Finances

Bankruptcy Alternatives: What are they?

Explore a range of compelling bankruptcy alternatives to find your path towards financial recovery. From debt consolidation to credit counseling, discover strategies to avoid bankruptcy and regain control of your financial future.

Advertisement

Learn how to explore powerful alternatives to financial recovery

Looking for a way out of the financial abyss without resorting to bankruptcy? When debts pile up and the future looks uncertain, it’s time to explore the world of bankruptcy alternatives.

These alternative solutions offer a glimmer of hope. They also provide options that can help you regain control of your financial situation and steer clear of the bankruptcy path.

10 Mistakes People Make With Their Money

Learn the top 10 mistakes people make with their money and how to avoid them with our easy guide!

From debt settlement and consolidation to credit counseling and repayment plans. There are plenty of ways to get out of this situation.

So let’s dive into the realm of bankruptcy alternatives! That way you can discover a brighter road to financial freedom.

Credit Counseling

When drowning in a sea of debt, bankruptcy might seem like the only way out. But before you make that drastic decision, consider the life raft known as credit counseling.

This is one of the best bankruptcy alternatives, and offers a beacon of hope, guiding you towards financial stability.

With the help of trained professionals, credit counseling empowers you to gain control over your finances. It helps you to develop a realistic budget, and create a plan to repay your debts.

It’s like having a knowledgeable co-pilot navigating you through the stormy waters. Helping you steer clear of bankruptcy and towards a healthier financial future.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Debt Consolidation

If you’re feeling overwhelmed by multiple debts, debt consolidation may be the shining light you’ve been searching for.

As one of the best bankruptcy alternatives, debt consolidation simplifies your financial landscape by combining all your debts into a single manageable payment.

Imagine bidding farewell to the chaos of juggling various due dates and interest rates.

With debt consolidation, you can streamline your finances. Also, you can potentially secure a lower interest rate, and create a clear roadmap to paying off your debts.

It’s like hitting the reset button on your financial journey, offering you a chance to regain control and pave the way towards a debt-free future.

Debt Management

When bankruptcy lurks as a daunting prospect, there’s a ray of hope in the form of debt management – a compelling alternative to steer clear of the financial abyss.

Debt management provides a structured and practical solution to tackle overwhelming debt without resorting to bankruptcy.

With the guidance of a reputable credit counseling agency, you can craft a personalized repayment plan and negotiate with creditors to potentially lower interest rates and waive fees.

It’s like having a financial ally in your corner. It helps you regain control of your finances and pave the way to a debt-free future.

So, wave goodbye to bankruptcy worries and embrace the empowering path of debt management.

Repayment plans

Rather than surrendering to the storm of insolvency, repayment plans offer a structured approach to weather the debt crisis.

By working with creditors or a credit counseling agency, you can negotiate manageable repayment terms, spreading out your payments over time.

This alternative allows you to regain control of your financial destiny while avoiding the drastic consequences of bankruptcy.

Debt Settlement

Finally, if bankruptcy feels like an imminent shadow casting a gloom over your financial situation, debt settlement can be a powerful alternative to lead you towards the light of financial recovery.

With debt settlement, you have the opportunity to negotiate with your creditors and reach an agreement to pay off a portion of your debt, often with a reduced total amount.

This alternative allows you to avoid the drastic measures of bankruptcy while still finding a resolution to your overwhelming financial burdens.

By enlisting the help of experienced professionals, you can navigate the complexities of debt settlement. You can also reduce your debts and find a path towards financial freedom.

So, instead of succumbing to bankruptcy, explore the realm of debt settlement as one of the bankruptcy alternatives.

And to avoid falling into the same mistakes again, developing money management skills is a must. See the following link to learn what this means and how to take part in it!

Money Management: Your Path to Financial Success!

Learn the importance of having money management skills and how to develop them.

Trending Topics

Affordable rates for you: Apply for a Navy Federal Personal Loan!

Take the next step towards financial empowerment as a veteran or armed forces member. Learn how to apply for a Navy Federal Personal Loan!

Keep Reading

Apply for the Chase Slate Edge℠ credit card

Discover the benefits and steps: Learn how to apply for the Chase Slate Edge℠ and unlock exclusive advantages.

Keep Reading

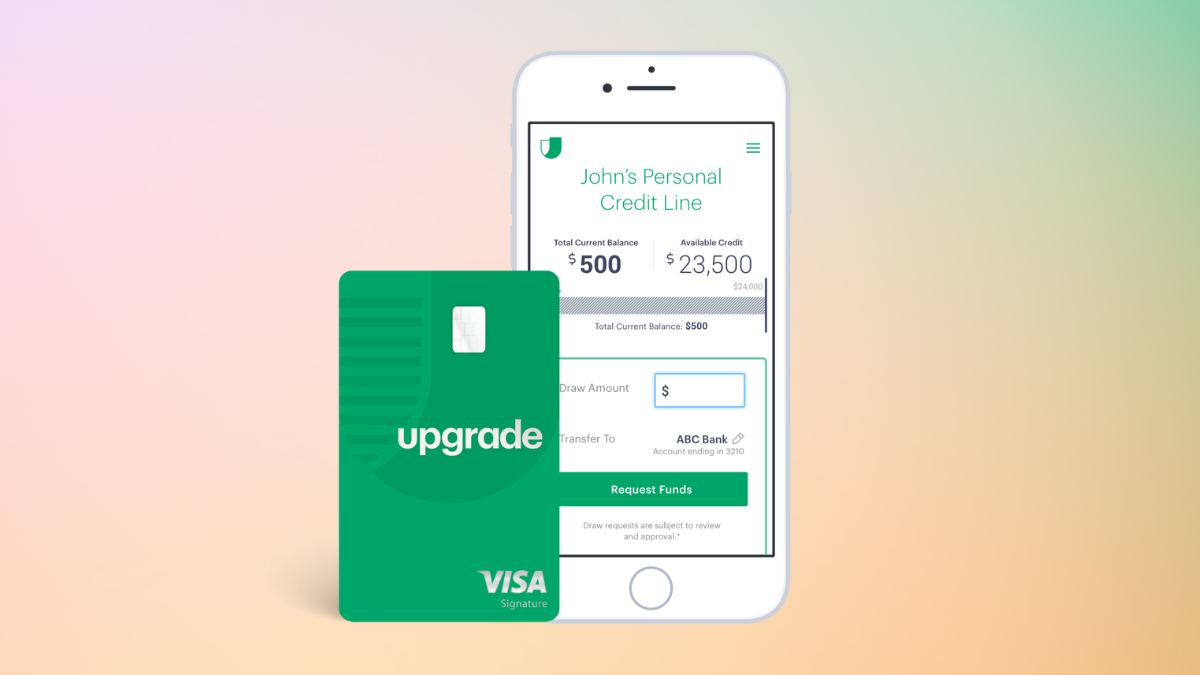

$0 annual fee: Apply for Upgrade Card today

Applying for the Upgrade Card has never been easier. You can complete your entire application online. Earn a $200 bonus - learn how!

Keep ReadingYou may also like

Find a job at The Cleaning Authority: Competitive pay and professional training

Unlock a world of possibilities with a job at The Cleaning Authority. Join a team that combines excellence and a passion for cleanliness!

Keep Reading

Honest Loans review: get your loan funded in 24h

Get an honest review of the features and benefits of Honest Loans. Connect with several lenders and ensure up to $50,000 fast! Read on!

Keep Reading

$0 annual fee: Apply for HSBC Cash Rewards Mastercard® now

Learn how to apply for the HSBC Cash Rewards Mastercard® and earn rewards with your purchase - up to 14% additional cash back! Read on!

Keep Reading