Credit Cards

Earn 3% back: Apply for Woolworths Black Credit Card

Enjoy exclusive perks with the Woolworths Black Credit Card - earn cash back and exclusive benefits! Travel insurance and Visa Purchase Protection.

Advertisement

Apply for the Woolworths Black Credit Card and Start Earning Rewards Today

Imagine a credit card that rewards you every time you shop. That’s exactly what the Woolworths Black Credit Card does when you apply for it.

Not only it provides financial flexibility, but it also unlocks a realm of exclusive offers and discounts. So learn how to get this card from your home.

Apply for the card: Online

Indeed, applying for the Woolworths Black Credit Card online is quick and easy. Simply visit the website and navigate to the credit cards section.

So look for the Woolworths Black Credit Card and click on the “Apply Now” button. You’ll be guided through a secure application form.

Furthermore, you’ll need to provide your personal details, income information, and other required information.

Review your application carefully before submitting it.

Once your application is processed and approved, you’ll receive further card delivery and activation instructions.

You will be redirected to another website

Step-by-step application straightforward resume

- Visit the Woolworths website and navigate to the credit cards section.

- Locate the Woolworths Black Credit Card and click the “Apply Now” button;

- Complete the secure application form;

- Review your application carefully for accuracy and submit it;

- Await processing and approval to receive further instructions on card delivery and activation.

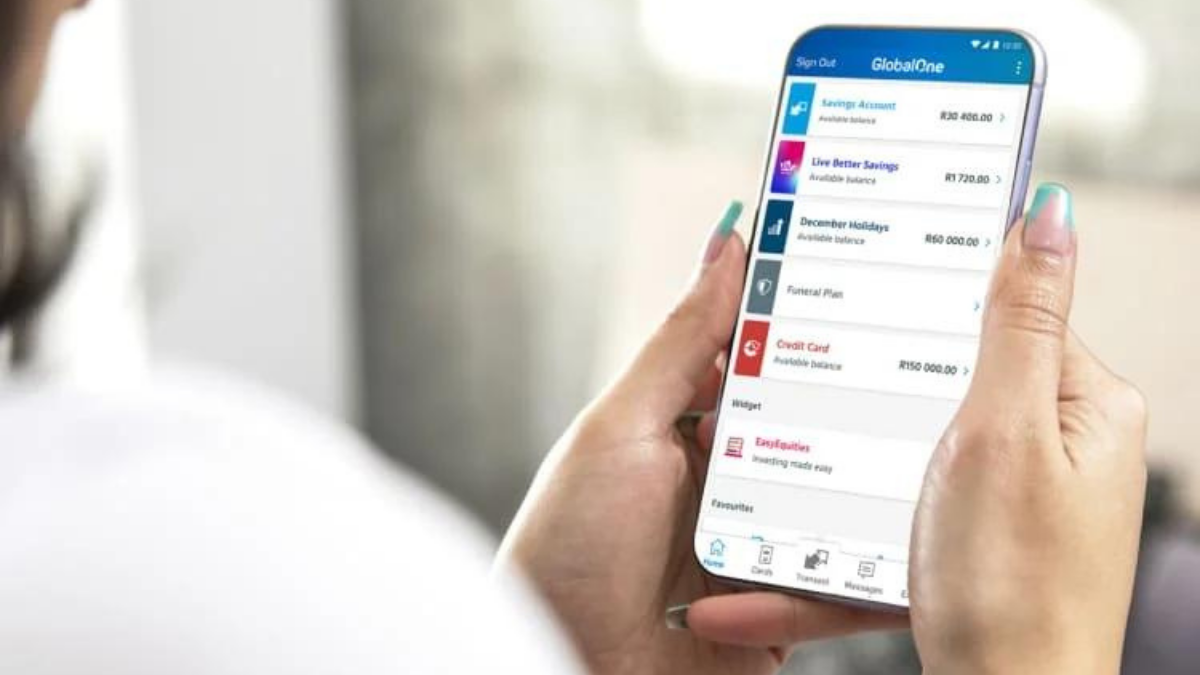

Apply for the card: Mobile App

Yes, Woolworths provides a mobile app that allows you to conveniently manage your credit card accounts.

Indeed, to apply for the Woolworths Black Credit Card through the app, download and install it from the relevant app store for your device.

Launch the app and select the “Apply for Credit Card” option. Follow the prompts to provide the necessary info and complete your application.

Once approved, you’ll receive instructions on how to proceed with card activation and delivery.

Woolworths Black Credit Card or Capitec Global One Card?

Are you shopping for a credit card but unsure which one to choose? Let’s compare the Woolworths Black Credit Card and the Capitec Global One Card.

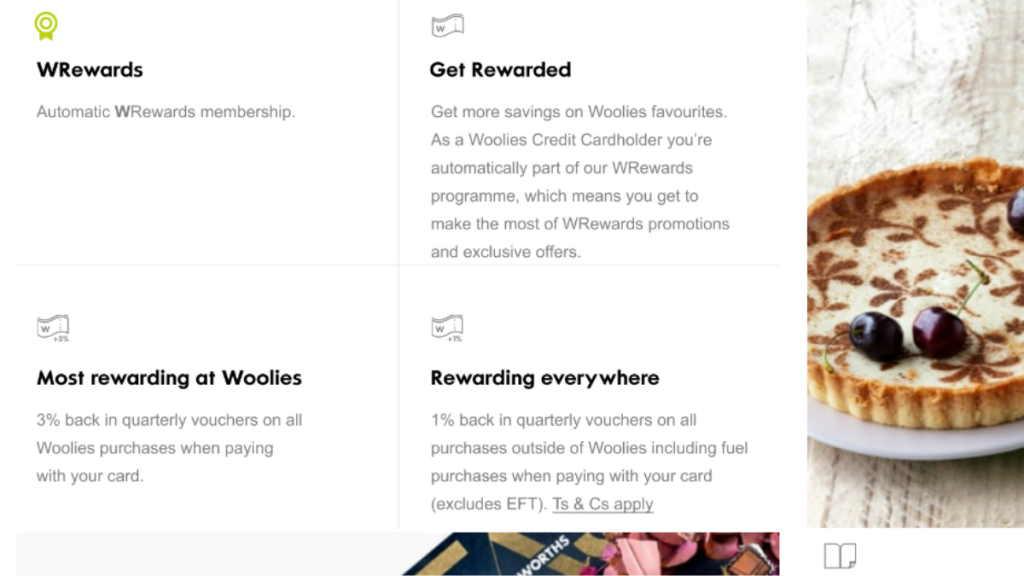

The Woolworths Black Credit Card offers rewards for purchases, travel benefits, and dedicated customer service, making it great for avid shoppers.

The Capitec Global One Card provides simplicity, low fees, and a simple banking solution, making everyday transactions and savings convenient.

| Woolworths Black Credit Card | Capitec Global One Card | |

| Min. Monthly Income | R41,666 income per month; | R5 000 (R10 000 for self-employed); |

| Initiation Fee | R150; | R100; |

| Maintenance Fee | R69; | R7 for the debit card, R50 for the credit card; |

| Interest Rate | 21%; | 55 days of no interest; after that 11.75% – 22.25%; |

| Rewards | 3% WRewards on Woolworths purchases, 1% WRewards on other purchases. | Up to 1.5% cash back on transactions. |

Further, for a detailed review of the Capitec Global One Card, check out our full review and find the perfect credit card that suits your needs.

Apply for the Capitec Global One Card

Apply for the Capitec Global One Card and gain access to an extensive branch! Earn 1.5% cash back on transactions and much more!

About the author / Julia Bermudez

Trending Topics

NedBank Gold Credit Card: how to apply

Check how to apply for NedBank Gold Credit Card! Ensure up to 55 interest-free days and several discounts! Keep reading and learn more!

Keep Reading

Apply for a job at Unilever: learn how

If you want to apply for a job at Unilever, this is the article you've been looking for! We'll teach you all there is to it over here.

Keep Reading

African Bank Gold Credit Card review: 60 days interest-free

Read this review to learn how efficient the African Bank Gold Credit Card is. Earn 3% interest back on a positive balance. Enjoy free swipes.

Keep ReadingYou may also like

Hoopla Loans: all you need to apply

If you're looking for a loan and want to find the best lenders and offers, check out how to apply for Hoopla Loans! Up to R250,000!

Keep Reading

Find a job at Absa: an innovative face in the financial industry!

If you want a good job at Absa, check out this article! We'll give you lots of tips and details about the company so you can succeed!

Keep Reading

How to reverse money using Capitec App: easy step-by-step

If you've ever accidentally sent a payment with the Capitec App you didn't mean to, learn how to reverse money using Capitec App!

Keep Reading