Loans

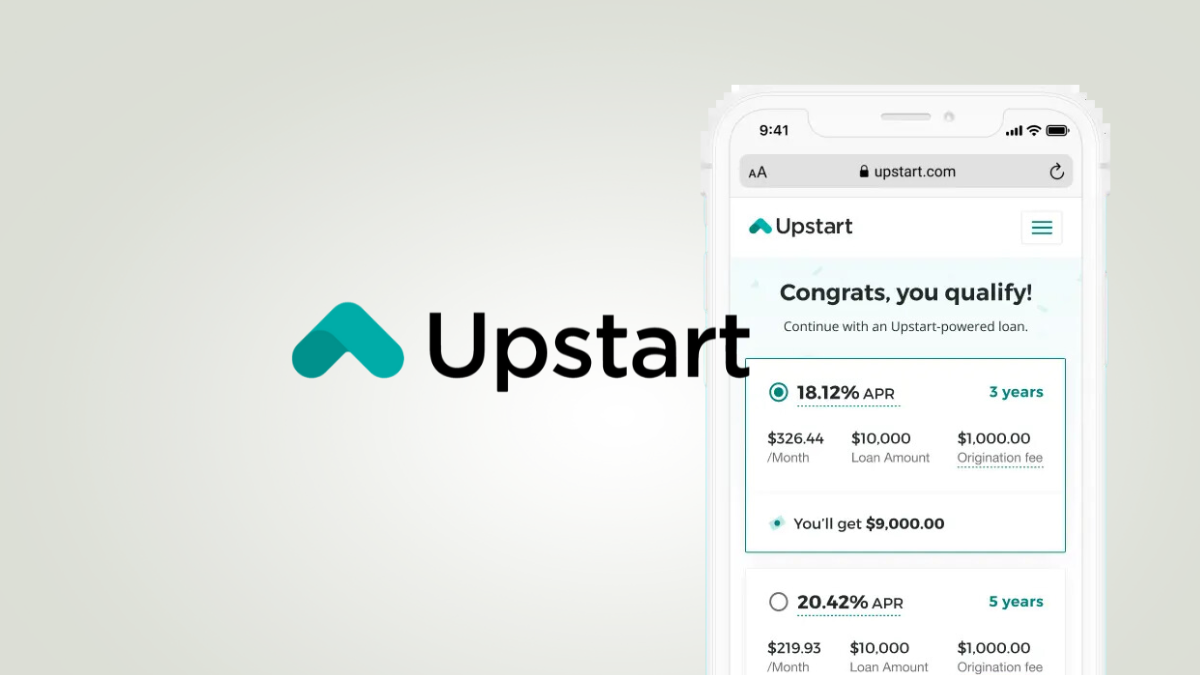

Find financial freedom: Upstart Loan review!

Looking to secure a loan but tired of the traditional hoops and hurdles? Enter our Upstart Loans review to see the pros and cons!

Advertisement

Upstart Loan review: Get your funds in as little as 1 business day!

If you’re looking for a fresh and innovative approach to lending, you can read on for our Upstart Loan review!

Find out how to apply for an Upstart Loan!

Find a loan option with an innovative model and loans of up to $50,000! Read on to learn how to apply for an Upstart Loan!

We’ll dive deep into the world of Upstart Loans, exploring their unique lending model, the application process that promises to be a breath of fresh air!

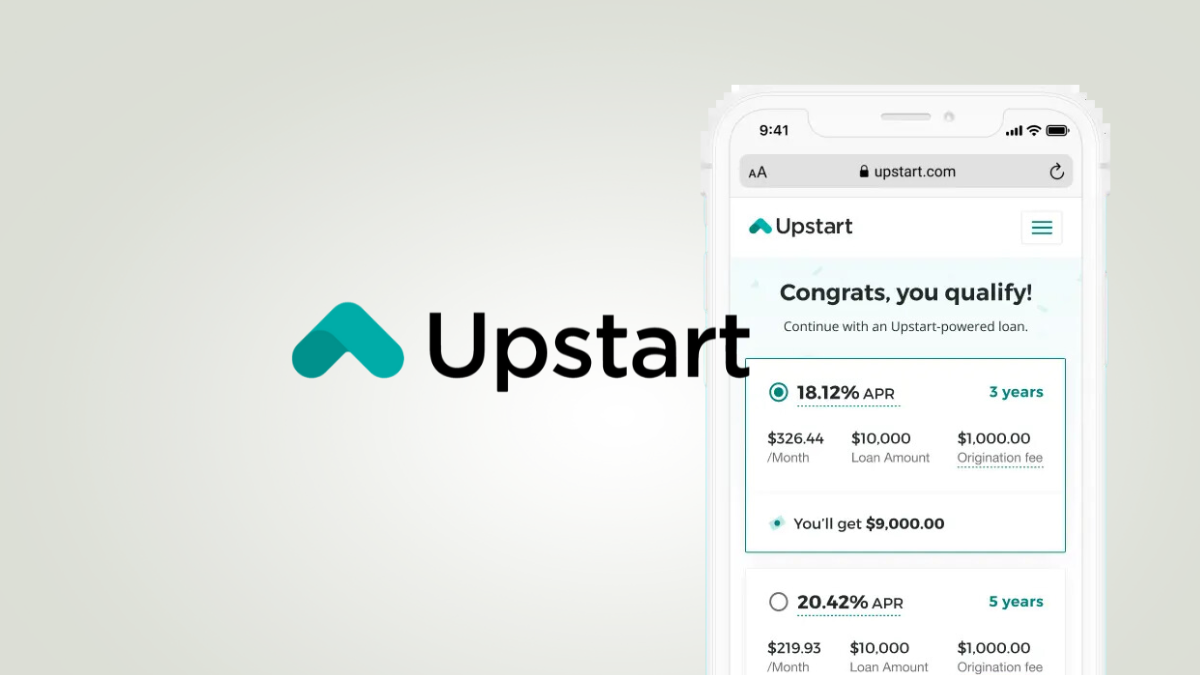

| APR | 5.2% to 35.99% variable APR; |

| Loan Purpose | Almost all personal loan reasons, including moving-out loans, credit card debt consolidation loans, wedding loans, and more; |

| Loan Amounts | From $1,000 to $50,000; |

| Credit Needed | The initial credit check won’t affect your credit score. However, there is no minimum credit score; |

| Terms | From 3 to 5 years with fixed rates; |

| Origination Fee | There can be origination fees depending on the loan terms and amount; |

| Late Fee | There can be late fees, depending on the loan terms and amount; |

| Early Payoff Penalty | There are no prepayment penalty fees. |

Upstart Loan details

Upstart has reimagined the landscape by incorporating artificial intelligence and machine learning into the decision-making process.

Moreover, no more relying solely on your credit score to determine your loan eligibility.

Upstart takes a holistic approach, considering factors like education, job history, and even your online behavior to assess your creditworthiness.

Therefore, you may be able to find the best personal loan for your needs even with a not-so-good credit score!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Upstart Loan: pros and cons

We all know that all companies can have some downsides. So, it’s no different with Upstart Loan. For example, you’ll need to pay origination fees and others.

Therefore, you can read our pros and cons list below to learn more about this lender and if it’s the best option for your financial needs!

Pros

- You can find loan options even with poor or no credit;

- There is a good customer service for clients;

- You’ll be able to pre-qualify for this loan with no credit score impact;

- You can change your payment date;

- Also, you’ll find loan options of up to $50,000.

Cons

- There are origination fees;

- You won’t get many repayment options to choose from;

- Also, there are no co-signed loan options or secured loan options.

What is the minimum credit score to apply?

You’ll be able to have a chance to get a loan through this lender even with no credit score.

Also, you can have chances to qualify even with a poor or bad credit score.

However, if you have a bad score or no score, you may not get good rates.

Therefore, we recommend that you have good finances and a good credit score before you apply for a loan with this lender or any other lender.

Upstart Loan: steps to apply

You can find that it can be really easy to apply for a loan through this lender. Therefore, you can do it all online from the comfort of your home!

Moreover, you can find out the steps to apply for a loan through this lender in our post below!

Find out how to apply for an Upstart Loan!

Find a loan option with an innovative model and loans of up to $50,000! Read on to learn how to apply for an Upstart Loan!

About the author / Victoria Lourenco

Trending Topics

PenFed Platinum Rewards Visa Signature® Card Review: Earn rewards

Say hello to the future of credit card rewards. Our review of the PenFed Platinum Rewards Visa Signature® Card reveals how it stands out.

Keep Reading

PenFed Power Cash Rewards Visa Signature® Card: apply now!

Get all your questions answered on how to apply for the PenFed Power Cash Rewards Visa Signature® Card today and start getting cash back!

Keep Reading

Find a job a Tidy: Earn up to $19 an hour!

Find the perfect job for you at Tidy! Join a dynamic team, make spaces shine, and be part of a rewarding cleaning journey.

Keep ReadingYou may also like

Listen to the Holy Bible online: apps to nurture your faith

Now you can read the Holy Bible online on your computer or even on your smartphone. Get one of these apps today!

Keep Reading

Apply for First Latitude Platinum Mastercard® Secured Credit Card

Apply for the First Latitude Platinum Mastercard® Secured Credit Card and earn rewards on every purchase - quick and simple process!

Keep Reading

Avant Credit Card: how to apply

Getting an unsecured credit card can be simple! Check now how to apply for Avant Credit Card. Qualify with fair credit and build it fast!

Keep Reading