Credit Cards

Revvi Card Review: Earn 1% Cash Back While Building Credit

Are you suffering from a low score? We have a possible solution for you. Introducing the Revvi Card - a simple and fast way to build credit!

Advertisement

Enjoy free credit monitoring and more!

Having bad credit can make life more challenging than it needs to be. That’s where the Revvi Card review tells you how to get out of this situation!

Revvi Card: how to apply

Follow our friendly guide and learn how to apply for the Revvi Card today. Earn 1% cash back on purchases and build credit fast! Read on!

In this review, we’ll look at the features of this card, as well as any potential drawbacks, eligibility requirements, and how to apply. So keep reading!

| Credit Score | Fair Credit. |

| Annual Fee | $75.00 1st year, $48.00 after. |

| Purchase APR | 35.99%. |

| Cash Advance APR | 35.99%. |

| Welcome Bonus | N/A. |

| Rewards | 1% cash back on card payments. |

Revvi Card overview

Make smart financial moves and build your credit score with the Revvi Card! It’s an easy way to demonstrate responsible spending for major credit bureaus.

Also, you can earn 1% cash back on payments and start making the most of your spending.

In addition, you can count on a mobile app to monitor balances and view your credit score anytime at home.

You’ll also receive alerts when important information comes up – talk about convenience!

On top of this, they also have their own helpful Credit Education Center full of resources on how best to maintain excellent finances.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Revvi Card main features

Now that you have the big picture let’s focus on this detailed list of pros and cons to make the best of this Revvi Card review.

Pros

- Earn 1% cash back rewards^^ on payments made to your Revvi Credit Card.

- Perfect credit not required.

- $300 credit limit (subject to available credit).

- Checking account required.

- Opportunity to request credit limit increase after twelve months, fee applies.

- ^^See Revvi Rewards Programs Terms & Conditions for details.

- Monthly reports to all 3 major credit bureaus.

- Fast and easy application; response provided in seconds.

- Easy-to-use mobile app for management on the go!

- Reports monthly to all three major credit bureaus.

- Manageable monthly payments.

- Secure online application with fast response.

- Build your credit score with on-time payments and keeping your balance below the credit limit.

- Opportunity to request credit limit increase after twelve months, fee applies.

- *See rates, fees, costs & limitations, and rewards for complete offer and Revvi Rewards details.

Cons

- $95 one-time program fee, annual fee, $8.25 monthly after the first year – all non-refundable;

- No welcome bonus;

- The cash back rewards will be collected as points and can only be redeemed as a statement credit.

Minimum credit score to apply

The eligibility requirements standard is low, and you don’t need a stellar credit score to be approved.

How to apply for the Revvi Card?

Now that you know the pros and cons of this card, you can choose whether to apply for it or not.

If you’re willing to take the risk, learn how to apply for the Revvi card on the following link.

Revvi Card: how to apply

Follow our friendly guide and learn how to apply for the Revvi Card today. Earn 1% cash back on purchases and build credit fast! Read on!

About the author / Julia Bermudez

Trending Topics

The Weekend Woodworker Course review

This in-depth review will provide a comprehensive look at the Weekend Woodworker Course. Learn everything you need in 6 weekends! Read on!

Keep Reading

Turn Your Credit Around: Discover the Best Cards for Bad Credit

Get information on how to turn your financial life around - learn what are the best credit cards for bad credit.

Keep Reading

Is there any difference between Transunion and Equifax?

Confused about the differences between TransUnion and Equifax? Learn what makes them different and how they compare in this friendly guide!

Keep ReadingYou may also like

Citrus Loans review: Your Guide to Borrowing

Are you in need of payday loans with good terms up to $2,500? If so, you can read our Citrus Loans review to learn all about it!

Keep Reading

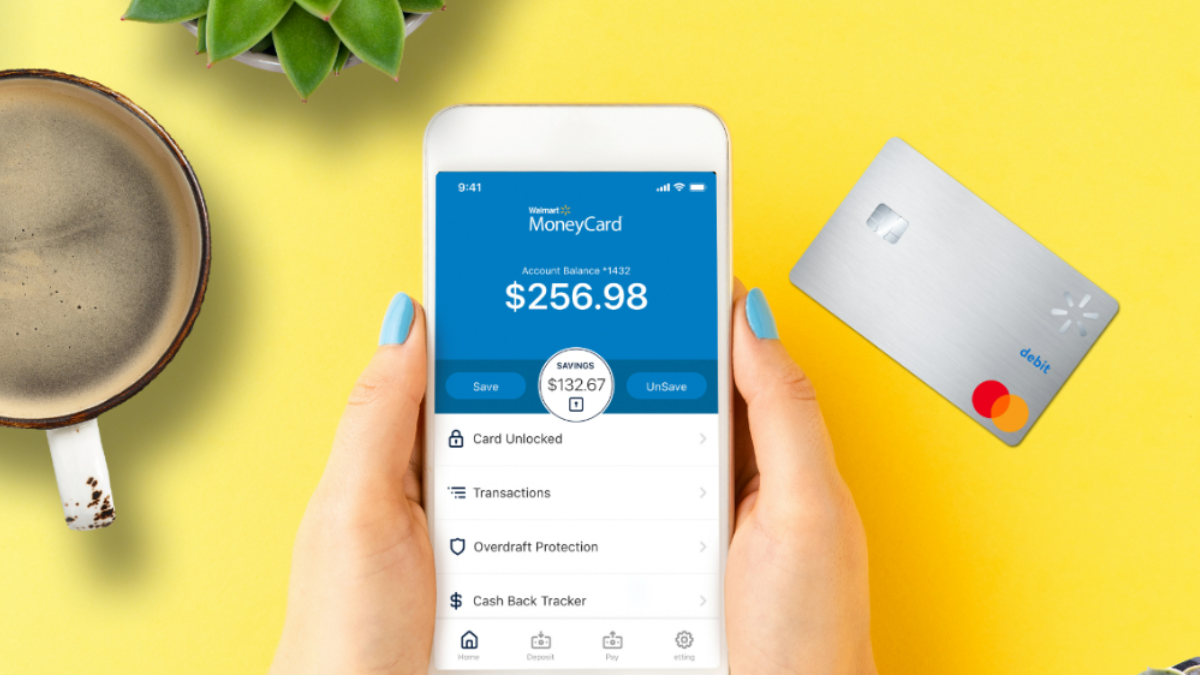

Earn up to 3% cash back: Walmart MoneyCard® review

Learn a better way to use money! Check this Walmart MoneyCard® review and start earning rewards - up to 3% cash back!

Keep Reading

Gel Nail Course by Courses for Success review

Get a full review of the Gel Nail Course from Courses for Success. You're one step close to becoming a professional nail technician! Read on!

Keep Reading