Credit Cards

FNB Petro Card review: get flexible rates!

This credit card offers free AA Roadside Assistance worth R100 per month. Check its features in this review and learn more!

Advertisement

Enjoy emergency roadside assistance

If you’re looking for a credit card that allows you to pay conveniently and offers flexible interest rates, check this FNB Petro Card Review.

FNB Petro Card: how to apply

Learn how to apply for FNB Petro Card: made to simplify your vehicle expenses and offer you AA emergency roadside assistance.

This basic but nice credit card can be used for your gasoline, toll payments, and vehicle expenses! So check this card’s features below!

| Min. Monthly Income | R84.000 per year; |

| Initiation Fee | Up to a maximum of R175; |

| Monthly Fee | R40; |

| Interest Rate | Personalized Interest Rates; |

| Rewards | N/A. |

FNB Petro Card overview

The FNB Petro Card offers several advantages to those who want to secure their vehicle.

Thus, it offers AA roadside assistance and easy fuel expenses management. It comes with an R17 credit facility service fee.

Meanwhile, linking your credit card with an account will cost you an additional R40 monthly account fee.

Furthermore, you can use this card to purchase petrol at any fuel station in SA and pay vehicle maintenance and tolls.

In addition, you can qualify for personalized rates and enjoy contactless payments!

You will be redirected to another website

FNB Petro Card main features

Although you cannot use this card for any transactions other than vehicle-related expenses, it has some benefits.

Then use this FNB Petro Card Review to check its pros and cons:

Pros

- AA Roadside Assistance, which includes roadside repair, tow-in service, and other benefits;

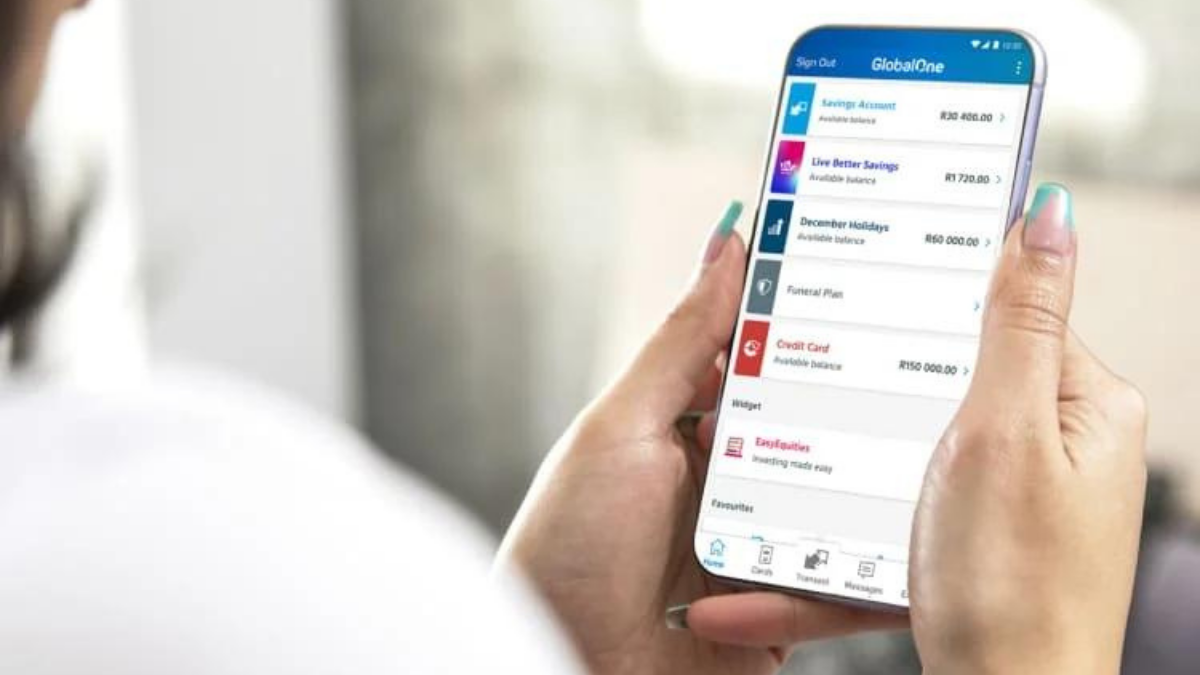

- Subscription to cellphone banking, online banking, and the FNB Banking App at no charge;

- Auto payment solution offers the convenience of paying your account on time;

- Secure payments with chip and pin;

- Subscription to inContact: you get an SMS every time more than R100 goes in or out of your account;

- Balance inquiries on the cellphone, online or telephone banking, and the FNB app.

Cons

- This card functions as a simple credit card. So you don’t need a Petro Card if you already have a credit card;

- It applies transaction fees. Basically, this means the more you transact, the more money you will be charged in fees.

Requirements needed to apply

Since FNB requires a minimum income of R84,000.00 per year, you must provide recent 3 months of bank statements.

Also, you’ll need to be 18 or older to qualify for the FNB Petro Card.

How to apply for the FNB Petro Card?

This card can be a good option if you’re looking for an affordable way of getting free AA roadside assistance worth R100 per month.

If you would like to know more about how to apply for this card, read our next post.

FNB Petro Card: how to apply

Learn how to apply for FNB Petro Card: made to simplify your vehicle expenses and offer you AA emergency roadside assistance.

About the author / Giovanna Klein

Trending Topics

How to apply for a job at Tongaat Hulett

If you want to apply for a job at Tongaat Hulett successfully, you've come to the right place! Check this article if you want a full guide!

Keep Reading

Apply for ABSA Personal Loans with Confidence

Need funds for your dreams? Apply for ABSA personal loans and make them a reality with quick access to the funds you require.

Keep Reading

Simplify Your Finances: Standard Bank Blue Card Review

Uncover the exclusive benefits, rewards, and features of the Standard Bank Blue Card in our in-depth review and make your decision about it.

Keep ReadingYou may also like

How to reverse money using Capitec App: easy step-by-step

If you've ever accidentally sent a payment with the Capitec App you didn't mean to, learn how to reverse money using Capitec App!

Keep Reading

MG Silver Prepaid Debit Card review

Read this MG Silver Prepaid Debit Card review to see the benefits of using a prepaid card. Enjoy discounts at MG partners!

Keep Reading

Find a job at Shoprite: Flexible schedules and PTO!

Getting a job at Shoprite can boost many people's careers. Learn more about the company in this article! Enjoy a vacation and other benefits.

Keep Reading