Credit Cards

BOOST Platinum Card review: $750 limit plus benefits

Tired of being denied credit? In this BOOST Platinum Card review, we'll show you how to regain your purchasing power regardless of your credit score!

Advertisement

BOOST Platinum Card: All types of credit scores are accepted!

In this review, we bring the BOOST Platinum Card. It is an excellent option for those who want to take their shopping experience to the next level.

BOOST Platinum Card: how to apply

If you'd like to know how to apply for BOOST Platinum Card, check out this complete article! Pay 0% APR and enjoy exclusive benefits.

This card provides members value and flexibility that no other credit card can match. Learn more about it below!

| Credit Score | No credit score is required; |

| Annual Fee | US$ 177.24 ($14.77 per month); |

| Purchase APR | 0%; |

| Cash Advance APR | N/A; |

| Welcome Bonus | No Welcome bonus |

| Rewards | N/A. |

BOOST Platinum Card overview

This is a store card issued by Horizon Card Services. This card only works at the Horizon Outlet, an online shopping portal.

Furthermore, it offers a $750 merchandise credit line at the Horizon Outlet shopping website.

It does not require any credit check or an employment check. Meanwhile, it helps you improve your credit score!

According to the Federal Reserve Board, its purchase APR is potentially lower than average.

Besides, it offers a Customer advocacy service, privileges in Credit Hawk, My Universal RX, and other membership benefits.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

BOOST Platinum Card main features

After all, this card is a great choice for budget-conscious consumers.

While looking for building credit, consider the BOOST Platinum Card hot takes and downsides.

Pros

- The BOOST Platinum Card has a Purchase APR lower than average;

- If you have bad or poor credit, don’t worry: Horizon asks for no employment or credit check;

- Horizon offers a 7-day trial period. New cardholders can use their new card to make purchases at horizon outlet during this period, and – if they don’t like the experience – they can cancel it and only pay the value of their purchases;

- Lastly, Applying for a BOOST Platinum Card is simple, fast, and online.

Cons

- As a merchandise credit card, it can only be used at the Horizon Outlet

- It does charge an annual fee of $177.24;

- It does not offer rewards or cash back, as it does not include many credit card benefits.

Minimum credit score to apply

The BOOST Platinum Card offers, besides no interest on purchases and a credit limit of $750, no credit check.

Basically, even if your credit is poor or even if you have no credit, Horizon offers you instant access to the card and its benefits.

How to apply for the BOOST Platinum Card?

This card may be a good option if you’re looking to rebuild your score and are tired of being denied access to credit.

With this card, you’ll have access to all the exclusive membership benefits and a credit limit for exclusive use with Horizon Outlet.

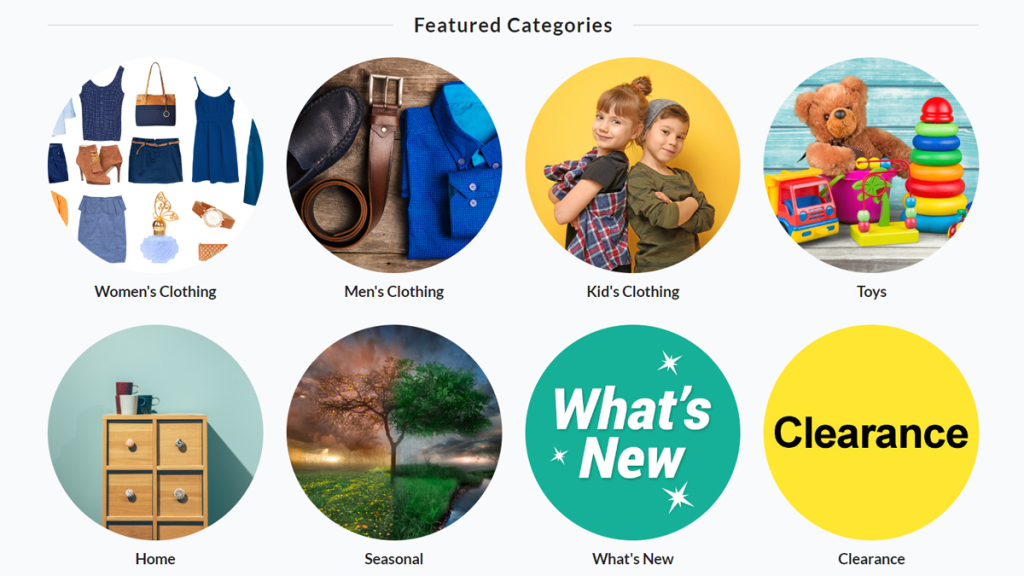

Since the Horizon Outlet is an online store with many products, you may be interested in applying for the BOOST Platinum Card.

So check on our next post to know how to do it.

BOOST Platinum Card: how to apply

If you'd like to know how to apply for BOOST Platinum Card, check out this complete article! Pay 0% APR and enjoy exclusive benefits.

About the author / Giovanna Klein

Trending Topics

PenFed Platinum Rewards Visa Signature® Card Review: Earn rewards

Say hello to the future of credit card rewards. Our review of the PenFed Platinum Rewards Visa Signature® Card reveals how it stands out.

Keep Reading

Hair Stylist Training by Online Makeup Academy review

Check out this Hair Stylist Training by Online Makeup Academy review and learn all you need about the course before enrolling!

Keep Reading

15 Months of 0% APR: Apply for the Citi Custom Cash℠ Card

Apply now for Citi Custom Cash℠ Card and earn up to 5% cash back on purchases! Pay no annual fee! Read on and learn more!

Keep ReadingYou may also like

First Digital Mastercard® review: Nationwide acceptance!

Check this First Digital Mastercard® review and how the stands out from the competition! Qualify with bad credit and build it up!

Keep Reading

Limited Credit, Unlimited Potential: Find the Best Credit Cards

Learn how credit cards for limited credit can open doors to better financial opportunities and find the best one!

Keep Reading

Apply for the Citi® / AAdvantage® Executive World Elite Mastercard®

Learn more about the Citi® / AAdvantage® Executive World Elite Mastercard® in this review! Earns 1 mile per dollar spent and more! Read on!

Keep Reading