Finances

Choose your loan: fast and affordable options tailored for you

Select an option below, and we'll recommend you the best lender option available!

Advertisement

Find easy and fast loan options that will provide the money you need in no time!

Select a loan option based on your needs!

Finding the best loan for you can be a daunting task. With so many lenders out there, it can be difficult to choose the right loan for you.

How to make money fast in South Africa?

Making extra money can be less complicated than you think. Check out these options to make money fast in South Africa! Read on!

That’s why it’s important to take the time to do your research and compare loans before you make any decision. Here is everything you need to know!

What is a loan?

A loan is a form of borrowing wherein the borrower and lender agree.

It is money you borrow, expecting to pay it back with interest later.

You can use a loan from a bank, credit union, or other financial organization for various reasons.

The loan you select will determine the maximum amount you can borrow, the time you have to repay the loan, and the rate.

You will be redirected to another website

How does a loan work?

To choose a loan, you must take note of four key components: the principal, the interest rate, the monthly payments, and the terms.

Firstly, the whole amount you borrow. For instance, you might take out a loan for $40,000 (the “principal”) to fix up your house.

Secondly, when you borrow money, you must pay it back plus interest. It will depend on several factors.

Finally, the installment payment is a convenient monthly payment plan for settling debts. It determines how many payments you will make.

The term is the amount of time you have to repay the loan. In the case of payday loans, it can take days, months, weeks, or even years.

Will my credit score be affected if I get a loan?

Getting a loan will affect your credit history positively and negatively.

A payday loan, for instance, could hurt your credit because it is a small loan with a high-interest rate for a short period.

The timely repayment of a long-term personal loan from a respectable lender, however, has the potential to boost credit scores.

You can keep your credit score high as long as you’re responsible for timely payments.

Consider your alternatives carefully and choose the loan that best fits your needs.

What are the main types of loan available?

You must know the two most common kinds of loans to choose a loan. They are secured and unsecured.

Loan with collateral

The borrower pledges an item of value, such as their home or automobile, as collateral in a secured loan.

So, the lender can reclaim the asset to recuperate losses if the borrower defaults on the loan.

Auto loans and mortgages are two prominent types of secured loans.

The best investments that pay monthly income

Some investments will compensate only in the long term, while others will give you monthly earnings. Learn more below!

Loan without collateral

This loan requires no collateral. The bank will determine the loan eligibility by a lender’s assessment of the applicant’s income and credit history.

Personal loans are the most typical kind of credit in this category. The loan can be used for almost anything.

A student loan is one common example of an unsecured loan. The interest is typically lower than other loan types, and repayment is often delayed.

Unsecured loans are also available from credit card issuers, although they often come with higher interest rates and shorter repayment terms.

How can you know which loan is right for you?

There are some factors to think about while comparing loans. To begin, what is the rate of interest? Naturally, the lesser the price, the better.

The length of the loan is another important consideration. In what time frame must the loan be repaid?

Monthly payments will increase with a shorter loan term, but the total interest paid will decrease.

The cost should also be taken into account. There may be additional costs associated due to origination fees or prepayment penalties.

Finally, know how you will pay back the debt. There are loans with automatic payments and loans that require human intervention.

How to choose your loan?

With what you know about loans now, here are four guidelines to follow when selecting one:

Be familiar with your credit rating

The loan’s interest rate will be based on the borrower’s credit rating. A lower interest rate corresponds to a higher credit score.

Raise it before applying for a loan if it is lower than you’d like.

Pick the proper duration of your contract

The loan’s term length affects the monthly payment and overall cost of your loan.

Longer loan terms typically result in lower monthly payments. Yet, if you’re trying to cut costs, a loan with a shorter duration is your best bet.

Choose a term that works best with your finances and long-term plans.

Evaluate the terms of various lenders’ preapprovals

After choosing a loan type, it’s time to search for potential lenders.

Most lenders will provide a preapproval, an estimate of the loan amount based on your financial information.

Get preapprovals from multiple lenders and then choose the one with the most favorable terms.

Bottom line

Which loan option do you think is the best one for your needs? That depends on how much money you have available.

Do your homework before committing to a loan. Check out the rates and terms given by various financial institutions.

Be sure you comprehend everything by inquiring extensively. It will guide you toward the one that meets your requirements best.

Finally, think things out thoroughly before settling on a course of action. That might end up saving you cash in the end.

Up next, learn how to make money fast in South Africa! We’ve gathered the best tips to help you!

How to make money online in South Africa

The internet is an infinite source of opportunities. This post will tell some of the best ways to make money online living in South Africa! Read on!

About the author / Giovanna Klein

Trending Topics

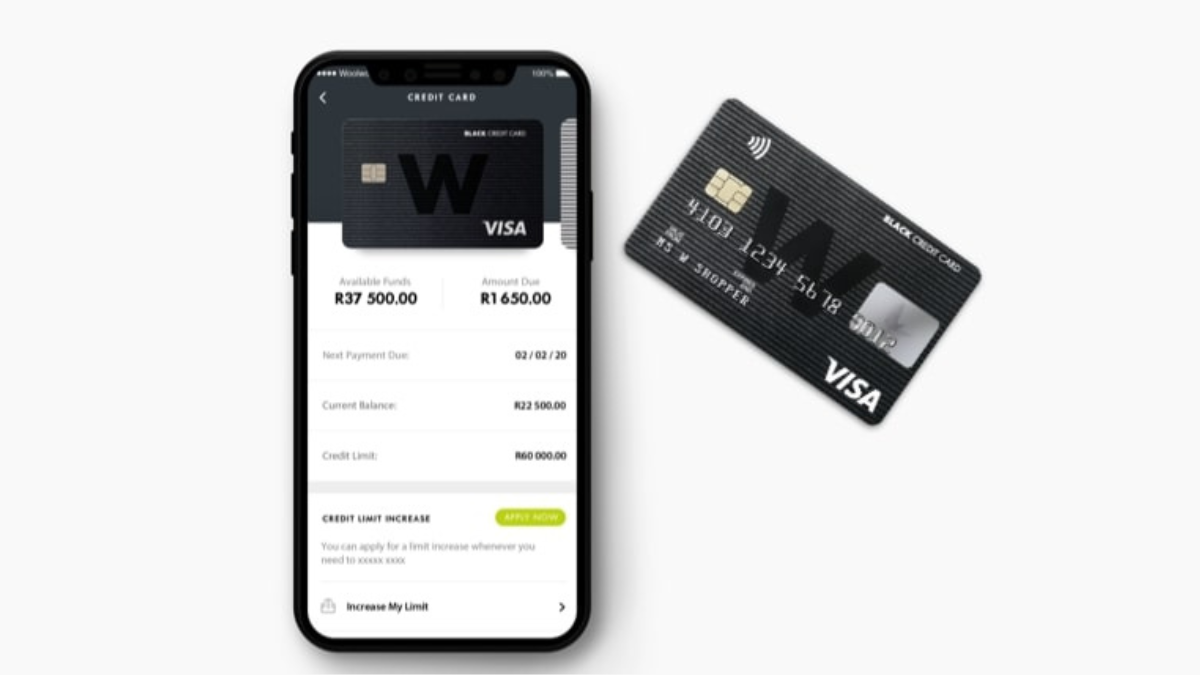

Earn 3% back: Apply for Woolworths Black Credit Card

Want to enjoy exclusive perks and rewards? Learn how to apply for the Woolworths Black Credit Card and elevate your shopping experience.

Keep Reading

Career field and occupation: What is the difference?

Would you like to know the core difference between a career field and an occupation? If yes, check out this article and solve your queries!

Keep Reading

Expand Your Financial Horizons: Apply for Capitec Global One Card

Apply for the Capitec Global One Card and gain access to an extensive branch! Earn 1.5% cash back on transactions and much more!

Keep ReadingYou may also like

Hoopla Loans: all you need to apply

If you're looking for a loan and want to find the best lenders and offers, check out how to apply for Hoopla Loans! Up to R250,000!

Keep Reading

Apply for a Nedbank Loan Today and Achieve Your Goals!

Ready to apply for a Nedbank Loan? Our step-by-step guide simplifies the process. Get started now and rewrite your history!

Keep Reading

Find a job at Checkers: Annual bonuses and benefits!

Elevate your career with a job at Checkers! Join a dynamic team, enjoy growth opportunities, and be part of a leading brand!

Keep Reading