Credit Cards

Get Exclusive Rewards: Woolworths Black Credit Card Review

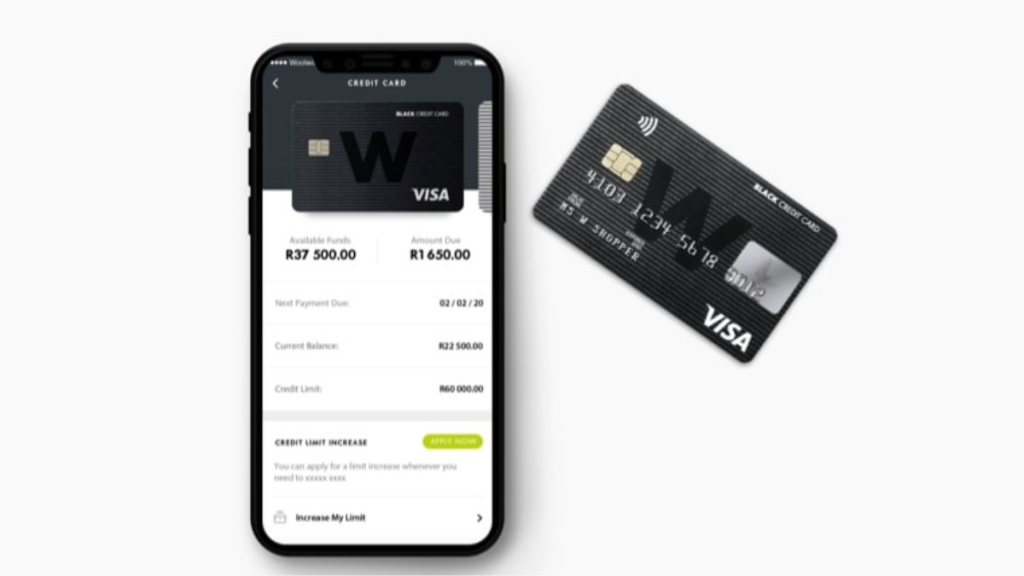

Make every purchase count with the Woolworths Black Credit Card and enjoy a host of exciting benefits - 3% cash back on purchases and more!

Advertisement

Maximizing Savings and Rewards: A Review of the Woolworths Black Credit Card

Are you looking for a card that goes beyond ordinary benefits? Look no further than our Woolworths Black Credit Card review.

Apply for Woolworths Black Credit Card

Want to enjoy exclusive perks and rewards? Learn how to apply for the Woolworths Black Credit Card and elevate your shopping experience.

Following, we’ll explore the features, advantages, and why it has become a top choice for savvy shoppers and frequent travelers in South Africa.

| Min. Monthly Income | R41,666 income per month; |

| Initiation Fee | R150; |

| Monthly Fee | R69; |

| Interest Rate | 21%; |

| Rewards | 3% WRewards on Woolworths purchases, 1% WRewards in other purchases. |

Woolworths Black Credit Card overview

The Woolworths Black Credit Card is a premium financial product designed to provide exclusive benefits and rewards to its cardholders.

Firstly, you can earn Woolworths WRewards for every eligible purchase made, allowing you to enjoy discounts and savings on future purchases.

Also, the card offers travel insurance coverage, travel vouchers based on spending, access to airport lounges, and a dedicated customer service helpline.

The Woolworths Black Card also provides competitive interest and flexible payment, allowing you to manage your finances.

You will be redirected to another website

Woolworths Black Credit Card main features

Further, let’s review the pros and cons of the Woolworths Black Credit Card!

Pros

- Earn Woolworths WRewards for every eligible purchase made with the card;

- Also, enjoy exclusive discounts and savings at Woolworths stores;

- Access to travel insurance coverage for local and international trips;

- Earn travel vouchers based on spending with the card;

- Moreover, you can get complimentary access to airport lounges for a more luxurious travel experience;

- Dedicated customer service support is available 24/7;

- Competitive interest rates and flexible payment options;

- Make cash withdrawals at any ATM that accepts Visa credit cards.

Cons

- The Woolworths Black Credit Card is only available to customers who meet certain eligibility criteria;

- Also, some benefits and rewards may have specific terms and conditions attached;

- Annual fees or charges may apply, depending on the cardholder’s usage and agreement.

Requirements needed to apply

Now, are you ready to apply for a Woolworths Black Credit Card? So just make sure you meet the requirements.

Firstly, you must be of legal age and a resident of South Africa. Plus, having a minimum income meeting their specified threshold is good.

They’ll also consider your credit history and assess your ability to manage credit responsibly through an affordability check.

During the application, you’ll need to provide your identification documents, income proof, and address.

How to apply for the Woolworths Black Credit Card?

Applying for a Woolworths Black Credit Card is a breeze!

With a straightforward application process, you’ll be on your way to enjoying exclusive rewards and benefits in no time.

If you’re eager to start, we invite you to check out our full application guide.

Simply click on the following link and take the first step toward unlocking a world of privileges

Apply for Woolworths Black Credit Card

Want to enjoy exclusive perks and rewards? Learn how to apply for the Woolworths Black Credit Card and elevate your shopping experience.

About the author / Julia Bermudez

Trending Topics

How to apply for a job at RCL Foods: Competitive pay!

Are you interested in learning how to apply for a job at RCL Foods? Check out this post! Earn up to R20,000 per month! Read on!

Keep Reading

Discovery Bank Gold Card review: earn up to 40% back

Read our Discovery Bank Gold Card full review to learn how this credit card helps you save money! Enjoy 55 days of interest-free credit!

Keep Reading

NedBank Gold Credit Card review: earn points on purchases

Looking for a reliable and rewarding credit card? Check out now our NedBank Gold Credit Card review! Ensure up to 55 interest-free days!

Keep ReadingYou may also like

Find a job at Boxer: Earn up to R17,500 monthly!

Would you like to land a job at Boxer? Read this post closely and discover more about this amazing company! Earn up to R17,500 per month.

Keep Reading

Find a job at Capitec: discover a whole new world of opportunity

If you want to land that sweet job at Capitec you're looking for, why not check our company review before? We'll give you some tips!

Keep Reading

Binixo Personal Loans review: up to R9,000

This comprehensive review will familiarize you with all the Binixo Personal Loans lender platform features. Enjoy flexible rates and terms!

Keep Reading