Credit Cards

TSB Platinum Purchase Card review: Save on purchases!

Discover the TSB Platinum Purchase Card 15-month introductory period, fee structures, and eligibility criteria to make informed financial decisions!

Advertisement

TSB Platinum Purchase Card review: No monthly fees!

The TSB Platinum Purchase Card review can show you that this card is a financial tool that promises flexibility and convenience for users.

Apply for the TSB Platinum Purchase Card

Learn how to apply for the TSB Platinum Purchase Card with our step-by-step guide. Save on purchases and balance transfers!

Also, in this comprehensive review, we’ll explore the key features, advantages, and drawbacks of this credit card.

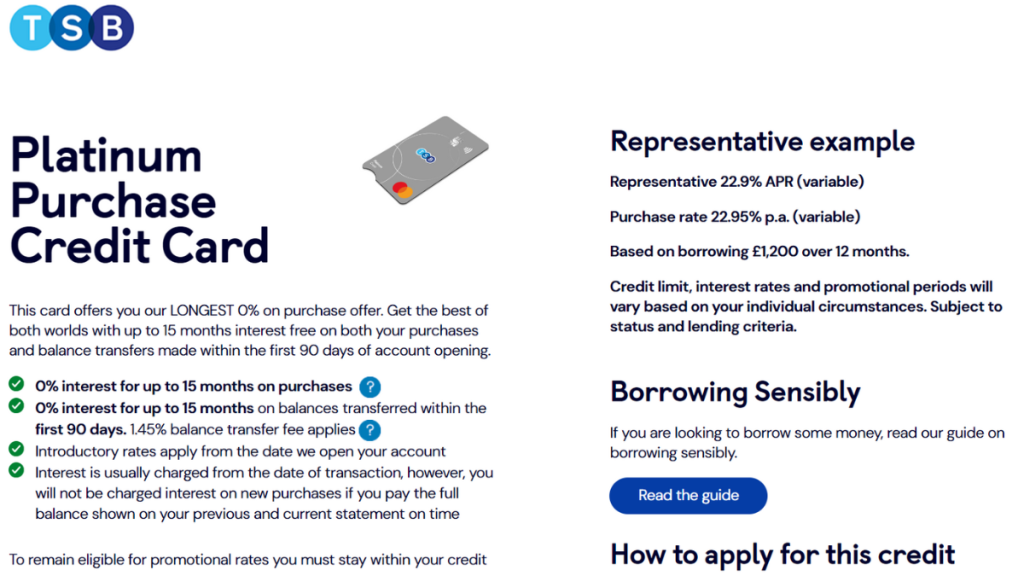

| Annual Fee | No monthly fees; |

| Credit Limit | The credit limit depends on your financial situation at the moment of application; |

| Representative APR | 22.90% variable representative APR; |

| Purchase Rate | 0% interest for up to 15 months on purchases; 22.95% variable p.a. for purchases; |

| Welcome Bonus* | You can get up to 15 months on balances you transfer within your first 90 days with the card; *Terms apply |

| Rewards | There are no rewards programs. |

TSB Platinum Purchase Card overview

You can get incredible perks by using this card. Moreover, you’ll be able to get 0% interest for up to 15 months on purchases as a new cardholder.

Also, despite its strengths, the TSB Platinum Purchase Card has its limitations.

Also, the advertised 1.45% balance transfer fee, while competitive for moderate balances, might become a notable factor for individuals looking to transfer larger sums of debt.

Moreover, the absence of additional perks, such as discounts or cashback offers, might make it less attractive to those who prioritize rewards as part of their credit card usage.

You will be redirected to another website

TSB Platinum Purchase Card main features

This card can offer so many incredible perks to its users. You’ll be able to save money on balance transfers and purchases.

However, as with any other card, you’ll find that this one has some downsides.

Therefore, you can read below to see the pros and cons to help you see if this is the best credit card for your needs!

Pros

- With this card, you’ll be able to get all the incredible perks it offers for no annual fee or monthly fees;

- This card allows you to save money on balance transfers and purchases for up to 15 months;

- You’ll be able to get a relatively high minimum and initial credit limit of £500.

Cons

- The balance transfer fee can be a downside for many cardholders;

- People with low credit scores may not be able to qualify for this card;

- The 0% intro fee may not be for every cardholder.

Minimum credit score to apply

To get this card, you’ll need to meet many requirements. For example, you’ll need to be at least 18 years old.

Also, you’ll need to have a certain income, and it needs to be regular.

Moreover, you’ll need to have at least a good credit score to have more chances to qualify for this card.

How to apply for the TSB Platinum Purchase Card?

You can apply for this card online and in the branch.

Therefore, you can read our blog post below to learn more about this card and see how the application process works!

Apply for the TSB Platinum Purchase Card

Learn how to apply for the TSB Platinum Purchase Card with our step-by-step guide. Save on purchases and balance transfers!

About the author / Victoria Lourenco

Trending Topics

Minty Personal Loans review: borrow up to £3,000

Do you need a loan with flexible repayment plans? Check our Minty Personal Loans review. Qualify with poor credit and pay no hidden fees!

Keep Reading

Minty Personal Loans: all you need to apply

Are you looking for an easy application and no additional costs? Learn how to apply for Minty Personal Loans! Up to £3,000!

Keep Reading

Apply for the Ocean Credit Card: No credit score harm!

Discover the seamless process of how to apply for the Ocean Credit Card - up to £8,000 credit limit! Keep reading and learn more!

Keep ReadingYou may also like

Apply for the Zable Credit Card: Build credit

Explore a guide to apply for your Zable Credit Card effortlessly. No hidden fees - achieve your ideal credit rating!

Keep Reading

Loans for people with an IVA: is it possible?

Do you have an IVA and are thinking about applying for loans? Don’t do it before reading this post, because there are some intricacy in it.

Keep Reading

Koyo Personal Loans: all you need to apply

Take a look at this blog post and discover how easy it is to apply for Koyo Personal Loans. Borrow up to £12,000 in no time! Read on!

Keep Reading