Credit Cards

PREMIER Bankcard® Mastercard® review: Build credit fast

Increase your purchasing power and build up a healthy credit score with the PREMIER Bankcard® Mastercard®! Check our full review to learn more.

Advertisement

Get approved in minutes and access more benefits with PREMIER Bankcard® Mastercard®

Are you struggling to find a credit card with your current low score? Then read our PREMIER Bankcard® Mastercard® review for an easy and convenient solution.

PREMIER Bankcard® Mastercard®: how to apply

Learn how to apply and build up your credit score fast with the PREMIER Bankcard® Mastercard®!

After all, most people are subject to financial difficulties for many reasons. But you deserve the chance to write a new credit history! So read on!

| Credit Score | At least over 500; |

| Annual Fee | It varies from $50 to $125 depending on your creditworthiness; |

| Purchase APR | 36%; |

| Cash Advance APR | 36%; |

| Welcome Bonus | Currently no welcome bonus; |

| Rewards | PREMIER has no rewards programs for credit cards. |

PREMIER Bankcard® Mastercard® overview

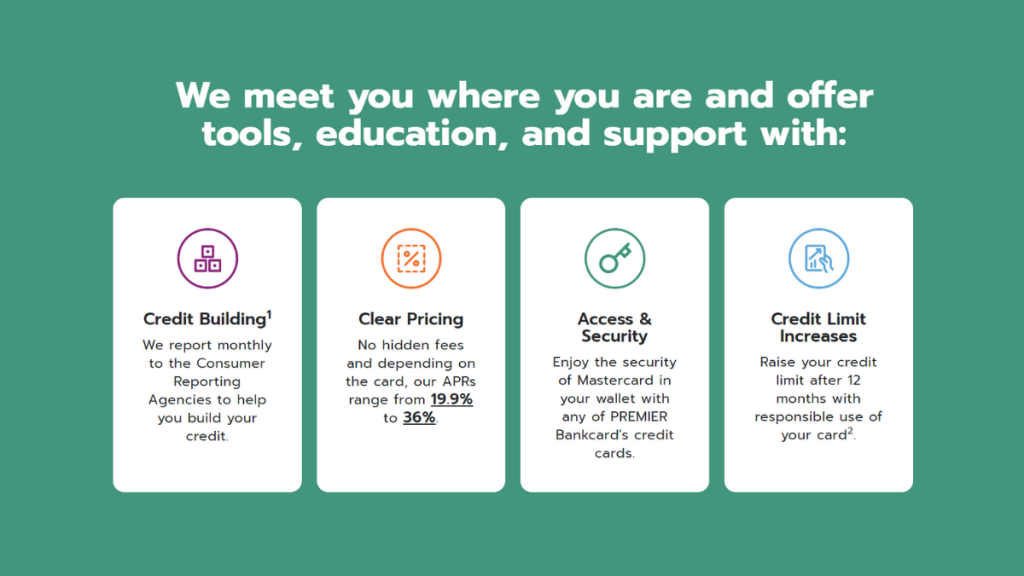

The PREMIER Bankcard® Mastercard® is a great way for those looking to rebuild their credit score.

That said, this is not a premium credit card, nor does it offers any kind of reward. The major benefit you’ll have is the credit line itself.

The interest rate is quite salty, but you can use it strategically by avoinding carrying a balance from month to month.

Your credit limit can range between $200 and $700. It may seem low, but it’s enough to make a great credit report for major credit bureaus.

While this card works great as a credit builder, it carries quite a lot of fees. One-time program fees range from $55 to $95, and monthly fees can cost you up to $10.40 per statement period.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

PREMIER Bankcard® Mastercard® main features

While the PREMIER Bankcard® Mastercard® does not offer premium benefits, it could be a great stepping stone in your credit building ladder.

So let’s take a closer look at the pros and cons of this PREMIER Bankcard® Mastercard® in this full comprehensive review.

Pros

- Suitable for people with fair and poor credit scores;

- No need to make a security deposit;

- Enjoy the safety of a Mastercard®;

- Possibility to increase your limit if you make on-time payments for 12 months.

Cons

- The annual fee can be high with this PREMIER Bankcard® Mastercard®. And the higher your credit limit, the higher will be the annual fee;

- To activate the card, you must pay a $95 program fee;

- If those fees are not enough, you must also pay a monthly fee ranging from $0 (waived during the first year) to $10.40;

- You’ll get no rewards of any kind.

Minimum credit score to apply

That’s the good part about the PREMIER Bankcard® Mastercard®: you can apply with a credit score as low as 500.

How to apply for the PREMIER Bankcard® Mastercard®?

If you need a credit card to build credit and are unwilling to pay a security deposit, this card can be an option.

Further, we’ll tell you how to apply for it – you’ll see it is as easy as getting approved.

PREMIER Bankcard® Mastercard®: how to apply

Learn how to apply and build up your credit score fast with the PREMIER Bankcard® Mastercard®!

About the author / Julia Bermudez

Trending Topics

Nurse Career: Average Salary and Skills Necessary

Curious about nursing salaries and a Nurse Career? Our post breaks down the salary range for nurses, helping you navigate the complexities!

Keep Reading

From Ordinary to Extraordinary: Turn Photos into Unique Caricatures

Discover the best apps for turning your photos into hilarious caricatures or artworks! Customization options, filters, and effects galore.

Keep Reading

Destiny Mastercard® Card: how to apply

Thanks to the internet, now you can apply for the Destiny Mastercard® Card from the comfort of your home. Qualify with poor credit! Read on!

Keep ReadingYou may also like

Apply for Capital One QuicksilverOne Cash Rewards: quick and easy

Getting a credit card has become easier. Read on and see how to apply for the QuicksilverOne Cash Rewards by moving your fingers.

Keep Reading

How to apply for the OpenSky® Secured Visa®

Learn how to apply for the OpenSky® Secured Visa® Credit Card and get one of the best tools available to help you improve your credit score!

Keep Reading

Unlock Savings: A Step-by-Step Guide to download Super+!

Ready to make your online shopping more rewarding? Read our blog post for a step-by-step guide to download Super+!

Keep Reading