streamline your application process and harness the benefits of this versatile credit tool!

Advertisement

TSB Platinum Purchase Card: Long 0% purchase offer!

Navigating the world of cards to find the right fit for your financial needs can be a daunting task. Among the options available, the TSB Platinum Purchase Card review stands out!

Also, this card can be an enticing choice for those seeking a balance between managing existing debts and handling ongoing expenses. So, read on to learn!

Apply for the card: Online

In this guide, we’ll walk you through the essential steps and considerations when applying for the TSB Platinum Purchase Card.

Also, from understanding its unique features to navigating the application process, we aim to equip you with the knowledge needed to make a confident decision about this card.

Applying for the TSB Platinum Purchase Card involves more than just filling out a form—it’s about understanding how this card aligns with your financial goals and lifestyle.

You will be redirected to another website

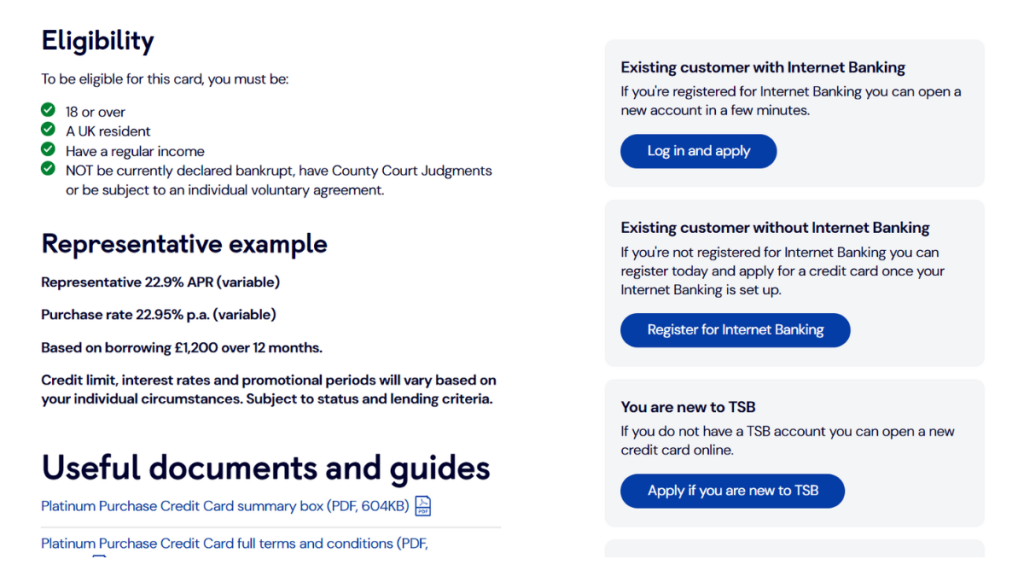

Requirements

You’ll need to be at least 18 years old, be a UK resident, have a regular income, and not be bankrupt to apply for this card.

Therefore, there can be other requirements. You’ll need to complete the application to see if you qualify.

Apply online

To apply online, you can go to the official website and provide the personal information required.

Moreover, you may need to send some documents and go to the branch near you to complete the application.

Apply for the card: Mobile App

You’ll be able to use the mobile app to handle all your finances with this card. However, you’ll need to apply online through the official website.

TSB Platinum Purchase Card or Ocean Credit Card?

Are you not so sure about getting the TSB Platinum Purchase Card? If that’s the case, you can try applying for the Ocean Credit Card.

Also, with this card, you’ll be able to get 0% on balance transfers and purchases for 6 months as a new cardholder.

Moreover, you’ll be able to get a credit limit ranging from £200 to £8,000, depending on your finances.

Therefore, you can read our comparison table below to learn more and see which card is the best one for your needs!

| TSB Platinum Purchase Card | Ocean Credit Card | |

| Annual Fee | No monthly fees; | No annual fee; |

| Credit Limit | The credit limit depends on your financial situation at the moment of application; | Credit limit of £200 to £8,000; |

| Representative APR | 22.90% variable representative APR; | 39.9% representative variable APR; |

| Purchase Rate | 0% interest for up to 15 months on purchases; 22.95% variable p.a. for purchases; | 39.9% variable APR; |

| Welcome Bonus* | You can get up to 15 months on balances you transfer within your first 90 days with the card; *Terms apply | You’ll have a chance to get 05 on balance transfers and purchases for 6 months as a new cardholder; Terms apply* |

| Rewards | There are no rewards programs. | No regular rewards program. |

So, if you’re looking for a card with the features of the Ocean Credit Card, you can read our blog post below!

Therefore, read on to learn how to apply for this card!

Apply for the Ocean Credit Card

Discover the seamless process of how to apply for the Ocean Credit Card – up to £8,000 credit limit! Keep reading and learn more!

About the author / Victoria Lourenco

Trending Topics

HSBC Classic Credit Card review: build a credit rating

If you’re looking for an HSBC credit card, read this HSBC Classic Credit Card review! Qualify with low credit score and pay no annual fee!

Keep Reading

Lifestyle Personal Loans review: no hidden fees!

Are you on the quest for the best personal loan in the Uk? Read this Lifestyle Personal Loans review to see if this is the one! Up to £5,000!

Keep Reading

Post Office Money Classic Credit Card: how to apply

Learn how to apply for the Post Office Money Classic Credit Card. £0 annual fee! Read on to find out how to do it!

Keep ReadingYou may also like

10 Top Secret Websites to Make Money Online

Ready to uncover the hidden gems of online earning? Delve into our post unveiling top-secret websites to make money online!

Keep Reading

Loans for people with an IVA: is it possible?

Do you have an IVA and are thinking about applying for loans? Don’t do it before reading this post, because there are some intricacy in it.

Keep Reading

Capital One Balance Transfer Card review: No annual fee!

Discover in the Capital One Balance Transfer Card review if this is your ticket to managing debts efficiently! 0% intro interest!

Keep Reading