Credit Cards

Westpac Low Rate Card review: Is it Worth It?

Considering the Westpac Low Rate Card? Read our in-depth Westpac Low Rate Card review to discover how it stacks up!

Advertisement

Unveiling the Westpac Low Rate Card review

Are you in search of a card that strikes a balance between affordability and convenience? If so, you can read our Westpac Low Rate Card review!

Find out how to apply for a Westpac Low Rate Card!

Looking for a card with perks and low rates? If so, discover the hassle-free process of learning how to apply for the Westpac Low Rate Card!

Moreover, we’ll dive deep into the features, benefits, and potential drawbacks of this card to help you make a decision. So read on!

| Annual Fee | $59 ongoing annual fee; |

| Purchase Rate | 13.74% p.a. variable purchase rate; |

| Interest-Free Period | 55 days interest-free; |

| Minimum Credit Limit | You’ll find a minimum credit limit of $500, depending on your finances; |

| Credit Score | You’ll need a reasonable credit score to have more chances to qualify for this credit card; |

| Rewards | No rewards besides the cashback offer or the balance transfer offer. |

Westpac Low Rate Card overview

The Westpac Low Rate Card has garnered attention for its competitive interest rates and appealing perks.

As we dissect its offerings, we’ll highlight its standout features and explore the real-world benefits it provides.

Moreover, we can provide insights into who might benefit the most from having this card in their wallet.

In addition, as a new cardholder, you’ll be able to get an intro 0% p.a. for 28 months.

Therefore, this card can be great for those who are not Westpac customers and are opening their account for the first time!

You will be redirected to another website

Westpac Low Rate Card’s main features

Even though this card offers incredible perks to its cardholders, there are also some downsides, as with any other card.

For example, you won’t get many more perks other than the balance transfer intro period.

Therefore, you can read our pros and cons list below to learn more about this card and see if it’s the best option for your finances at the moment!

Pros

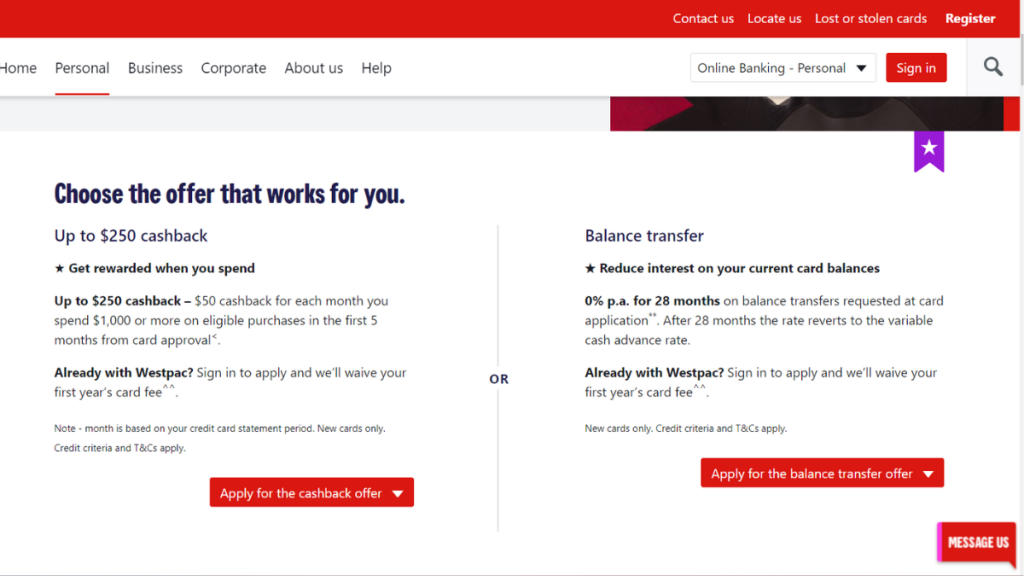

- 0% intro p.a. for up to 28 months on eligible balance transfers with no fees;

- You’ll find low rates and interest on purchases;

- There is up to 55 days interest-free.

Cons

- There is an annual fee of $59 for all cardholders;

- The balance transfer can be a bit high after the intro period.

Minimum credit score to apply

There is no official information about this card having a minimum credit score for the application.

However, it is always recommended that you have a higher credit score to get the best rates and fees.

How to apply for the Westpac Low Rate Card?

You can apply for this incredible card through the official website by providing the personal information required.

Moreover, you can read our blog post below to learn more about this card and find out how the application process works!

Find out how to apply for a Westpac Low Rate Card!

Looking for a card with perks and low rates? If so, discover the hassle-free process of learning how to apply for the Westpac Low Rate Card!

About the author / Victoria Lourenco

Trending Topics

A Step-by-Step Guide: Applying for the ANZ Low Rate Credit Card

Discover the hassle-free way to apply for the ANZ Low Rate Credit Card with our step-by-step guide. Get the card that helps you save!

Keep Reading

Budget-Friendly and User-Focused: St.George Vertigo Card review

Read this St.George Vertigo Card review for a look at its pros, cons, and whether it's the right fit - ensure an interest-free period!

Keep Reading

Apply for HSBC Low Rate Card: Unlocking Financial Freedom

Discover the secrets to securing the HSBC Low Rate Card with our comprehensive guide. Learn the step-by-step application process!

Keep ReadingYou may also like

Simplicity Meets Savings: Apply for the St.George Vertigo Card

Ready to simplify your finances? Learn how to apply for the St.George Vertigo Card - enjoy up to 55 days interest-free! Read on!

Keep Reading

How to Make Money Online: 10 Proven Strategies

Find out how to make money online in the UK! Explore affiliate marketing, freelancing, digital products, ad monetization, and more!

Keep Reading

Apply for ANZ First Credit Card: Your Key to Financial Freedom

Learn the easy steps to apply for the ANZ First Credit Card. Enjoy $0 annual fee in the first year, plus amazing cardholder benefits!

Keep Reading