Loans

Up to $50,000: Find out how to apply for an Upstart Loan!

Are you looking for a good loan option even with a low score? If that's the case, you can read on to learn how to apply for an Upstart Loan!

Advertisement

Apply for an Upstart Loan: Check your rate in 5 minutes!

Securing a loan can often feel like navigating a maze of paperwork. But, Upstart can help you. So, read on to see how to apply for an Upstart Loan!

Moreover, if you’re ready to discover a hassle-free approach to borrowing, you’re in the right place. Therefore, read on to learn how to apply!

Apply for the loan: Online

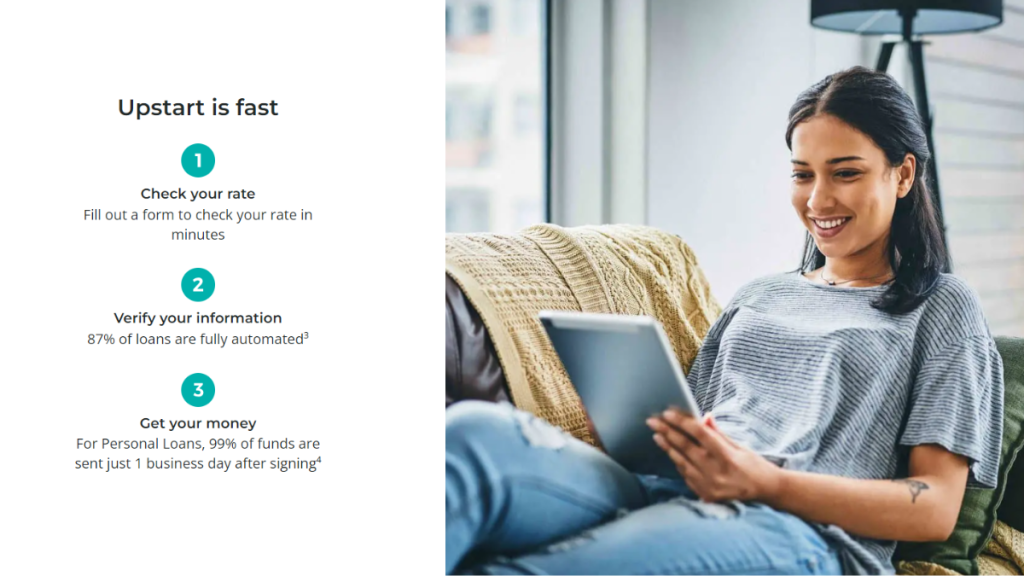

Gone are the days of drowning in stacks of documents and waiting anxiously for loan approvals.

So, with Upstart, the application process has been reimagined for the modern world.

Moreover, to apply online, you’ll need to go to the website and provide your personal information to get pre-qualified.

Then, you’ll need to complete the application providing more information and wait for a response!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

To have more chances to qualify, you’ll need to have a credit score of at least 300 points.

However, this lender can accept borrowers with no credit score or a lower score.

Moreover, you’ll need to reach a minimum income and be at least 18 years old!

Apply for the loan: Mobile App

You can download the Upstart app to use its many features online. However, you won’t be able to find a way to apply for a loan through the mobile app.

Also, you can use the app to manage your loan once you’ve received your funds.

Therefore, you’ll need to apply online to get your loan.

Upstart Loan or Honest Loans?

Are you not so sure about getting a loan through Upstart Loans? If that’s the case, you can try getting a loan through Honest Loans.

Also, with this platform, you’ll be able to find incredible personal loan options with amounts of up to $50,000 in loan amounts!

Therefore, you can check out our comparison table below to learn more about these incredible lenders and see which is the best option for your needs!

| Upstart Loan | Honest Loans | |

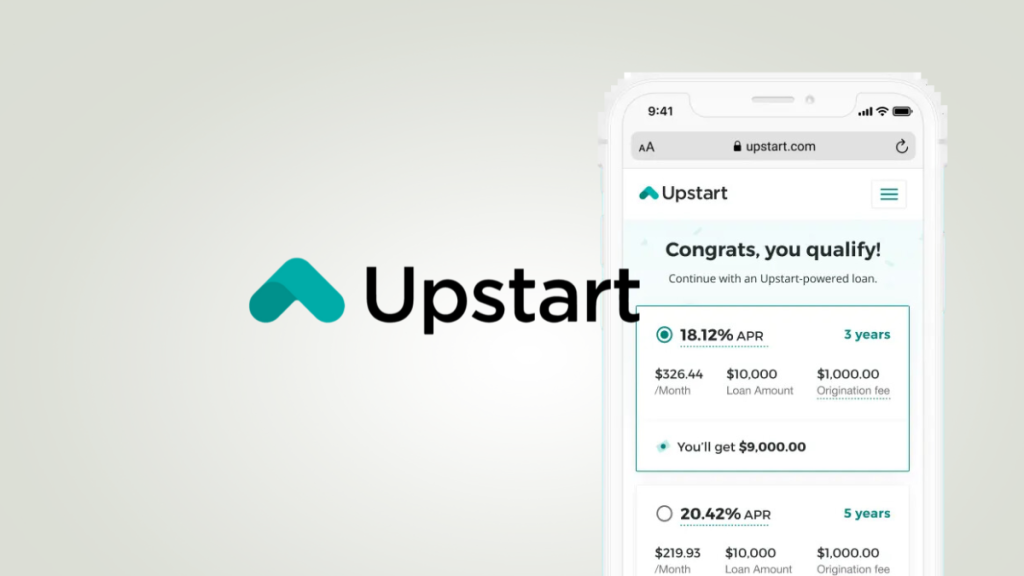

| APR | 5.2% to 35.99% variable APR; | The APR varies according to the lender; |

| Loan Purpose | Almost all personal loan reasons, including moving-out loans, credit card debt consolidation loans, wedding loans, and more; | Personal loans for any purpose you wish; |

| Loan Amounts | From $1,000 to $50,000, | $100 – $50,000 (depending on the lender); |

| Credit Needed | The initial credit check won’t affect your credit score. However, there is no minimum credit score; | Each lender has its eligibility criteria; |

| Terms | From 3 to 5 years with fixed rates; | It depends on the lender; |

| Origination Fee | There can be origination fees depending on the loan terms and amount; | You must check with the lender you chose; |

| Late Fee | There can be late fees, depending on the loan terms and amount; | Each lender has its fees; |

| Early Payoff Penalty | There are no prepayment penalty fees. | Some lenders charge an early payoff penalty fee, so read the fine print and conditions before applying for a personal loan. |

Now that you’ve learned more about Honest Loans, you can learn how to apply for it! So, read our post below to learn how to apply!

Honest Loans: all you need to apply

Find out what makes Honest Loans the right choice before you decide to apply. Borrow up to $50K for several purposes! Keep reading!

About the author / Victoria Lourenco

Trending Topics

How to plan your career trajectory: 4 easy steps

Are you planning your career trajectory? Take the next step in reaching your goals and follow these simple steps for a successful plan.

Keep Reading

How to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card

See how to apply for the First Progress Platinum Prestige Mastercard® Secured Credit Card and earn cash back while you build credit!

Keep Reading

Savings vs. checking accounts: What is the difference?

In the savings vs. checking accounts battle, which one will be the best for your financial journey? Check this article

Keep ReadingYou may also like

Best Credit Cards for Poor Credit: Make the Right Choice

Find out everything you need to know about credit cards for poor credit and how they can help you overcome financial obstacles.

Keep Reading

Discover It® Secured Credit Card: how to apply

Learn how you can easily and quickly apply for the Discover It® Secured Credit Card and build up your score while earning cash back!

Keep Reading

75K bonus miles: Capital One Venture Rewards Credit Card review

Looking for a card that makes your travels more rewarding? Check our Capital One Venture Rewards Credit Card review - up to 5 miles per $1!

Keep Reading