Credit Cards

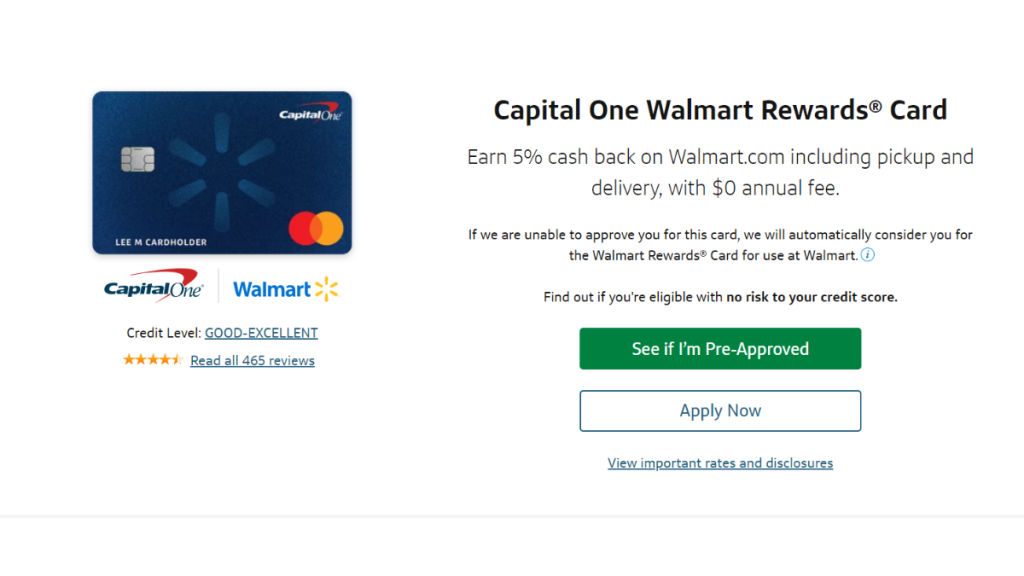

Up to 5% cash back: Capital One® Walmart Rewards® Card Review

Are you ready to earn on every purchase? Then check out the Capital One® Walmart Rewards® Card - $0 annual fee and amazing benefits!

Advertisement

No annual fees and flexible redemption options!

Are you looking for a card offering a range of features and generous rewards? Take a look at our Capital One® Walmart Rewards® Card Review!

Apply for Capital One® Walmart Rewards® Card

Love shopping at Walmart? Learn now how to apply for the Capital One® Walmart Rewards® Card – $0 annual fee and reward program!

Using a Walmart credit card to pay for your purchases is a surefire way to save money – further, check the card’s main features!

| Credit Score | Good or Excellent. |

| Annual Fee | No annual fees. |

| Purchase APR | 18.99% or 29.99% variable for purchases and balance transfers. |

| Cash Advance APR | 29.99% variable. |

| Balance Transfer Fee: | $0 at the Transfer APR, 3% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you. |

| Welcome Bonus | When you use your Capital One Walmart Rewards® Card with Walmart Pay, you’ll get 5% cash back in stores for the first 12 months following approval. |

| Rewards | You’ll get 5% cash back when you shop on the Walmart website or the Walmart app (this includes grocery pickup and delivery), 2% cash back when you eat out or take a trip, and 1% on all other purchases. |

Capital One® Walmart Rewards® overview

If you shop frequently at Walmart, the Capital One® Walmart Rewards® Card is a great option.

Using a Walmart credit card to pay for purchases is a surefire way to save money.

You’ll get a hefty 5% cash back when you shop on the Walmart website or through the Walmart app (including grocery pickup and delivery).

You will also get 2% cash back when you eat out or take a trip and 1% everywhere else.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Capital One® Walmart Rewards® main features

When it comes to choosing a credit card, knowing your card’s advantages and drawbacks can be a game changer.

Further, check the Capital One® Walmart Rewards® pros and cons.

Pros

- There is no yearly charge;

- Several options exist for cashing in your rewards;

- Walmart.com purchases, as well as grocery pickup and delivery, offer an excellent rewards program;

- After approval on the Walmart app, the card is immediately usable;

- There is no interest rate penalty.

Cons

- To receive a 5% discount in-store for the first year, you must use Walmart Pay;

- APR that is above average;

- Few benefits;

- Walmart’s in-store purchases have a lowly 2 percent ongoing rewards rate.

Minimum credit score to apply

Indeed, this credit card requires a good or excellent credit score.

However, if you do not meet this requirement, the Walmart Rewards® Card will be considered for you automatically.

How to apply for the Capital One® Walmart Rewards®?

If you are interested in earning rewards with your daily purchases but are still unsure how to apply, check out our next post and learn more!

Apply for Capital One® Walmart Rewards® Card

Love shopping at Walmart? Learn now how to apply for the Capital One® Walmart Rewards® Card – $0 annual fee and reward program!

About the author / Giovanna Klein

Trending Topics

Top Credit Cards for Excellent Credit: Find Your Perfect Match

Discover the ultimate guide to unlocking the full potential of your credit score! Read on to see the best credit cards for excellent credit!

Keep Reading

Find a job at The Cleaning Authority: Competitive pay and professional training

Unlock a world of possibilities with a job at The Cleaning Authority. Join a team that combines excellence and a passion for cleanliness!

Keep Reading

The perfect credit building tool: Apply for the Surge® Platinum Mastercard®

Learn how to apply for the Surge® Platinum Mastercard® to get inside the world of credit and boost your score with a high credit limit.

Keep ReadingYou may also like

How to apply for a job opening at USA Clean Master

Apply for a job at USA Clean Master! Join a dynamic team, embrace growth opportunities, and make a difference in the cleaning industry.

Keep Reading

Apply for the FIT™ Platinum Mastercard®

Learn how to apply for the FIT™ Platinum Mastercard® with our easy walkthrough and get an unsecured credit line to improve your score!

Keep Reading

Find a job at Handy: Long-term incentives!

Discover the freedom and fulfillment of a job at Handy. Join a skilled community, set your own schedule, and unlock your career potential.

Keep Reading