Credit Cards

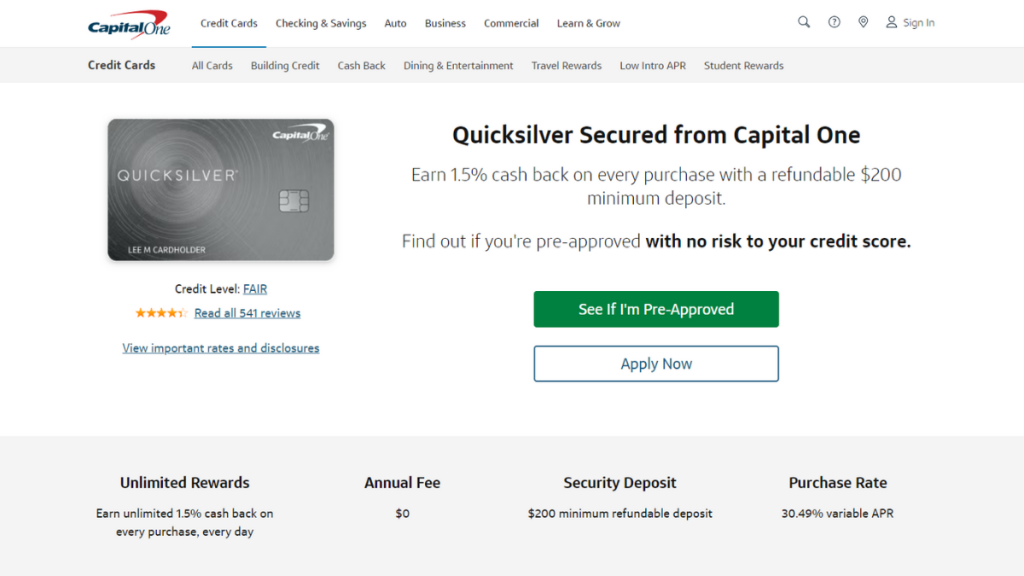

Capital One Quicksilver Secured Cash Rewards Credit Card Review

Earn 1.5% unlimited cash back on all your purchases - meet the Capital One Quicksilver Secured Cash Rewards Credit Card today!

Advertisement

Earn rewards on every purchase with a low refundable deposit!

Earn unlimited cash back with no annual fee. So learn more about this card with this Capital One Quicksilver Secured Cash Rewards Credit Card Review.

Apply for Capital One Quicksilver Secured

Learn how to apply for Capital One Quicksilver Secured Cash Rewards Credit Card now! $0 annual fee and 1.5% cash back on purchases! Read on!

If you’re looking for a secured card to help you rebuild your credit while earning and protecting your purchases, you have come to the right place.

| Credit Score | No credit check is required; |

| Annual Fee | Capital One charges no annual fee for this card; |

| Purchase APR | 30.74% variable APR; |

| Cash Advance APR | 30.74% variable APR; |

| Welcome Bonus | None; |

| Rewards | Earn 1.5% unlimited cash back on all your purchases. |

Capital One Quicksilver Secured Credit Card Overview

We will disclose its benefits and features in this Capital One Quicksilver Secured Credit Card review.

As a secured credit card, this card requires a minimum refundable deposit of $200, which is considered low compared to its rivals.

Indeed, Capital One charges no annual fee and promises to help you manage your financial life in an easier way.

Thus, you can build up credit if you have had any shortfall, as they accept those with fair credit scores.

Also, Visa’s Zero Fraud Liability Policy will protect your spending, and you can check your eligibility without hurting your credit score.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Capital One Quicksilver Secured Credit Card’s main features

The Capital One Quicksilver secured credit card is one of the market’s most affordable and secure credit cards today.

However, it also poses certain drawbacks. Let’s compare its pros and cons to help you decide whether this is the right credit card for you or not.

Pros

- Get approved even if you have poor credit;

- Sends reports to the three main credit reporting agencies;

- Earn cash back;

- There is no annual fee.

Cons

- There is no signup bonus available;

- There are no extra tiers;

- High APR.

Minimum credit score to apply

The card is a wonderful alternative for anyone attempting to develop or rebuild their credit because of the detailed credit reporting.

Capital One considers you even if you have a fair credit score.

How to apply for the Capital One Quicksilver Secured Credit Card Card?

If you’re interested in applying for the Capital One Quicksilver Secured Credit Card, then check out our next post.

Apply for Capital One Quicksilver Secured

Learn how to apply for Capital One Quicksilver Secured Cash Rewards Credit Card now! $0 annual fee and 1.5% cash back on purchases! Read on!

About the author / Giovanna Klein

Trending Topics

Apply for U.S. Bank Altitude® Go Visa Signature® Card easily

Learn now how to apply for the U.S. Bank Altitude® Go Visa Signature® Card and earn points on daily purchases - $0 annual fee! Read on!

Keep Reading

Affordable rates for you: Apply for a Navy Federal Personal Loan!

Take the next step towards financial empowerment as a veteran or armed forces member. Learn how to apply for a Navy Federal Personal Loan!

Keep Reading

15 Months of 0% APR: Apply for the Citi Custom Cash℠ Card

Apply now for Citi Custom Cash℠ Card and earn up to 5% cash back on purchases! Pay no annual fee! Read on and learn more!

Keep ReadingYou may also like

Apply for the FIT™ Platinum Mastercard®

Learn how to apply for the FIT™ Platinum Mastercard® with our easy walkthrough and get an unsecured credit line to improve your score!

Keep Reading

How to apply for the First Progress Platinum Select Mastercard® Secured Credit Card

Learn how to apply for the First Progress Platinum Select Mastercard® Secured Credit Card and build a strong credit score for yourself!

Keep Reading

How to apply for a job at Tidy: Get hourly pay

Learn how you can easily apply for a job opening at Tidy and jumpstart a rewarding career with flexible hours and great pay!

Keep Reading