Credit Cards

Upgrade Triple Cash Rewards Visa® Review: Up to 10% Cash Back

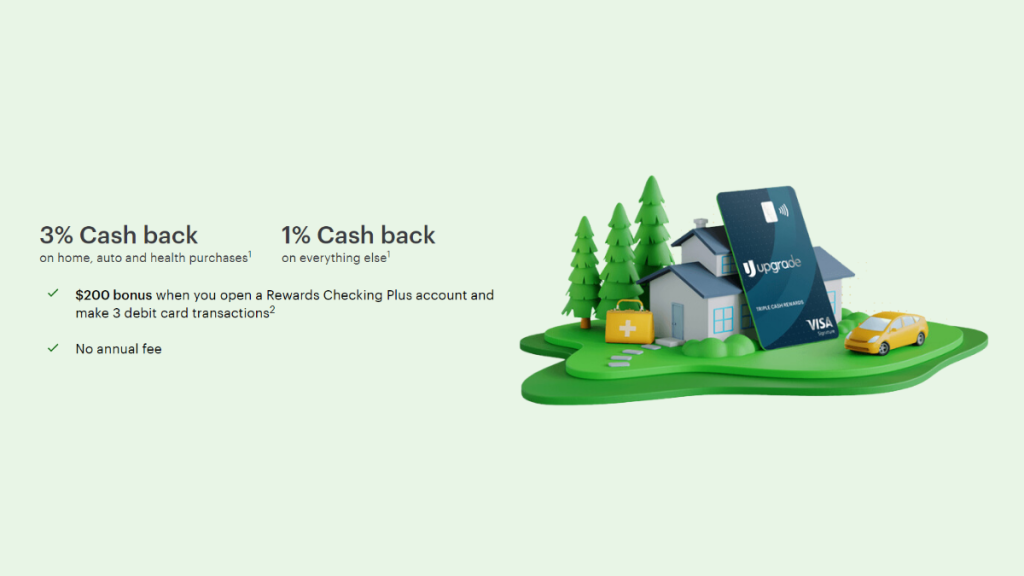

Upgrade Triple Cash Rewards Visa® will give you $200 bonus when you open a Rewards Checking account! Keep reading this review to see how it works!

Advertisement

Pay $0 annual fee with the Upgrade Triple Cash Rewards Visa®

Are you looking for a card with no annual fee and a reward program? Then this Upgrade Triple Cash Rewards Visa® review will show you a great option!

Upgrade Triple Cash Rewards Visa®: how to apply

We'll show you how to apply for the Upgrade Triple Cash Rewards Visa® online! Earn up to 10% cash back and more! Read on!

With bonus cash back and a fixed rate, predicting your monthly bills and earning rewards will be much easier. So read on and learn more!

| Credit Score | Good to excellent; |

| Annual Fee | $0 per year; |

| Purchase APR | From 14.99% to 29.99%; |

| Cash Advance APR | N/A; |

| Welcome Bonus | $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions. |

| Rewards | From 1% up to 10% cash back on purchases, according to its category. |

Upgrade Triple Cash Rewards Visa® overview

The Upgrade Triple Cash Rewards Visa® is a credit card with a high credit limit and fixed-rate installments.

Your credit limit will depend on your creditworthiness. It ranges from $500 to $25,000, but clients with outstanding credit scores can get up to $50,000.

Moreover, the Upgrade Triple Cash Rewards Visa® will give you a lot of cashback.

You get at least 1% for every purchase, but it can be as high as 10% for partner merchants.

Also, to wrap it all up with one of the best advantages a credit card can offer us, you will pay a total of $0 for its annual fee.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Upgrade Triple Cash Rewards Visa® main features

Further, let’s review the pros and cons of owning the Upgrade Triple Cash Rewards Visa® to see if swiping this credit card around is worth it.

Pros

- The potentially high credit limit that you can use as a personal loan;

- Some very convenient purchase categories will earn you 3% cashback: supermarket, home repair, auto repair, gas, health, drugstores, gym memberships, and more;

- No annual fee and no late payment fee;

- You can prequalify to avoid a hard check and get approved with a 630 credit score or higher.

- $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions.

Cons

- The APR will vary according to your credit score, and if your is low, the APR will be high;

- Upgrade does not allow card members to transfer a balance from another credit card.

Minimum credit score to apply

Even though it does not require a perfect credit score for new applicants, it can not be too low either.

Thus, you must present a credit score of 630 or more to get approved for the Upgrade Triple Cash Rewards Visa®.

How to apply for the Upgrade Triple Cash Rewards Visa®?

Now that you know everything about the Upgrade Triple Cash Rewards Visa®, how about learning how to apply for it?

Then see the content on the link below, and we’ll guide you through the application process.

Upgrade Triple Cash Rewards Visa®: how to apply

We'll show you how to apply for the Upgrade Triple Cash Rewards Visa® online! Earn up to 10% cash back and more! Read on!

Disclaimer: *To qualify for the welcome bonus, you must open and fund a new Rewards Checking Plus account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Plus account within 60 days of the date the Rewards Checking Plus account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Plus account as part of this application process, you are not eligible for this welcome bonus offer. Your Upgrade Card and Rewards Checking Plus account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade VISA® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Plus account as a one-time payout credit within 60 days after meeting the conditions.

About the author / Julia Bermudez

Trending Topics

Save money: apply for the Quicksilver Student Cash Rewards!

Apply for a Quicksilver Student Cash Rewards credit card to save money on every expense. We’ll tell you how!

Keep Reading

First Progress Platinum Prestige Mastercard® Secured Credit Card review

Check our First Progress Platinum Prestige Mastercard® Secured Credit Card review and learn how to earn rewards while you build your score!

Keep Reading

Woodworkers Training Program by GWTP review

Check out our Woodworkers Training Program by GWTP review and see if it aligns with your goals as a woodworker. Enroll for free! Read on!

Keep ReadingYou may also like

Apply for Chase Freedom Flex℠: Enjoy Rewards & No Annual Fee!

Learn how to apply for Chase Freedom Flex℠ today and take advantage of its rewards. Enjoy 0% intro APR for 15 months! Read on!

Keep Reading

$750 credit limit, no credit check: NetFirst Platinum Card review

Learn the ins and outs of the NetFirst Platinum card with our comprehensive review! We give you all the details about this store card!

Keep Reading

$0 annual fee: Apply for the Instacart Mastercard®!

Ready to level up your Instacart experience? Learn how to apply for the Instacart Mastercard® effortlessly - up to 5% cash back!

Keep Reading