Loans

Quick Loans Made Easy: Fasta Loans review

Find out why Fasta Loans is a top choice for quick loans in South Africa. Read our review and access funds in minutes.

Advertisement

Fast, Affordable, Reliable: Fasta Loans Solves Your Urgent Financial Needs

In this Fasta Loans review, we will provide an in-depth analysis of their quick credit solutions.

Apply for Fasta Loans

Need a quick loan? Follow our guide on how to apply for Fasta Loans and secure the financial assistance you require – up to R8,000!

From the application process to the repayment options, we’ll cover all the essential details to help you make an informed decision. Read on and learn!

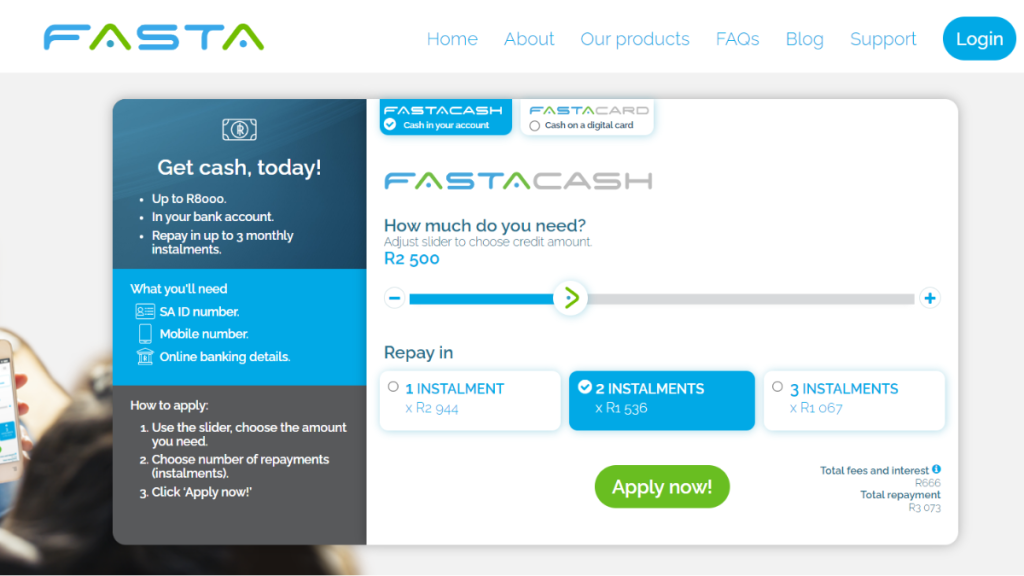

| Interest Rate | 3% per month; |

| Loan Purpose | Personal Loans for multiple purposes; |

| Loan Amounts | Up to R8,000; |

| Repayment Term | Fasta Loans give you 1, 2 or 3 months to repay your loan; |

| Initiation Fee | It varies depending on the loan conditions. |

Fasta Loans details

Fasta Loans is a leading provider of quick and convenient credit solutions in South Africa.

Moreover, they pride themselves on being innovative, flexible, and committed to offering some of the quickest loans on the market.

Also, with a user-friendly online process and partnerships with leading retailers and online merchants, they ensure a seamless borrowing experience.

From application to payout, their process is quick, often taking less than 5 minutes for approval. The funds are deposited directly into your account.

Fasta Loans aims to make borrowing simple, accessible, and convenient for South Africans, ultimately helping you overcome financial hurdles with ease.

You will be redirected to another website

Fasta Loans: pros and cons

You can get the money you need fast and hassle-free with Fasta Loans.

However, it is always good to check every side of the coin before opting for a financial product.

So, with this in mind, let’s review the pros and cons of Fasta Loans:

Pros

- Quick Approval: Fasta Loans offers a fast application process, with approvals often taking less than 5 minutes, allowing you to access funds of up to R8,000 promptly;

- Convenient Application: Their user-friendly online application process makes it easy to apply for a loan from the comfort of your own home or anywhere with internet access;

- Seamless Borrowing Experience: Fasta Loans ensures a smooth borrowing experience, providing a streamlined process from application to payout;

- Flexible Loan Options: Fasta Loans offers a range of loan amounts, allowing borrowers to select the option that best suits their needs and repayment capacity;

- Wide Partner Network: With partnerships with leading retailers and online merchants, Fasta Loans provides additional convenience and accessibility for borrowers.

Cons

- Limited Loan Amounts: While Fasta Loans offers flexibility in loan amounts, the maximum limit may not be suitable for borrowers with larger financial needs;

- Potentially Higher Interest Rates: Quick loans often come with higher interest rates compared to traditional bank loans. Borrowers should carefully consider the interest rates associated with Fasta Loans before committing;

- Limited Repayment Period: Fasta Loans typically offer repayment periods of 1 to 3 installments, which may not provide enough time for borrowers who require longer repayment terms.

Requirements

To apply for a Fasta Loan, you’ll need three things: your SA ID number, a mobile number, and your online banking details.

These requirements ensure a smooth and efficient application process.

Your SA ID number confirms your identification, while the mobile number allows for easy communication.

Providing your online banking details enables Fasta Loans to deposit approved funds directly into your bank account.

Indeed, with these requirements in place, you’ll be well on your way to accessing their quick and convenient credit solutions.

Fasta Loans: steps to apply

Now that you’re aware of the Fast Loans’ benefits, are you interested in applying for this quick and convenient line of credit?

If so, click the following link, and we’ll take you to the next post with the full application guide.

Apply for Fasta Loans

Need a quick loan? Follow our guide on how to apply for Fasta Loans and secure the financial assistance you require – up to R8,000!

About the author / Julia Bermudez

Trending Topics

Discovery Bank Gold Card: how to apply

Are you wondering how to apply for the Discovery Bank Gold Card? Wonder no more! Read on and learn how you can earn up to 40% cashback!

Keep Reading

Apply for a job at TFG (The Foschini Group): learn how

Would you want to apply for a job at TFG successfully? Check out this article and learn how to do it quickly! Ensure employee benefits!

Keep Reading

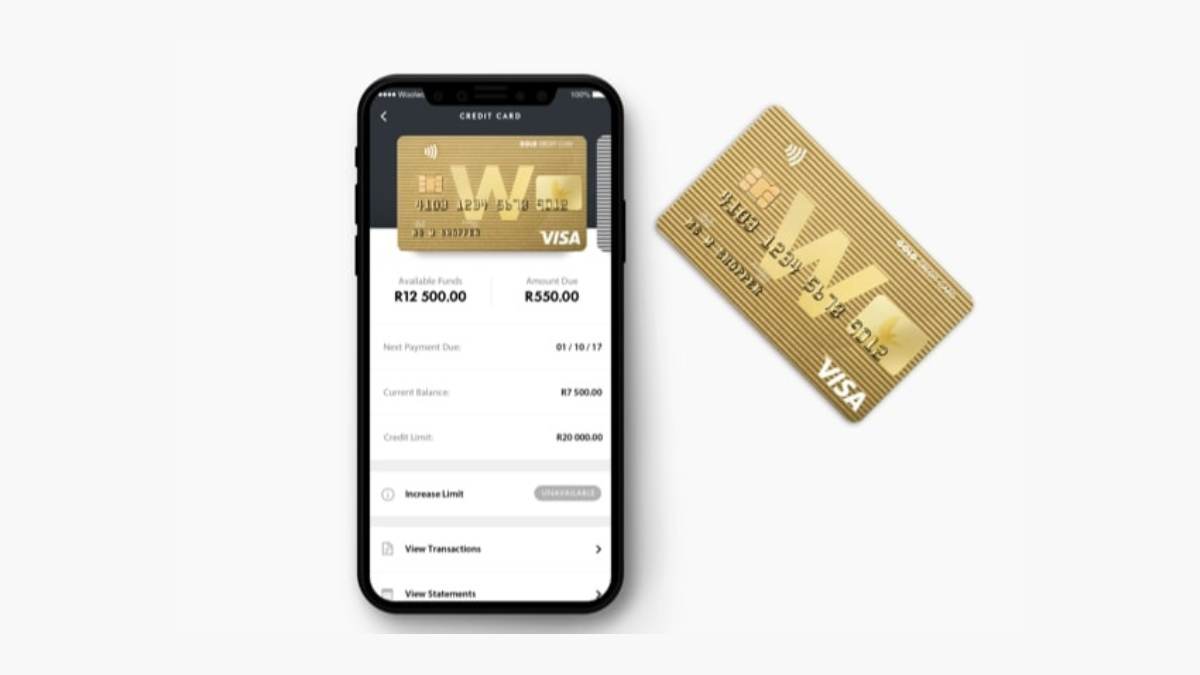

Your Ticket to Shopping Rewards: Woolworths Gold Credit Card review

Looking for a credit card that rewards your loyalty? Check out our review of the Woolworths Gold Credit Card.

Keep ReadingYou may also like

TFG (The Foschini Group): up to R600,000 annually

Would you like to know how to land a job at TFG? Check out this article and discover how to make it easy and quick!

Keep Reading

MG Black Prepaid Debit Card review: luxury travel rewards

Read this MG Black Prepaid Debit Card review and reset your mind about debit cards! Load up to R2,000,000 and enjoy travel perks.

Keep Reading

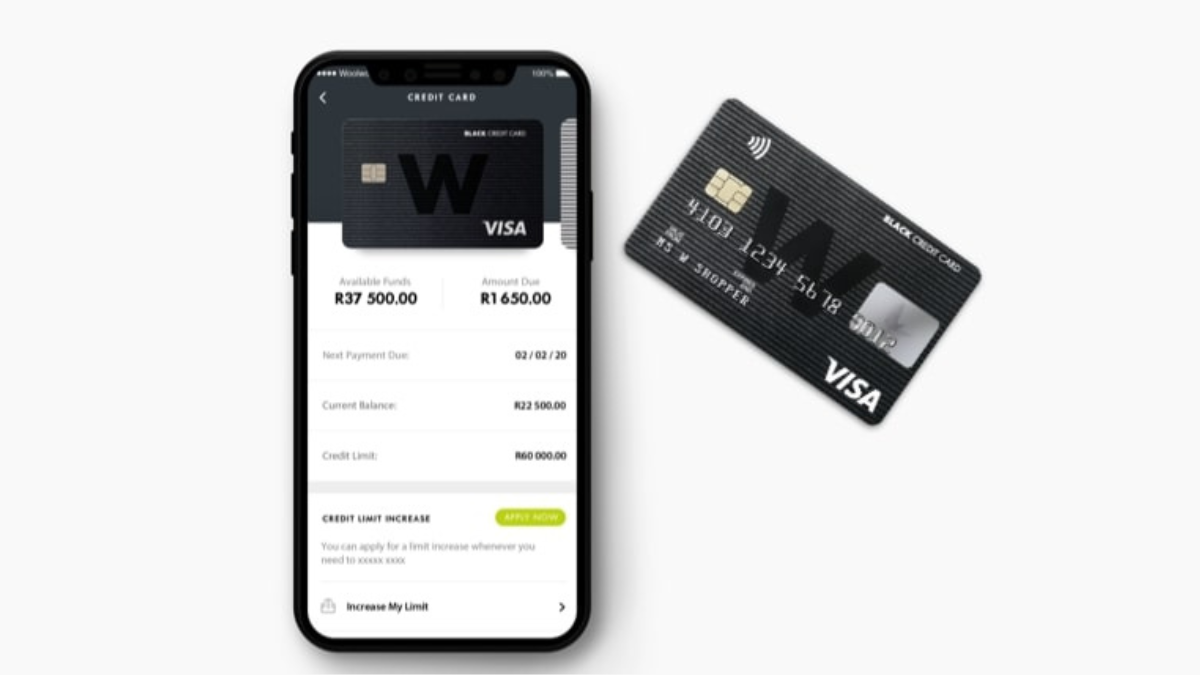

Earn 3% back: Apply for Woolworths Black Credit Card

Want to enjoy exclusive perks and rewards? Learn how to apply for the Woolworths Black Credit Card and elevate your shopping experience.

Keep Reading