Credit Cards

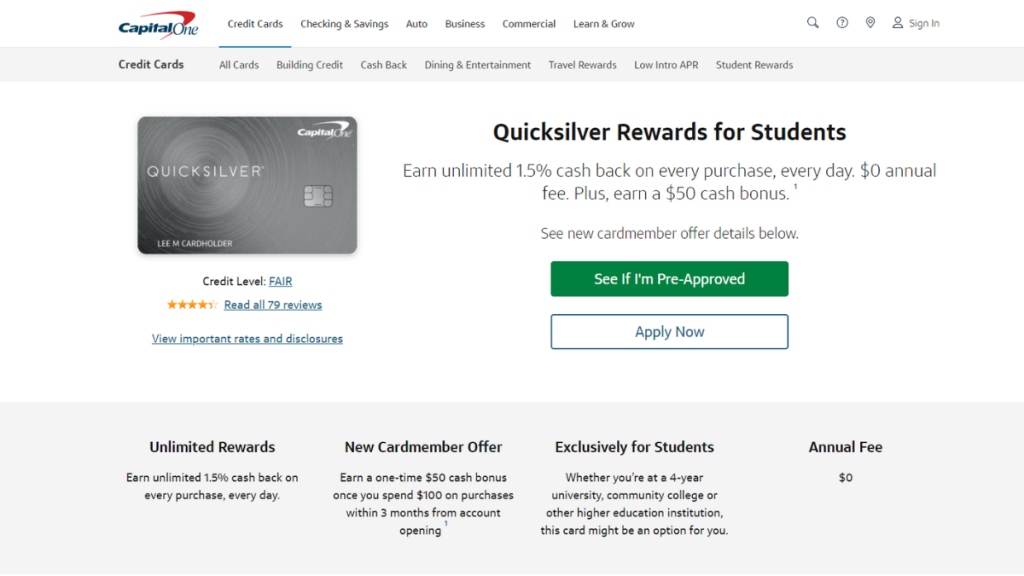

$0 annual fee: Quicksilver Student Cash Rewards review

The Quicksilver Student Cash Rewards has got your back when it comes to saving money! Earn 1.5% cash back on purchases and pay $0 annual fee! Read on!

Advertisement

Being a student has its struggles, but your credit card shouldn’t be one

You’re probably always on the lookout for ways to save. That’s something you can learn how to do in this Quicksilver Student Cash Rewards review!

Apply for the Quicksilver Student Cash Rewards

Apply for a Quicksilver Student Cash Rewards credit card to save money on every expense. We’ll tell you how!

One way to save money is getting a rewards card. It will help you earn cashback on purchases you’re already making. So read on and learn how!

| Credit Score | Fair credit; |

| Annual Fee | $0 annual fee; |

| Purchase APR | It will vary according to your credit history: 19.99%, 25.99% or 29.99%; |

| Cash Advance APR | 29.99% variable; |

| Welcome Bonus | $50 cash bonus as soon as you spend $100 using this credit card in the first 3 months, which is pretty easy to achieve; |

| Rewards | Unlimited cashback: 1.5% on every purchase! |

Quicksilver Student Cash Rewards overview

As a student, you need a credit card that fits your needs. The Quicksilver Student Cash Rewards card by Capital One does just that.

With a flat-rate cashback offer of 1.5%, you can earn unlimited rewards on every purchase.

Additionally, a welcome bonus of $50 cash for qualifying users after $100 of spending.

Also, it has no annual or foreign transaction fees – making it a great option for saving money!

However, there is a balance transfer fee of $0 at the Transfer APR, 3% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you.

So, with $0 liability on fraudulent charges and the option to use it abroad, the Quicksilver Student Cash Rewards card is the perfect choice.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Quicksilver Student Cash Rewards main features

Don’t underestimate the power of simple, straightforward rewards!

Even though there are student cards with higher cashback rates, they are not always the best.

In the following, we’ll make a clear list of pros and cons so that you can make the best out of this Quicksilver Student Cash Rewards review!

Pros

- The 1.5% reward rate for every purchase can get you a great amount of cash back, especially when it has no cap on how much you can earn;

- Generous welcome bonus and easy to get;

- The credit score requirement covers many people, and you have a high chance of getting approved. And if you’re unsure about it, you can pre-qualify before hitting your score with a hard check;

- Using a credit card can be safer than using cash or debit cards, as it comes with many security features, like zero fraud liability, account alerts, card lock, and many others.

Cons

- Even though this Capital One credit card does not require a perfect credit score, you may not be able to get it if your score is very poor or below 540;

- Other student credit cards might offer higher cashback rewards rates.

Minimum credit score to apply

You can apply for the Quicksilver Student Cash Rewards with fair credit.

This means you can not apply if you have no credit history at all, but you can do it with a little credit.

How to apply for the Quicksilver Student Cash Rewards?

If you’re tired of losing cashback opportunities with your everyday purchases, consider applying for the Quicksilver Student Cash Rewards!

In the next post, you can read all about the application process and demystify any fear you have of going through it.

Apply for the Quicksilver Student Cash Rewards

Apply for a Quicksilver Student Cash Rewards credit card to save money on every expense. We’ll tell you how!

About the author / Julia Bermudez

Trending Topics

Hairdressing Stylist Course by ICI review

Would you like to know more about the Hairdressing Stylist Course by ICI review? Check out this article and answer all your questions!

Keep Reading

Introduction to Technical Drawing by Alison: enroll today

If you want to enroll in the Introduction to Technical Drawing course by Alison, you'll do well to check this article! We'll teach you how!

Keep Reading

Upgrade Bitcoin Rewards Visa® review: Your ticket to the Cryptoland!

Are you a crypto investor? Don’t miss this Upgrade Bitcoin Rewards Visa® review because this card was tailored for you.

Keep ReadingYou may also like

Earn more: Apply for Petal® 1 “No Annual Fee” Visa® Credit Card

Learn now how to apply for the Petal® 1 “No Annual Fee” Visa® Credit Card and rebuild your credit score with no annual fee!

Keep Reading

PenFed Platinum Rewards Visa Signature® Card Review: Earn rewards

Say hello to the future of credit card rewards. Our review of the PenFed Platinum Rewards Visa Signature® Card reveals how it stands out.

Keep Reading

Find a job at The Cleaning Authority: Competitive pay and professional training

Unlock a world of possibilities with a job at The Cleaning Authority. Join a team that combines excellence and a passion for cleanliness!

Keep Reading