Credit Cards

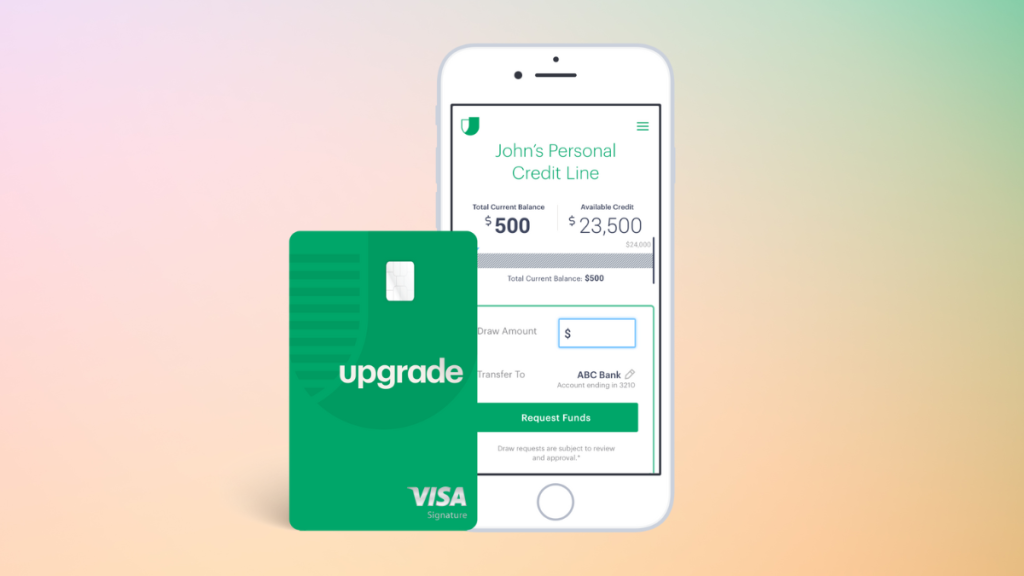

The Ultimate Credit Solution for All: Upgrade Card review

With a range of features, including a contactless payment system, $0 fraud liability, and no annual fee, the Upgrade Card is the perfect choice! Read on!

Advertisement

Build credit easily – $0 annual fee

This Upgrade Card review will bring an option designed to cater to all credit scores. So don’t miss it!

$0 annual fee: Apply for Upgrade Card today

Applying for the Upgrade Card has never been easier. You can complete your entire application online. Earn a $200 bonus – learn how!

With no annual fee and an attractive welcome bonus, it’s not hard to see why it is fast becoming a favorite among users. So, keep reading and learn!

| Credit Score | All types of credit scores are accepted; |

| Annual Fee | $0; |

| Purchase APR | 14.99% – 29.99%; |

| Cash Advance APR | Not disclosed; |

| Welcome Bonus | Earn a $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions within 60 days; |

| Rewards | None. |

Upgrade Card overview

The Upgrade Card offers its users a range of features and benefits. Indeed, it can be a great tool to those with lower credit!

After all, it is a cost-effective option for those looking for a convenient and hassle-free credit card experience.

Also, it accepts all types of credit scores, making it an excellent option for those trying to build their credit or with a less-than-stellar credit history.

Besides, one of the standout features is that its contactless payment system, which allows users to make payments without touching the card.

Finally, this card charges no annual fee and brings an excellent welcome bonus to their customers!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Upgrade Card main features

Like any credit card, the Upgrade Card has pros and cons. So, here are some of the advantages and disadvantages of using this card:

Pros

- No annual fee;

- Competitive purchase APR;

- All types of credit scores are accepted;

- Contactless technology for a no-touch payment experience;

- $0 fraud liability.

Cons

- Cash advance APR not disclosed;

- Limited rewards program.

Minimum credit score to apply

Indeed, the Upgrade Card has no minimum credit requirement, making it a great option for those trying to build their credit.

Moreover, it is also an excellent option for those looking to consolidate their credit card debt.

How to apply for the Upgrade Card?

Applying for the Upgrade Card is indeed a straightforward process that can be completed online.

Do you want to learn more? Then don’t miss our following article. It will explain the application process for this card in detail!

$0 annual fee: Apply for Upgrade Card today

Applying for the Upgrade Card has never been easier. You can complete your entire application online. Earn a $200 bonus – learn how!

About the author / Sabrina Paes

Trending Topics

Get more for your money: Choose your ideal 0% APR credit card!

This post will help you to choose the best 0% APR credit card and save money. Read on to learn more about credit cards!

Keep Reading

What credit score do you need to lease a car?

Check if you have the credit score needed to lease a car. It can be better than buying one. Read on, and you’ll see how it works.

Keep Reading

PenFed Pathfinder® Rewards Visa Signature®: how to apply

Learn now how to apply for the PenFed Pathfinder® Rewards Visa Signature® and earn premium travel rewards in a straightforward process.

Keep ReadingYou may also like

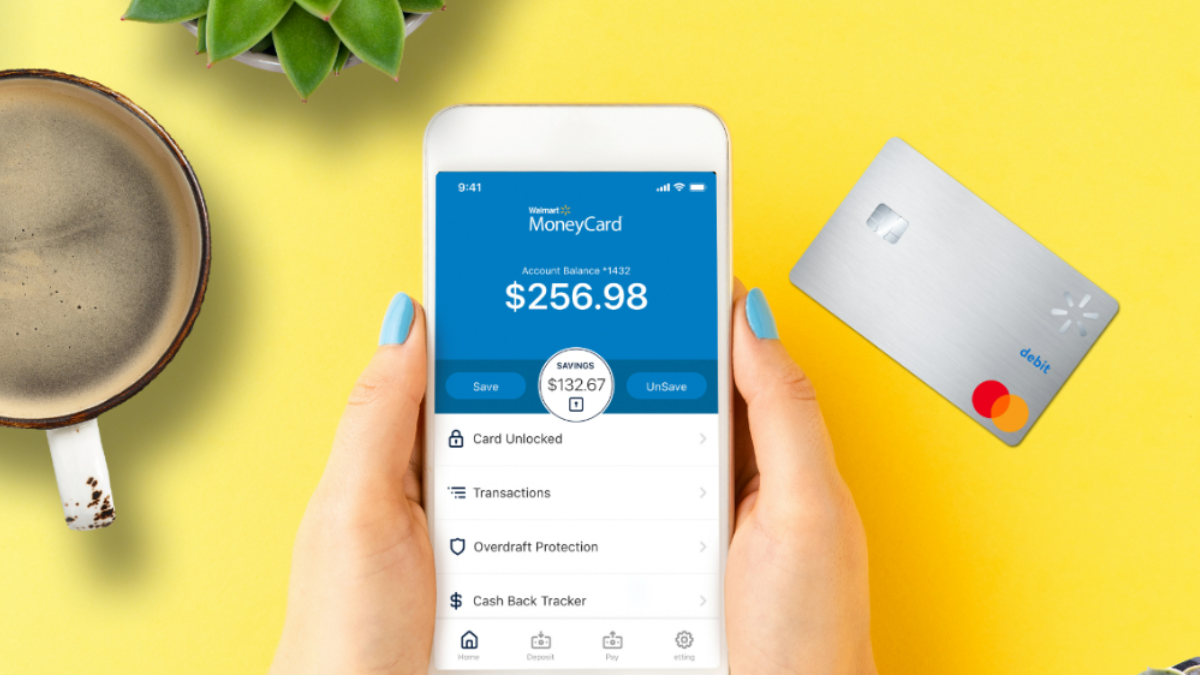

Earn up to 3% cash back: Walmart MoneyCard® review

Learn a better way to use money! Check this Walmart MoneyCard® review and start earning rewards - up to 3% cash back!

Keep Reading

Apply for Capital One Quicksilver Secured Cash Rewards Credit Card

Learn how to apply for Capital One Quicksilver Secured Cash Rewards Credit Card now! $0 annual fee and 1.5% cash back on purchases! Read on!

Keep Reading

Avant Personal Loans: how to apply

Learn how to apply for the Avant Personal Loans and get the money you need with fast funding and flexible terms!

Keep Reading