Reviews

FIT™ Platinum Mastercard® review

Achieve your financial goals and improve your score with the FIT™ Platinum Mastercard®. Check our full review to see how this card can help you!

Advertisement

Get an unsecured $400 credit line and double it in just six months!

Are you looking to improve your credit score and increase your purchasing power? If so, this FIT™ Platinum Mastercard® review may have the answer to your needs.

FIT™ Platinum Mastercard®: how to apply

See how easy it is to apply for the FIT™ Platinum Mastercard® and get an unsecured credit line with Mastercard prestige!

A credit card willing to give you a $400 credit limit even if you have poor credit is worth considering. Read on to make your conclusions well-informed.

| Credit Score | Poor/fair. |

| Annual Fee | $99 annual fee. You’ll also have to pay $6,25 monthly for maintenance from the second year ahead. |

| Purchase APR | 29.99% variable. |

| Cash Advance APR | 29.99% variable. |

| Welcome Bonus | The FIT™ Platinum Mastercard® does not offer a welcome bonus. |

| Rewards | Unfortunately, you’ll find no rewards program in this card features. |

FIT™ Platinum Mastercard® overview

The FIT™ Platinum Mastercard® is a card designed to help people with bad scores to improve their rating.

This card is easy to apply and you can do so online. Continental Finance, the issuer, even allows pre-qualification so you can check your approval odds.

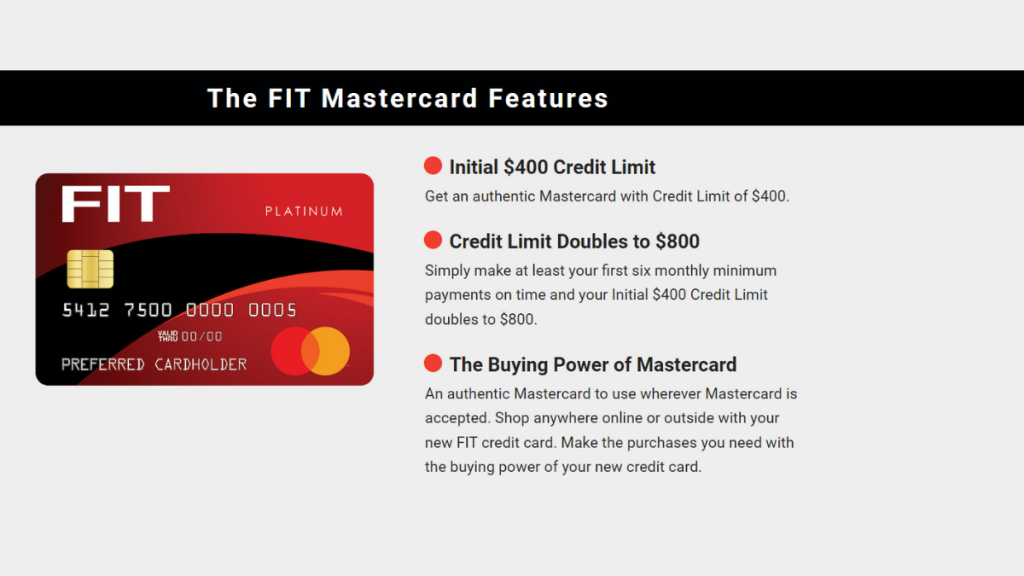

The FIT™ Platinum Mastercard® offers an initial credit limit up to $400, which you can double in just 6 months. All you need to do is pay your balance in time every month.

However, this might not be the best card for you if you’re planning to carry a balance. With a 29.99% variable APR, you’ll accrue more debt and may damage your score even further.

But if you pay your balance in full every month, the FIT™ Platinum Mastercard® is a great tool to help you improve your score within a few months.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

FIT™ Platinum Mastercard® main features

If you’re looking for an easy-to-get credit building card, the FIT is a solid choice. But as with any financial product, it comes with pros and cons.

Check the advantages and potential drawbacks next in our FIT™ Platinum Mastercard® review.

Pros

- $400 credit limit doubles to $800! (Simply make your first 6 monthly minimum payments on time).

- All credit types welcome to apply.

- Monthly reporting to the three major credit bureaus.

- Initial Credit Limit of $400.00 (Subject to available credit).

- Fast and easy application process; results in seconds.

- Use your card at locations everywhere Mastercard® is accepted.

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements).

- Checking Account Required.

Cons

- Too many fees! You’ll have to pay $188 in fees to start using your card in the first month;

- Be careful not to carry a balance over the months, or you’ll face the consequences of a high APR rate;

- The FIT Mastercard® Credit Card offers no rewards.

Minimum credit score to apply

As a perfect credit-building card, the FIT™ Platinum Mastercard® doesn’t care about your credit score. You can apply with a poor, fair, or good credit score.

How to apply for the FIT™ Platinum Mastercard®?

Applying for the FIT™ Platinum Mastercard® is a breeze. The online application process will take you only a few minutes.

The following link will take you to our FIT™ Platinum application walkthrough. So if you think this credit card is right for you, read on!

FIT™ Platinum Mastercard®: how to apply

See how easy it is to apply for the FIT™ Platinum Mastercard® and get an unsecured credit line with Mastercard prestige!

About the author / Julia Bermudez

Trending Topics

How to apply for a job at Panda Express: $40k a year + benefits!

Ready to make a delicious career move? Apply for a job at Panda Express and seize the opportunity to join their passionate team.

Keep Reading

Tasty and Time-Saving: The Best Air Fryer Recipes!

Cooking doesn’t have to be complicated! Check these Air Fryer recipes and enjoy crispy and oil-free meals!

Keep Reading

$0 annual fee: Apply for Capital One® Walmart Rewards® Card

Love shopping at Walmart? Learn now how to apply for the Capital One® Walmart Rewards® Card - $0 annual fee and reward program!

Keep ReadingYou may also like

Nail Technician Course by Nails Pro Academy review

Get an insider's review of the Nails Pro Academy Nail Technician Course. Enjoy an affordable course and start your own business!

Keep Reading

Empower Your Finances: Choosing Credit Cards for Good Credit

Unlock the full potential of your good credit score by choosing the perfect credit cards for good credit. Read on!

Keep Reading

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard®

Learn more about the Citi® / AAdvantage® Executive World Elite Mastercard® in this review! Earns 1 mile per dollar spent and more! Read on!

Keep Reading