Credit Cards

First Latitude Platinum Mastercard® Secured Credit Card review

The Platinum Mastercard® Secured Credit Card from Latitude is a smart choice for anyone looking to rebuild their credit history! Read on!

Advertisement

Build credit easily!

If you’re looking for a secured card to help establish your credit, look at our First Latitude Platinum Mastercard® Secured Credit Card review.

Apply for First Latitude Platinum Secured

Apply for the First Latitude Platinum Mastercard® Secured Credit Card and earn rewards on every purchase – quick and simple process!

With a low annual fee and no balance transfer or cash advance fees, this card is a great option for those looking to improve their financial situation.

| Credit Score | No credit history is required for this card; |

| Annual Fee | There is a one-time payment of $19.95 In your first year, you will be charged $25.00 After that, there will be a yearly charge of $35.00; |

| Purchase APR | 24.49%; |

| Cash Advance APR | 29.49%; |

| Welcome Bonus | No welcome bonus; |

| Rewards | On purchases made with your First Progress Secured credit card, earn 1% Cash Back Rewards. |

First Latitude Platinum Mastercard® Secured Credit Card overview

If you’re looking for a secured card to help rebuild your credit history, then the First Latitude Platinum Mastercard® could be worth considering.

As a secured credit card, you’ll need to make a security deposit, but the good news is that this deposit will also serve as your credit limit.

Thus, this card reports to all three major credit bureaus, which is great news if you want to establish or improve your credit score.

Besides, on purchases made with your First Progress Secured credit card, you will earn 1% Cash Back Rewards.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

First Latitude Platinum Mastercard® Secured Credit Card main features

Indeed, this card offers several features to help you stay on track with your credit goals.

Still, there are some downsides worth considering before applying.

Further, check the benefits and disadvantages of this card below.

Pros

- 1% Cash Back Rewards on payments;

- Indeed, you can choose your fully-refundable credit line – $100 to $2000 – based on your security deposit;

- Build your credit score. Reports to all 3 credit bureaus;

- No minimum credit score is required for approval;

- Cardholders who keep their balance low and pay their credit card bill on time every month typically do see an increase in their credit score.

Cons

- Membership fees;

- High regular APR;

- Foreign fee.

Minimum credit score to apply

Indeed, this card does not require a credit history to apply, as it intends to help you build one.

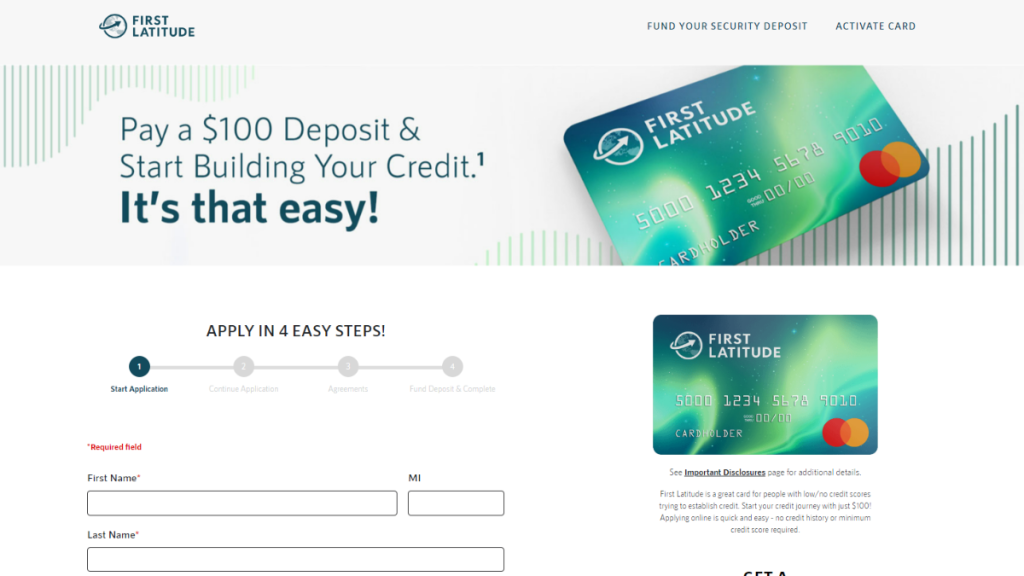

How to apply for the First Latitude Platinum Mastercard® Secured Credit Card?

Furthermore, if you’re in the market for a secured credit card, the First Latitude Platinum Mastercard® Secured Credit Card is an excellent option.

Applying for the card is simple; then make sure to check our next post to learn how to do it!

Apply for First Latitude Platinum Secured

Apply for the First Latitude Platinum Mastercard® Secured Credit Card and earn rewards on every purchase – quick and simple process!

About the author / Giovanna Klein

Trending Topics

What credit score do you need to lease a car?

Check if you have the credit score needed to lease a car. It can be better than buying one. Read on, and you’ll see how it works.

Keep Reading

The best pregnancy test apps: get the result you need fast

These pregnancy test apps will help you sleep in peace knowing if you’re probably expecting a baby or not: download one today!

Keep Reading

Up to 10% back: Petal® 1 “No Annual Fee” Visa® Credit Card review

Have you had enough of credit card annual fees? The Petal® 1 "No Annual Fee" Visa® Credit Card is discussed here in our review.

Keep ReadingYou may also like

Money Management: Your Path to Financial Success!

Take charge of your finances with effective money management techniques. Achieve financial freedom and secure your future with confidence!

Keep Reading

Limited Credit, Unlimited Potential: Find the Best Credit Cards

Learn how credit cards for limited credit can open doors to better financial opportunities and find the best one!

Keep Reading

What credit score do you start with?

If you’d like to determine what credit score you start your financial life with, you’re in the right place. Read on to find out.

Keep Reading