Credit Cards

Fluid Credit Card review: No annual fee!

Exploring the Fluid Credit Card: From its enticing balance transfer perks to potential drawbacks like variable APR rates, our review offers insights for informed decision-making!

Advertisement

Get great perks: Fluid Credit Card review!

Embarking on a quest to find the ideal credit card often involves navigating through a sea of options. So, you can read our blog post with a Fluid Credit Card review!

Apply for the Fluid Credit Card

Learn how to apply for the Fluid Credit Card: 0% interest on balance transfer for 9 months! Keep reading and learn more!

In today’s financial landscape, the Fluid Credit Card emerges as a potential contender, promising a blend of perks and considerations.

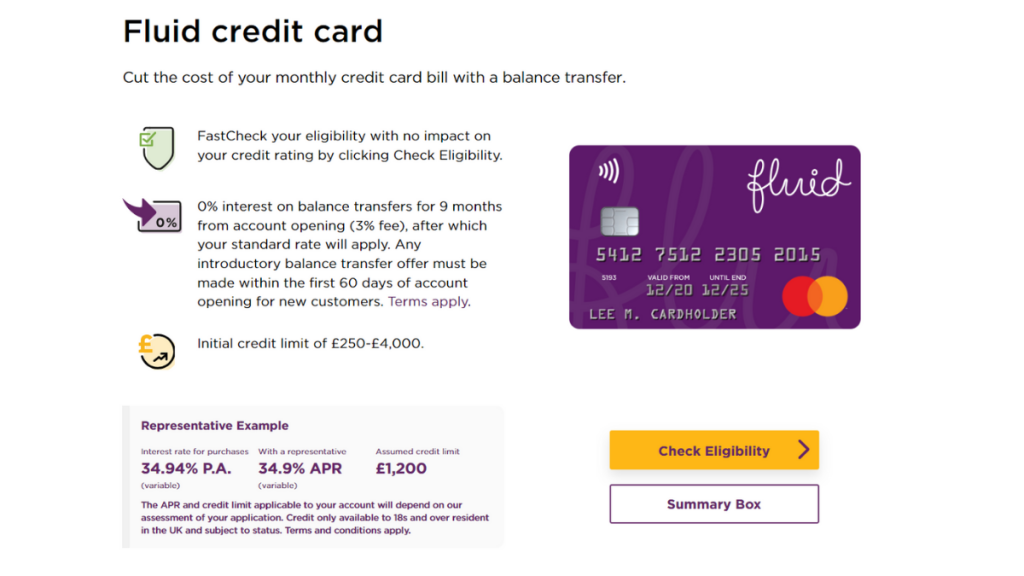

| Annual Fee | There is no annual fee; |

| Credit Limit | Initial credit limit of £250-£4,000; |

| Representative APR | 34.90% variable APR; |

| Purchase Rate | Representative 34.94% variable purchase rate; |

| Welcome Bonus* | You’ll get 0% interest on balance transfers for your first 9 months using the card (with a 3% fee); *Terms apply; |

| Rewards | No rewards program. |

Fluid Credit Card overview

The Fluid Credit Card presents a versatile financial tool catering to various financial needs.

Also, it boasts a compelling 0% interest offer on balance transfers within the initial 60 days.

Indeed, this card facilitates debt consolidation with a nine-month interest-free window.

Furthermore, you can enjoy a credit limit ranging from £250 to £4,000.

You will be redirected to another website

Fluid Credit Card main features

The Fluid Credit Card offers incredible features to its users. Therefore, you can read below this card’s main pros and cons!

Pros

This card can have incredible advantages for its cardholders. Therefore, read below the main pros of the Fluid Credit Card!

Credit limit transfer

One of the best things about the Fluid Credit Card is its flexibility—you may transfer up to 90% of your credit limit.

Reasonable credit limit

Fluid is aware that each person’s financial situation is different.

As a result, the available credit limits, which vary from £250 to £4,000, cater to a wide spectrum of clients.

Also, with this customized method, people may obtain credit that meets their needs, whether they need a bigger limit for large purchases or a lower limit for particular bills.

0% interest as a welcome bonus

The Fluid Credit Card offers an alluring perk in the form of 0% interest on debt transfers done during the first 60 days for a nine-month period.

Also, customers may transfer their existing debts to the Fluid card during this limited-time offer.

Get free text alerts

Users receive reminders about payments, transactions, and impending account due dates.

Also, by rapidly alerting clients to unusual activity, this proactive strategy improves security while helping customers monitor their spending and financial management.

Flexible payments

Fluid understands the value of flexibility in good financial management.

Moreover, cardholders with varied payment dates might enhance their cash flow management by strategically allocating their repayments.

Cons

Although this card offers incredible features to its users, it also has some downsides. Therefore, you can read below for the main ones.

Relatively high rates

The Fluid Credit Card’s variable annual percentage rate (APR), which may reach 49.9%, is one of its main disadvantages.

You can get a low limit

Although some applicants may only be granted a credit limit of £250 based on their financial circumstances, Fluid offers up to £4,000 credit limits.

Minimum credit score to apply

You’ll need a good credit score to have a higher chance of applying for this credit card.

How to apply for the Fluid Credit Card?

You can easily apply for this card online through the official website.

Therefore, you can read our blog post below to learn more and learn how to apply!

Apply for the Fluid Credit Card

Learn how to apply for the Fluid Credit Card: 0% interest on balance transfer for 9 months! Keep reading and learn more!

About the author / Victoria Lourenco

Trending Topics

Zable Credit Card review: No annual fee!

Delve into our insightful Zable Credit Card review - no hidden fees and amazing credit-building features! Keep reading and learn more!

Keep Reading

Capital One Classic Credit Card review: Up to £1500 credit limit

This is the Capital One Classic Credit Card review you were looking for. Learn everything about this card! Pay no annual fee! Read on!

Keep Reading

Why Has My Credit Score Gone Down? 10 Possible Reasons

Why has my credit score gone down? Find the answer to this question and learn more about your credit score in your blog post. Read on!

Keep ReadingYou may also like

HSBC Classic Credit Card: how to apply

Looking for a way to apply for the HSBC Classic Credit Card? You’ve just found the perfect application guide. Up to £1,000 credit limit!

Keep Reading

What is a good credit score in the UK?

You need to know what is a good credit score in the UK to make better choices in your finances. This post has everything you need to know!

Keep Reading

Marbles Credit Card review: No annual fee!

Unveiling the Marbles Credit Card, a review of its features, benefits, and limitations. Find out if the card fits your finances!

Keep Reading