Credit Cards

No Annual Fee: PenFed Gold Visa® Card Review

Is the PenFed Gold Visa® Card right for you? Low APRs and no annual fees - find out more about the PenFed Gold Visa® Card in our review.

Advertisement

The Golden Key to Smart Spending: PenFed Gold Visa® Card

Are you tired of high-interest rates eating into your savings? Look no further than this PenFed Gold Visa® Card review!

Apply for the PenFed Gold Visa® Card

Ready to embrace low-interest credit? Learn how to apply for the PenFed Gold Visa® Card in our step-by-step guide.

In this review, we’ll dive deep into the perks and possibilities that come with this card. Unlock the secrets to financial freedom this card holds.

| Credit Score | Good to excellent; |

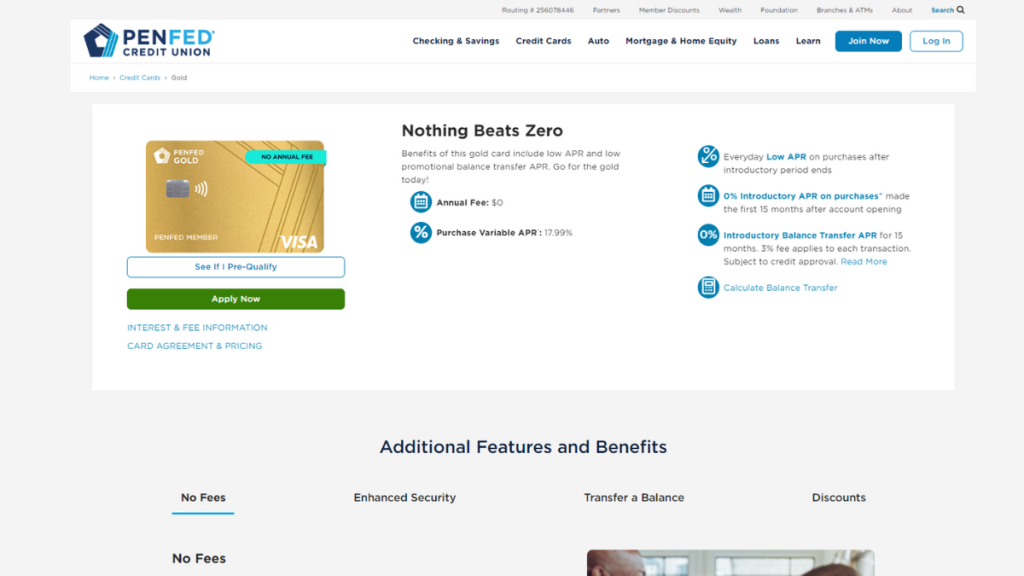

| Annual Fee | $0; |

| Purchase APR | 0% intro APR for 15 months, 17.99% thereafter; |

| Cash Advance APR | 17.99%; |

| Welcome Bonus | None; |

| Rewards | No rewards program. |

PenFed Gold Visa® Card overview

The PenFed Gold Visa® Card stands out for its attractive features. This includes low Annual Percentage Rates (APRs) and no annual fees.

Indeed, this credit card is an excellent choice for individuals who are looking for a straightforward and cost-effective option to manage their finances.

Thus, with the PenFed Gold Visa® Card, you’ll have access to a credit line tailored to your needs. You won’t have to worry about excessive fees.

Whether you want to finance a large purchase or consolidate existing high-interest card debt, this card can be a valuable tool in your financial arsenal.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

PenFed Gold Visa® Card main features

If you’re in search of a credit card that offers simplicity, low interest rates, and no annual fees, this PenFed Gold Visa® Card review might catch your eye.

Before you make your decision, let’s explore the key pros and cons of this financial gem to help you determine if it aligns with your financial needs.

Pros

- Low APRs – Save on Interest: This feature can be a game-changer for cardholders who tend to carry a balance on their credit cards.

- No Annual Fees – Keep Your Wallet Happy: The PenFed Gold Visa® Card doesn’t burden you with this additional cost.

- Flexible Credit Lines – Tailored to You: Flexible credit lines based on your creditworthiness.

- PenFed’s Exceptional Customer Service: Whether you have questions about your account or need assistance with a transaction, PenFed’s dedicated support team is ready to help you navigate any concerns that may arise.

Cons

- Membership Required – Exclusive Access: One of the limitations of the PenFed Gold Visa® Card is that it requires membership with PenFed Credit Union to be eligible for application.

- Limited Rewards Program – Fewer Perks: While it excels in low interest and no annual fees, it doesn’t offer a robust rewards program compared to some other credit cards on the market.

Minimum credit score to apply

When applying for the PenFed Gold Visa® Card, it’s essential to have a solid credit history.

While specific credit score requirements vary, a fair credit score or higher is typically recommended for approval.

The credit union will evaluate your creditworthiness and financial standing before extending the credit line.

How to apply for the PenFed Gold Visa® Card?

After learning about the card features with our PenFed Gold Visa® Card review, it’s time to learn how to apply for it and enjoy the benefits.

The following link will take you straight to our application guide. So don’t miss this golden ticket to get better financial management.

Apply for the PenFed Gold Visa® Card

Ready to embrace low-interest credit? Learn how to apply for the PenFed Gold Visa® Card in our step-by-step guide.

About the author / Julia Bermudez

Trending Topics

First Progress Platinum Elite Mastercard® Secured Credit Card review

Read our First Progress Platinum Elite Mastercard® Secured Credit Card review and learn how to get better credit in no time!

Keep Reading

CNC Machine Operator Training Program by Amatrol review

This CNC Machine Operator Training Program by Amatrol review will cover any doubts about this course. Check it out!

Keep Reading

Capital One Quicksilver Secured Cash Rewards Credit Card Review

If you are looking for a secured credit card that offers rewards, check our Capital One Quicksilver Secured Cash Rewards Credit Card review!

Keep ReadingYou may also like

Navigating Fair Credit: Top Credit Cards for Smart Consumers

Take charge of your financial future with these credit cards catered to fair credit holders, making credit building a seamless journey.

Keep Reading

Hairdressing Stylist Course by ICI: enroll today

If you want to enroll in the Hairdressing Stylist Course by ICI, check this article out! Find a comprehensive curriculum and amazing perks!

Keep Reading

Bankruptcy Alternatives: What are they?

Discover powerful bankruptcy alternatives to regain financial stability. Explore them well and achieve financial freedom!

Keep Reading